Germany Bio Lubricants Size

Germany Bio-lubricants Market Growth Projections and Opportunities

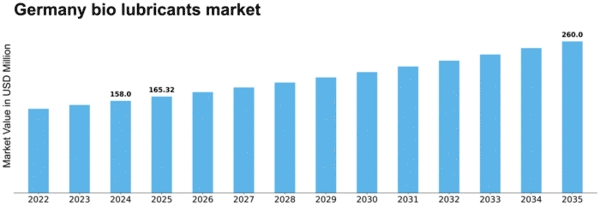

Germany Bio-lubricants Market is influenced by several market variables which are responsible for its growth and prominence in sustainable lubrication. Enhanced ecological awareness and dedication to the environment conservation in Germany are some of the main forces that drive this market. The country has been one of the leading pioneers of sustainability, thus more accentuation is being placed on reducing the environmental impact of lubricants. Eco-friendly bio-lubricants made from renewable sources, offering biodegradability have become popular due to their greenness. This raised consciousness is driving the demand for bio-lubricants across various sectors including automotive manufacturing and agriculture. Government policies and regulations greatly shape the Germany Bio-lubricants Market. In a bid to protect its environment systematically there are set rules, regulations and standards that encourage use of bio based/ environmentally friendly products. Government incentives, subsidies, and statutory requirements underpinning use of bio-lubricants provide a favorable regulatory climate for both manufacturers and consumers alike. Besides driving market growth, this alignment with government policies promotes industrial sector’s goal. The trend towards sustainable eco-friendly products is shaping consumer preferences in Germany Bio-Lubricants Market currently as shown in figure 1 below: Growing consumer environmental awareness leads to increased demand for green oriented goods as well as services.For those customers who want an alternative from traditional lubricating oils they will choose bio-based oil as it comes with such features like biodegradable property.Bio-Lubes Innovations Ltd., Green Earth Technologies Inc., Renewable Lubricants Inc., NeoBio Oil GmbH, Biosynthetic Technologies LLC., Polnox Corporation, BP PLC (Castrol), Klüber Lubrication München SE & Co. KG, Fuchs Petrolub AG, Exxon Mobil Corporation. Technological innovations involving formulation of biolubricants, significantly contribute to market development. On-going research and development effort target improvement of performance attributes of bio-lubricants such as lubricity, stability and temperature resistance. Advanced manufacturing techniques and exploration of new feedstocks improve the overall efficiency and competitiveness of bio-lubricants compared with traditional lubricants. To meet the changing demands from different industries, it is vital for manufacturers of bio-lubricants to keep up with these technological advances. The success of Germany Bio-lubricants Market depends on supply chain considerations such as availability of feedstock and logistical efficiency. Sustainable sourcing of renewable feedstocks like vegetable oils for producing bio-lubricant requires proper planning to ensure sustainability. Further, a well-managed supply chain guarantees that end-users in various sectors receive timely delivery of bio-lubricant thereby further contributing towards the growth in the market. Market collaborations and partnerships are crucial in shaping Germany Bio-Lubricants Market. Bio-lube manufacturers partnering with researchers at universities or other private research facilities can get help doing this by sharing information on how they can go about replacing petroleum based raw materials with the most efficient ones. This paper examines several key factors affecting German biolubes industry: changes in consumer demand, government regulations, pricing trends, technological advancements and sources of feed stocks.These partnerships increase competition within the market and promote innovation through exchange of ideas among partners leading to new technologies being used in production.

Leave a Comment