Expansion of IoT Devices

The proliferation of Internet of Things (IoT) devices in Germany significantly influences the big data-software market. With millions of devices generating vast amounts of data, organizations are compelled to adopt advanced software solutions to manage and analyze this influx. The number of connected devices in Germany is projected to reach over 50 million by 2026, creating a substantial need for effective data management tools. This expansion not only enhances operational efficiency but also provides opportunities for innovative applications across various sectors, including manufacturing and healthcare. Consequently, the big data-software market is likely to see increased investment as companies strive to harness the potential of IoT data. The integration of IoT with big data analytics can lead to improved predictive maintenance, enhanced customer insights, and optimized resource allocation, further propelling market growth.

Rising Demand for Real-Time Analytics

The big data-software market in Germany experiences a notable surge in demand for real-time analytics solutions. Organizations are increasingly recognizing the value of immediate insights derived from data, which can enhance decision-making processes. This trend is particularly evident in sectors such as finance and retail, where timely data interpretation can lead to competitive advantages. According to recent studies, approximately 60% of German enterprises are prioritizing real-time data capabilities, indicating a shift towards more agile business models. The ability to analyze data as it is generated allows companies to respond swiftly to market changes, thereby driving growth in the big data-software market. As businesses continue to seek ways to optimize operations and improve customer experiences, the demand for real-time analytics is likely to remain a key driver in the industry.

Regulatory Compliance and Data Governance

The big data-software market in Germany is significantly influenced by the increasing emphasis on regulatory compliance and data governance. With stringent regulations such as the General Data Protection Regulation (GDPR) in place, organizations are compelled to adopt software solutions that ensure compliance while managing vast datasets. This regulatory landscape creates a demand for big data software that can facilitate data governance, security, and privacy. Companies are investing in technologies that not only comply with legal requirements but also enhance their data management capabilities. As a result, the market is likely to witness growth driven by the need for solutions that address compliance challenges while enabling effective data utilization. The focus on governance and compliance is expected to shape the development of big data software, leading to innovations that prioritize security and ethical data handling.

Increased Investment in Data Infrastructure

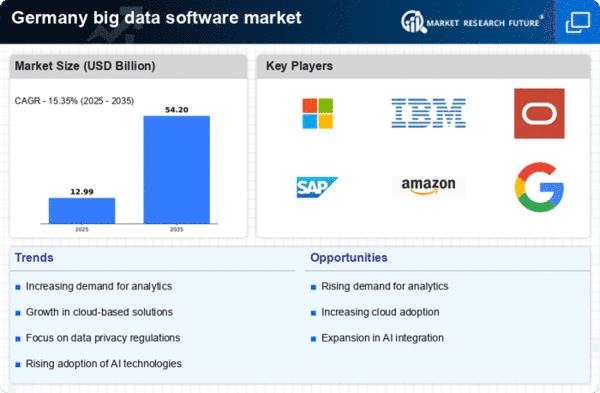

The big data-software market in Germany is poised for growth due to increased investment in data infrastructure. Organizations are recognizing the necessity of robust data architectures to support their analytics initiatives. This investment trend is reflected in the allocation of substantial budgets towards upgrading data storage, processing capabilities, and analytics tools. Reports suggest that spending on data infrastructure in Germany is expected to grow by approximately 15% annually over the next few years. This influx of capital is likely to enhance the capabilities of big data software, enabling organizations to process larger datasets more efficiently. As businesses strive to leverage data for competitive advantage, the emphasis on building a solid data foundation will continue to drive demand for advanced big data solutions, thereby shaping the future of the market.

Growing Focus on Data-Driven Decision Making

In Germany, there is a marked shift towards data-driven decision making, which serves as a catalyst for the big data-software market. Organizations are increasingly leveraging data analytics to inform strategic choices, thereby enhancing operational efficiency and competitiveness. A recent survey indicates that over 70% of German businesses consider data analytics essential for their growth strategies. This trend underscores the importance of investing in robust big data software solutions that can provide actionable insights. As companies recognize the potential of data to drive innovation and improve performance, the demand for sophisticated analytics tools is expected to rise. This focus on data-driven methodologies not only fosters a culture of informed decision making but also positions organizations to adapt more effectively to market dynamics, thereby stimulating growth in the big data-software market.