Research Methodology on Mining Chemicals Market

Abstract

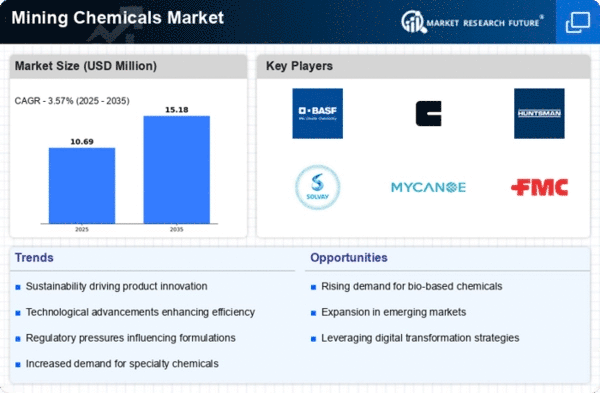

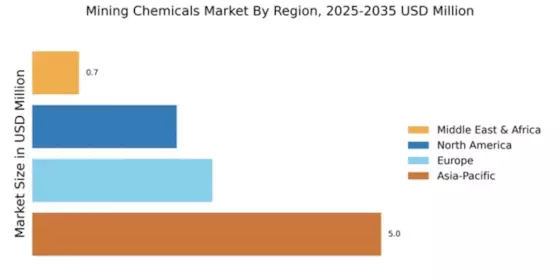

Mining chemicals are used to extract useful elements from the mined ore. The global mining chemicals market is expected to witness impressive growth during the forecast period (2023 to 2030). Growth in the mining industry and increased demand for mineral extraction are anticipated to fuel the demand for mining chemicals.

Introduction

Mining chemicals are extensively used to extract useful elements from the mined ore. The growth of the global mining chemicals market can be attributed to the increasing demand for mineral extraction, especially in developing countries. The rise in the number of mining operations, growth in industrialization, surge in investment in the exploration of non-metallic minerals, the increasing need for advanced technologies to increase the productivity of mining industries, and rising awareness about environmental protection are the major factors driving the growth of the mining chemicals market.

Research Objectives

The primary objective of this research is to understand the global mining chemicals market and its trends. This research aims to study the factors influencing the growth of the global mining chemicals market. Additional objectives of this research are as follows:

- To study the market dynamics of the mining chemicals market

- To determine the market entry and expansion strategies of players in the mining chemicals market

- To provide insights into the competitive landscape of the global mining chemicals market

- To investigate the prevailing industrial regulations and policies related to the global mining chemicals market

Research Methodology

This research is conducted using both primary and secondary research methods. The primary research phase involves interviews with experts in the mining chemicals industry. The experts will include senior executives, professionals, and industry professionals from large and small mining chemicals manufacturers, distributors, and service providers.

Data Sources

The secondary research phase is based on extensive data collected from various sources such as industry journals, reports from chemicals and mining companies, government publications, and other relevant sources. The data sources used for this research report include the following:

- Worldwide annual production and consumption of chemicals

- Company websites

- Business Directories

- Newspapers

- Journals

- Statistical reports

Research Design

The research design used in this research report includes a mix of both qualitative and quantitative methods. Qualitative research techniques such as interviews, focus groups, and online surveys will be used to study the market dynamics of the mining chemicals industry, while quantitative techniques such as descriptive and inferential analyses will be used to analyze the gathered data.

Data Collection

The primary data is gathered from the interviews conducted with experts and industry personnel. Interviews are conducted in three phases: preliminary interviews, mid-level interviews, and expert interviews. The primary data gathered from the interviews are complemented by secondary data collected from several sources.

Data Analysis

The data collected in this research study is analyzed using several statistical tools such as correlation and regression analysis, factor analysis, and chi-square test. The data analysis techniques used in this research report help identify correlations between different variables related to the mining chemicals market.

Conclusion

This research study provides a comprehensive analysis of the trends and drivers in the global mining chemicals market. The findings of the study help stakeholders understand the key factors influencing the growth of the global mining chemicals market. This research report provides a valuable source of information to investors, who are planning to enter the mining chemicals market.