Global Geomembranes Market Overview

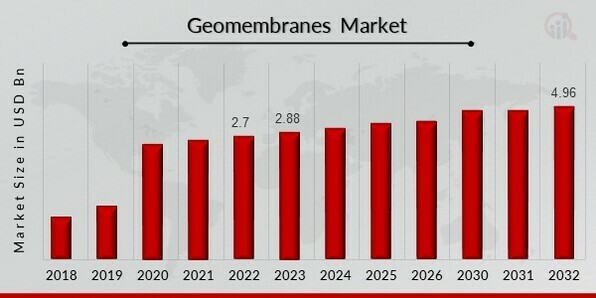

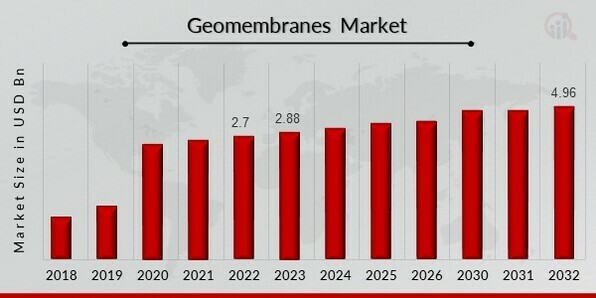

Geomembranes Market Size was anticipated at USD 2.88 billion in 2023. The Geomembranes industry is projected to grow from USD 3.08 Billion in 2024 to USD 4.96 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 6.13% during the forecast period (2024 - 2032). Increased awareness for water preservation and using geomembranes in various industries are key market drivers contributing to the market’s overall growth and expansion.

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Geomembranes Market Trends

-

The growing use of geomembranes in various industries is driving the market growth.

Market CAGR for Geomembranes is being driven by using geomembranes in various industries. The demand for geomembranes will expand in the upcoming years due to rising environmental consciousness, stricter government environmental conservation regulations, etc. Additionally, manufacturers' increased efforts to release novel membranes foster market expansion. Furthermore, domestic infrastructure development is accelerating in developing economies, supported by increased government initiatives to pour money into the sector. Rising infrastructure investment and water management awareness are also expected to drive it. Additionally, the market is anticipated to be driven by rising environmental preservation, building for civil purposes, and groundwater preservation efforts throughout forecasting.

Additionally, Low-cost recovery from low-grade ores has been made possible by the growing use of novel mining techniques. Due to the high levels of chemical contamination during this procedure, geomembrane liners are the best options for minimizing the buildup of chemicals. Additionally, with the advancement of Technology and the introduction of new arc devices, TRI is used to detect leaks using geomembrane and are anticipated to benefit financially from environmental efforts and the installation of solar energy systems on landfills utilizing geomembranes.

The rise of the various end-user sectors due to the COVID-19 epidemic and the ensuing interruptions to the supply chain has had a detrimental effect on the market. In addition, several businesses that provide water treatment technology have cut their subsidized rates due to the unstable economy, which has further influenced the market. The market is still expected to grow quickly shortly because of the enormous need for geomembranes, particularly in water and wastewater management.

For instance, Germany generates over five billion cubic meters of sewage water annually from private houses, businesses, and industries. A significant additional amount of infiltrated water enters the drainage system via leaks, adding to the roughly 3 billion cubic meters of rainfall from pavements and roads that end up going into sewage treatment plants, leading to the use of geomembranes in water management. As a result, it is anticipated that demand for Geomembranes will increase throughout the projection period due to the use of geomembranes in various industries. Thus, driving the Geomembranes market revenue.

Geomembranes Market Segment Insights

Geomembranes Resin Type Insights

The Geomembranes market segmentation, based on Resin Type, includes Thermoplastic Polymers and Elastomers. Thermoplastic Polymers dominated the market, accounting for 65% of market revenue (USD 1.8 billion) in 2022. HDPE (High-density polyethylene) is a subsegment of Thermoplastic Polymers, which is in huge demand for their durability, UV protection, and resistance to harsh climatic conditions.

Figure 1: Geomembranes Market by Resin Type, 2022 & 2032 (USD billion)

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Geomembranes Technology Insights

The Geomembranes market segmentation, based on Technology, includes Blown Film, Calendaring, and Spread Coating. Calendaring dominated the market, accounting for 48% of the market share (USD 1.3 billion) in 2022. It is a widely used technology due to its ability to process engineering polymers, boosting the market growth for geomembranes.

Geomembranes Application Insights

The Geomembranes market segmentation, based on Application, includes Landfills, Water Management, Mining, Bioenergy Generation Plants, and Agricultural. The Mining category generated the highest revenue of about 49% (USD 1.3 billion) in 2022. Geomembranes are commonly used in mining to process water contamination, soil remediation, and heap leach padding, boosting the overall market growth. Water management is the fastest-growing segment due to people's awareness of water conservation.

Geomembranes Regional Insights

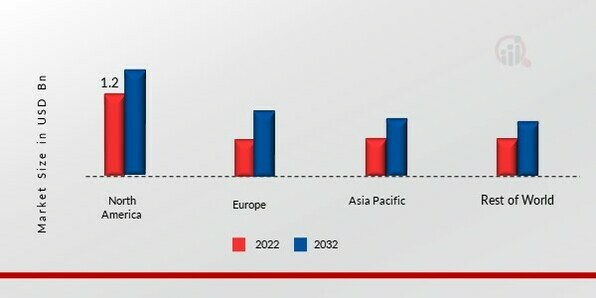

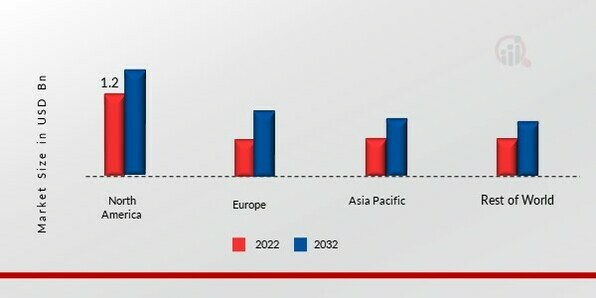

By region, the study provides market insights into North America, Europe, Asia-Pacific, and Rest of the World. The North American Geomembranes market area will dominate this market, owing to rising awareness and government regulation on water conservation and pollution.

Further, the major countries studied in the market report are The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: Geomembranes Market Share by Region 2022 (%)

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Europe’s region Geomembrane’s market accounts for the second-largest market share due to the establishment of large-scale mining industries. Further, the German Geomembranes market dominates the market share, and the UK Geomembranes market is expected to grow significantly in the European Region.

The Asia-Pacific Geomembranes Market is anticipated to grow steadily during the projected period. This is due to rising construction and mining activity that boosts the overall market demand. Moreover, China’s Geomembranes market holds the highest market share, and the Indian Geomembranes market is expected to expand quickly in the Asia-Pacific region.

For instance, Due to the increasing need for water conservation and groundwater treatment, geomembrane has been in greater demand for applications such as canal lining. India, China, and Uzbekistan are some Asia-Pacific nations driving the greatest geomembrane demand for canal lining applications.

Geomembranes Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development to produce new solutions, which will help the Geomembranes market to expand further. Market participants are also undertaking a strategic approach to strengthen their international footprint, with important market developments including new product lines, contracts, mergers and acquisitions, capex, and alliances with other organizations. The Geomembrane industry must offer cost-effective solutions to expand and compete in a fragmented market.

Manufacturing locally to minimize expenses is one of the key business tactics organizations use in the Geomembranes industry to benefit customers and capture market share. In recent years, the Geomembranes industry has offered some of the most significant advantages to environmental concerns. Major players in the Geomembranes market, including GSE Environmental (US), NAUE GmbH & Co. KG (Germany), Owens Corning (US), Atarfil SL (Spain), Evoqua Water Technologies LLC (US), AGRU AMERICA, INC (US), Icopal company (UK), Officine Maccaferri Spa (Italy), GEOSER (Turkey), Plastika Kritis S.A. (Greece), GEOFABRICS AUSTRALASIA PTY LTD (Australia), and Geosynthetic Technology Ltd (UK), are attempting to cater market share by investing in research and development operations to offer sustainable solutions.

RENOLIT SE was established on May 4, 1946. It enjoys a stellar reputation as a leading manufacturer of premium films made of plastic and other products for various markets and applications, such as the automotive, healthcare, housing, transportation, marketing & packaging industries. From furniture surfaces and window profiles to swimming pool lining and elements for transfusion packages, they seek innovation to develop goods and solutions that improve lives. In July 2019, A joint venture (JV) will be established in India to manufacture geomembranes for use in construction and civil engineering, according to RENOLIT SE. The plant will also be located in the business' distribution facility in Pune, Maharashtra, India, and it is anticipated to begin operating on January 1, 2021.

American business Raven Industries, Inc. creates technologies for farmers to manage their data and supplies for agricultural precision. It was established in 1956 and headquartered in Sioux Falls, South Dakota. It additionally had a Designed segment that manufactured plastic films for various farming and industrial uses. In February 2021, about the 7-layer barrier extruded line and the most recent polished-edge technology, Raven Industries, Inc. announced its Engineered Films department produces 23' wide textured sheet geomembranes. The most recent smooth-edge extrusion method creates a top-notch, smooth surface edge on the rough side goods on both the top and bottom. The newest technology aids in increasing the surface area for thermal fusion welding. To provide more stability on steep slopes, increased worksite safety, and stabilization of primary and secondary geosynthetics, the Raven HydraLineTM HDT- and LLT-Series are designed with a textured surface.

Dow will begin selling INTREPID 2499 Bimodal HDPE Resin for geomembranes in 2021. Geomembranes provide an important barrier against chemicals, poisons, and other dangerous substances entering the earth's soil and water. They serve an important role in conserving the earth's most valuable resources by acting as a barrier to the spread of toxins.

Key Companies in the Geomembranes market include

- GSE Environmental (US)

- NAUE GmbH & Co. KG (Germany)

- Owens Corning (US)

- Atarfil SL (Spain)

- Evoqua Water Technologies LLC (US)

- AGRU AMERICA INC (US)

- Icopal Company (UK)

- Officine Maccaferri Spa (Italy)

- GEOSER (Turkey)

- Plastika Kritis S.A. (Greece)

- GEOFABRICS AUSTRALASIA PTY LTD

- Geosynthetic Technology Ltd (UK)

Geomembranes Industry Developments

April 2021: SOLMAX, a producer of polyethylene geomembranes, declared in April 2021 that it had concluded a contractual agreement with Koninklijke Ten Cate to purchase TenCate Geosynthetics.

February 2021: About the 7-layer barrier extruded line and the most recent polished-edge technology, Raven Industries, Inc. announced its Engineered Films department produces 23' wide textured sheet geomembranes. The most recent smooth-edge extrusion method creates a top-notch, smooth surface edge on the rough side goods on both the top and bottom. The newest technology aids in increasing the surface area for thermal fusion welding. To provide more stability on steep slopes, increased worksite safety, and stabilization of primary and secondary geosynthetics, the Raven HydraLineTM HDT- and LLT-Series are designed with a textured surface.

July 2019: A joint venture (JV) will be established in India to manufacture geomembranes for construction and civil engineering, according to RENOLIT SE, a film manufacturer headquartered in Germany. The plant will also be located in the business' distribution facility in Pune, Maharashtra, India, and it is anticipated to begin operating on January 1, 2021.

Geomembranes Market Segmentation

Geomembranes Resin Type Outlook

- Thermoplastic Polymers

- Elastomers

Geomembranes Technology Outlook

- Blown Film

- Calendaring

- Spread Coating

Geomembranes Application Outlook

- Landfills

- Water Management

- Mining

- Bioenergy Generation Plants

- Agricultural

Geomembranes Regional Outlook

- North America

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America

| Attribute/Metric |

Details |

| Market Size 2023 |

USD 2.88 billion |

| Market Size 2024 |

USD 3.08 billion |

| Market Size 2032 |

USD 4.96 billion |

| Compound Annual Growth Rate (CAGR) |

6.13% (2024-2032) |

| Base Year |

2023 |

| Market Forecast Period |

2024-2032 |

| Historical Data |

2018- 2022 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Type, Technology, Application, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered |

The U.S., Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

GSE Environmental (US), NAUE GmbH & Co. KG (Germany), Owens Corning (US), Atarfil SL (Spain), Evoqua Water Technologies LLC (US), AGRU AMERICA, INC (US), Icopal company (UK), Officine Maccaferri Spa (Italy), GEOSER (Turkey), Plastika Kritis S.A. (Greece), GEOFABRICS AUSTRALASIA PTY LTD (Australia), and Geosynthetic Technology Ltd (UK) |

| Key Market Opportunities |

The increased awareness of preserving water is a key element propelling the international market expansion. |

| Key Market Dynamics |

The LLDPE is a premium geomembrane that is cost-effective for applications requiring high durability and strength and designed for a long lifespan. |

Geomembranes Market Highlights:

Frequently Asked Questions (FAQ) :

The Geomembranes market size was anticipated at USD 2.88 Billion in 2023.

The Geomembranes market is estimated to grow at a CAGR of 6.13% during the forecast period, 2024-2032.

North America had the largest share of the Geomembranes market.

The key players in the Geomembranes market are GSE Environmental (US), NAUE GmbH & Co. KG (Germany), Owens Corning (US), Atarfil SL (Spain), Evoqua Water Technologies LLC (US), AGRU AMERICA, INC (US), Icopal company (UK), Officine Maccaferri Spa (Italy), GEOSER (Turkey), Plastika Kritis S.A. (Greece), GEOFABRICS AUSTRALASIA PTY LTD (Australia), and Geosynthetic Technology Ltd (UK).

The thermoplastic polymer dominated the market in 2023.

The calendaring had the largest share in the Geomembranes market.