Market Trends

Key Emerging Trends in the Generic Pharmaceuticals Market

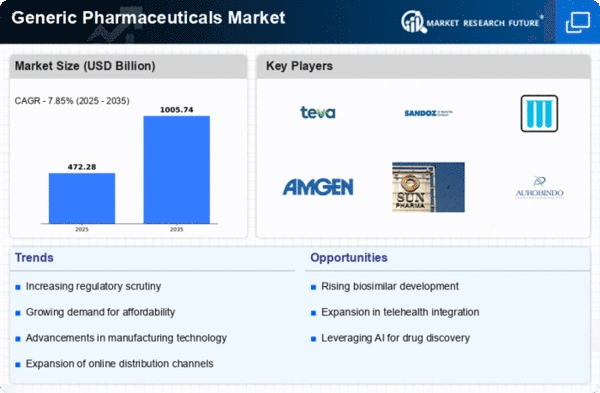

The generic pharmaceuticals market is undergoing significant changes, influenced by factors such as increasing demand for affordable healthcare, patent expirations of branded drugs, and regulatory initiatives promoting generic drug approvals. One of the prevailing trends in this market is the growing emphasis on biosimilars. As patents for biologic drugs expire, there is a rising interest in the development and approval of biosimilar versions, offering cost-effective alternatives to complex and high-cost biologics. This naturally is in accordance with the global aim for available and affordable healthcare as well as for low quick routes to deal with chronic illnesses.

Moreover, the epoch of complex Prescription/pills is a axial shift that is occurring in the genric drugs market The complex generics include drugs that have to have more components or complicated schemes of production and treatment. The pharmaceutical industry is now progressively addressing more difficult areas of therapy. Therefore, the production and application of sophisticated generics are important to overcome the current challenges. Along with this trend, the generic drugs industry will face increased market competition and reap the fruits of diversification, where drug manufacturers could consider value-added products to their portfolios

We are now observing a trend in the market that manufacturing of pharmaceutical drugs by means of 3D printing has been gaining popularity. 3D printing is advantageous in this sense as it enables the production of complex drug structures and patient-specific dosage forms so that the overall efficacy of the drug gets increased, and the chances of patients not adhering to the dosage timeline goes down. This technology is special not only in the manufacture of small-batch and niche drugs made for production purposes but also enables producers to suffice the market demand and government policies much faster. The application of 3D printing introduces 3rd millennium approaches to generic drug manufacturing which are aimed at increasing the development innovations.

Many such pharma generic market trends and also ongoing regulatory reforms are being implemented to facilitate streamlining approval process for generic drugs. Regulatory authorities are creating special programs to shorten the approval process for generics drugs, thus promoting the competition and benefiting consumers with a variety of drugs available. Such measures are not only necessary but also important as they develop a strong generic pharmaceutical market; it in turn reduces the cost of, as well as increases the accessibility to a multitude of life-saving drugs.

The market observe the hundreds of checks on quality and safety of generic drugs is coming under greater scrutiny. Regulatory agencies and consumers are placing greater importance on ensuring the bioequivalence and therapeutic equivalence of generic products compared to their branded counterparts. This heightened focus on quality underscores the industry's commitment to delivering safe and effective generic medications, building trust among healthcare professionals and patients.

Leave a Comment