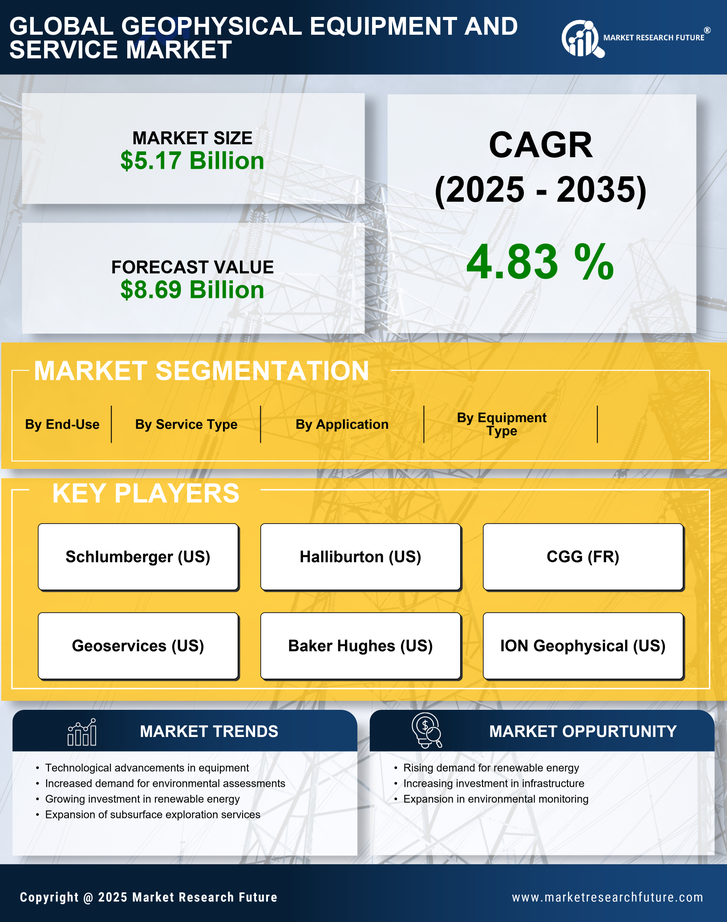

Rising Demand for Natural Resources

The increasing global demand for natural resources, such as oil, gas, and minerals, drives the Geophysical Equipment and Service Market. As countries strive to meet energy needs and industrial requirements, exploration activities intensify. This trend is evidenced by the projected growth in the oil and gas sector, which is expected to reach a market value of approximately 4 trillion USD by 2025. Consequently, companies are investing in advanced geophysical equipment to enhance exploration efficiency and accuracy. The need for precise data collection and analysis in resource extraction further propels the demand for geophysical services, indicating a robust market trajectory.

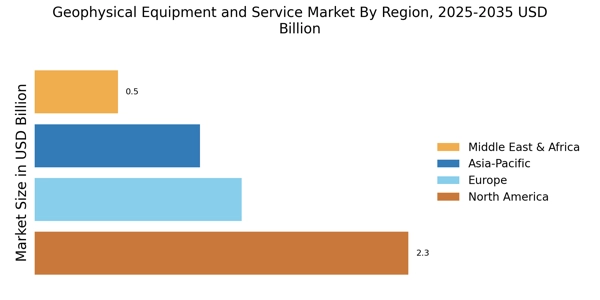

Infrastructure Development Initiatives

Infrastructure development initiatives across various regions contribute significantly to the Geophysical Equipment and Service Market. Governments and private entities are increasingly investing in infrastructure projects, including transportation, utilities, and urban development. For instance, the construction sector is anticipated to grow at a compound annual growth rate of around 5% through 2025. This growth necessitates the use of geophysical equipment for site characterization, subsurface mapping, and risk assessment. As infrastructure projects expand, the reliance on geophysical services to ensure safety and compliance with regulations becomes paramount, thereby enhancing market prospects.

Environmental Monitoring and Compliance

The heightened focus on environmental monitoring and compliance is a crucial driver for the Geophysical Equipment and Service Market. Regulatory frameworks are becoming more stringent, necessitating accurate assessments of environmental impacts associated with various projects. The market for environmental monitoring equipment is projected to grow significantly, with an expected increase in demand for geophysical services to assess soil and groundwater conditions. This trend is particularly relevant in sectors such as construction, mining, and waste management, where compliance with environmental regulations is essential. As organizations prioritize sustainability, the integration of geophysical methods for environmental assessments is likely to expand.

Advancements in Geophysical Technologies

Technological advancements in geophysical equipment and methodologies are reshaping the Geophysical Equipment and Service Market. Innovations such as 3D seismic imaging, ground-penetrating radar, and drone-based surveys enhance data collection and analysis capabilities. The market for geophysical technologies is projected to witness substantial growth, driven by the need for more accurate and efficient exploration techniques. These advancements not only improve the quality of geophysical data but also reduce operational costs, making them attractive to companies in various sectors. As technology continues to evolve, the demand for sophisticated geophysical services is expected to rise, indicating a positive market outlook.

Increased Investment in Renewable Energy

The shift towards renewable energy sources is emerging as a significant driver for the Geophysical Equipment and Service Market. As nations commit to reducing carbon emissions, investments in renewable energy projects, such as wind, solar, and geothermal, are on the rise. The renewable energy sector is projected to grow at a compound annual growth rate of over 8% through 2025. Geophysical services play a vital role in site selection, resource assessment, and environmental impact studies for these projects. This growing emphasis on sustainable energy solutions is likely to bolster the demand for geophysical equipment and services, reflecting a transformative shift in the energy landscape.