Market Trends

Key Emerging Trends in the Generative AI in Media and Entertainment Market

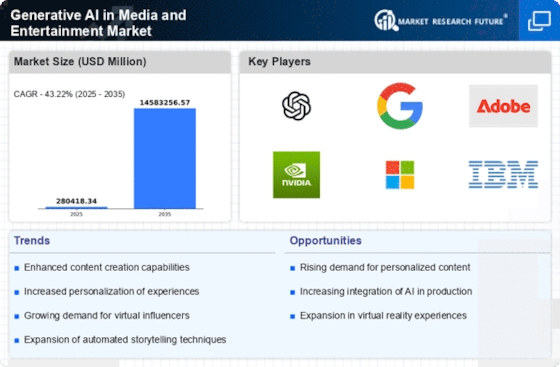

One huge market factor is the use of generative AI for content creation and expansion. This pattern mirrors the growing reception of generative AI to change content creation in the media and entertainment industry, leading to additional outwardly stunning and vivid meetings for audiences. This pattern highlights the increasing emphasis on leveraging generative AI to improve content revelation and client commitment, at last shaping the way groups consume and interact with media and entertainment offerings. Moreover, generative AI is driving the pattern of virtual and augmented reality (VR/AR) content generation within the media and entertainment market. By utilizing generative AI algorithms, organizations can make vivid VR/AR encounters, produce sensible 3D models and conditions, and foster interactive content that complicates the line between the advanced and actual creations. This pattern features the critical job of generative AI in shaping the eventual fate of VR/AR content creation, enabling seriously captivating and vivid encounters for audiences across various media and entertainment stages. Besides, the utilization of generative AI in versatile storytelling and narrative age is shaping the media and entertainment landscape by enabling dynamic and customized storytelling encounters. Media organizations are leveraging generative AI to make interactive narratives, versatile storylines, and customized content encounters that answer client input and decisions. This pattern mirrors the increasing reception of generative AI to redefine storytelling in media and entertainment, offering new roads for audience commitment and submersion in narrative-driven content. Besides, generative AI is playing an urgent job in the improvement of AI-produced music, sound, and soundscapes within the media and entertainment industry. By employing generative AI algorithms, organizations can consequently compose music, produce sound impacts, and make bright sound encounters for various types of media content. This pattern highlights the growing effect of generative AI on sound creation and music structure, offering innovative ways to deal with sound plan and hear-able encounters in media and entertainment offerings.

Leave a Comment