Rising Mobile Data Consumption

The wholesale telecom-carrier market is significantly influenced by the rising mobile data consumption across the GCC region. With an increasing number of smartphone users and the proliferation of mobile applications, data traffic is surging at an unprecedented rate. Reports indicate that mobile data traffic in the GCC is expected to grow by over 40% annually, leading to a heightened demand for wholesale data services. This trend compels telecom carriers to expand their network capabilities and invest in scalable solutions to accommodate the growing data needs. Consequently, the wholesale telecom-carrier market is likely to benefit from this surge, as carriers seek to enhance their offerings and improve service delivery to meet consumer expectations.

Regulatory Framework Enhancements

The regulatory landscape plays a crucial role in shaping the wholesale telecom-carrier market. Recent enhancements in regulatory frameworks across the GCC are aimed at promoting competition and ensuring fair practices among telecom operators. These regulations are designed to facilitate market entry for new players, thereby increasing competition and driving innovation. For instance, the introduction of policies that encourage infrastructure sharing is likely to lower barriers to entry, enabling smaller carriers to compete effectively. As a result, the wholesale telecom-carrier market is expected to experience a more dynamic environment which is characterized by improved service offerings and competitive pricing structures that benefit consumers.

Strategic Partnerships and Alliances

Strategic partnerships and alliances are emerging as a pivotal driver in the wholesale telecom-carrier market. Carriers are increasingly collaborating with technology providers, content creators, and other telecom operators to enhance service offerings and expand market reach. In the GCC, such collaborations are expected to facilitate the sharing of infrastructure and resources, thereby reducing operational costs. For instance, partnerships focused on cloud services and IoT solutions are likely to create new revenue streams for carriers. This collaborative approach not only strengthens the competitive position of participating entities but also fosters innovation within the wholesale telecom-carrier market, enabling the development of tailored solutions that cater to diverse customer needs.

Increased Focus on Cybersecurity Solutions

As the wholesale telecom-carrier market evolves, the focus on cybersecurity solutions has become increasingly paramount. With the rise in data breaches and cyber threats, telecom carriers are compelled to invest in robust security measures to protect their networks and customer data. In the GCC, the demand for cybersecurity services is projected to grow by approximately 30% over the next few years, reflecting the urgency of this issue. This heightened focus on cybersecurity not only safeguards the integrity of telecom networks but also enhances customer trust and loyalty. Consequently, the wholesale telecom-carrier market is likely to see an uptick in investments directed towards advanced security technologies, thereby fostering a more secure telecommunications environment.

Technological Advancements in Network Infrastructure

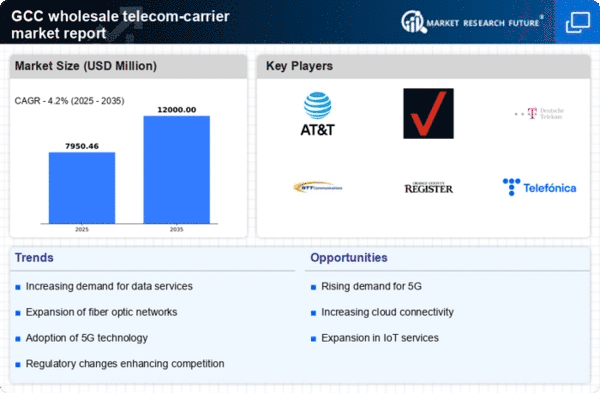

The wholesale telecom-carrier market is experiencing a transformative phase driven by rapid technological advancements in network infrastructure. Innovations such as 5G technology and fiber-optic networks are enhancing data transmission speeds and capacity. In the GCC region, investments in these technologies are projected to reach approximately $20 billion by 2026, indicating a robust growth trajectory. This evolution not only improves service quality but also enables carriers to offer more competitive pricing models. As a result, the wholesale telecom-carrier market is likely to witness increased participation from new entrants, thereby intensifying competition and reducing costs for end-users. Furthermore, the integration of artificial intelligence and machine learning in network management is expected to optimize operational efficiencies, further propelling market growth.