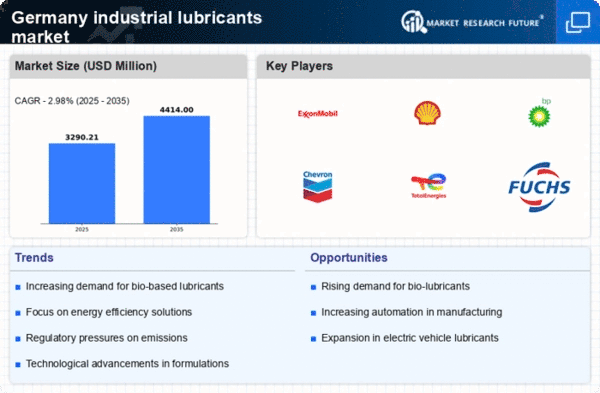

The industrial lubricants market in Germany exhibits a competitive landscape characterized by a blend of established players and emerging innovators. Key growth drivers include the increasing demand for high-performance lubricants across various sectors, such as automotive, manufacturing, and energy. Major companies like ExxonMobil (US), Shell (GB), and Fuchs Petrolub (DE) are strategically positioned to leverage their extensive product portfolios and technological advancements. ExxonMobil (US) focuses on innovation in synthetic lubricants, while Shell (GB) emphasizes sustainability through its eco-friendly product lines. Fuchs Petrolub (DE) is enhancing its regional presence by investing in local manufacturing capabilities, thereby optimizing supply chains and reducing lead times. Collectively, these strategies shape a competitive environment that is increasingly focused on performance and sustainability.In terms of business tactics, companies are localizing manufacturing to better serve regional markets and optimize supply chains. The market structure appears moderately fragmented, with a mix of large multinational corporations and smaller specialized firms. This fragmentation allows for diverse product offerings and competitive pricing, although the influence of key players remains substantial. The collective actions of these companies indicate a trend towards consolidation, as they seek to enhance their market share and operational efficiencies.

In October Shell (GB) announced a partnership with a leading automotive manufacturer to develop a new line of bio-based lubricants. This strategic move underscores Shell's commitment to sustainability and positions the company to capture a growing segment of environmentally conscious consumers. The collaboration is expected to enhance Shell's product offerings while aligning with global trends towards greener alternatives in industrial applications.

In September Fuchs Petrolub (DE) launched a new range of high-performance lubricants specifically designed for the renewable energy sector. This initiative reflects Fuchs' strategic focus on diversifying its product portfolio to meet the evolving needs of industries transitioning towards sustainable practices. The introduction of these lubricants is likely to strengthen Fuchs' competitive edge in a rapidly growing market segment.

In August BP (GB) expanded its digital services by integrating AI-driven analytics into its lubricant supply chain management. This strategic enhancement aims to improve operational efficiency and customer service by providing real-time insights into inventory and demand forecasting. Such advancements indicate BP's commitment to leveraging technology to maintain a competitive advantage in the industrial lubricants market.

As of November current competitive trends are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are becoming pivotal in shaping the landscape, as companies collaborate to innovate and enhance their product offerings. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is evident. Moving forward, competitive differentiation will likely hinge on the ability to adapt to these trends, with companies that prioritize sustainability and technological integration poised to lead the market.