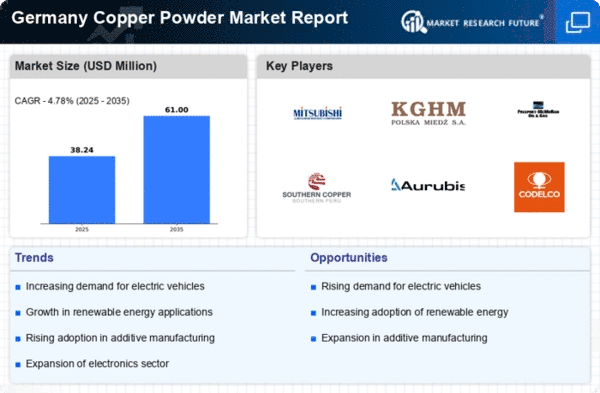

The copper powder market in Germany exhibits a competitive landscape characterized by a blend of established players and emerging innovators. Key growth drivers include the increasing demand for advanced materials in electronics, automotive, and renewable energy sectors. Major companies such as Aurubis AG (Germany), Mitsubishi Materials Corporation (Japan), and KGHM Polska Miedz S.A. (Poland) are strategically positioned to leverage these trends. Aurubis AG focuses on sustainability and circular economy practices, enhancing its operational efficiency and market appeal. Meanwhile, Mitsubishi Materials Corporation (Japan) emphasizes technological innovation and product diversification, which strengthens its competitive edge. KGHM Polska Miedz S.A. (Poland) is actively pursuing regional expansion and partnerships, thereby enhancing its market presence and operational capabilities. Collectively, these strategies shape a dynamic competitive environment, fostering innovation and responsiveness to market demands.In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to enhance efficiency and reduce costs. The market structure appears moderately fragmented, with several key players exerting influence over pricing and supply dynamics. This fragmentation allows for niche players to emerge, yet the collective strength of major companies like Aurubis AG (Germany) and KGHM Polska Miedz S.A. (Poland) remains significant in shaping market trends and consumer preferences.

In October Aurubis AG (Germany) announced a strategic partnership with a leading technology firm to develop advanced copper powder applications for the electric vehicle sector. This collaboration is poised to enhance Aurubis's product offerings and align with the growing demand for sustainable materials in the automotive industry. The strategic importance of this partnership lies in its potential to position Aurubis as a frontrunner in the green technology space, thereby attracting environmentally conscious consumers and investors alike.

In September Mitsubishi Materials Corporation (Japan) unveiled a new production facility in Germany aimed at increasing its copper powder output by 30%. This expansion reflects the company's commitment to meeting rising demand in Europe, particularly in high-tech applications. The strategic significance of this facility lies in its ability to enhance supply chain reliability and reduce lead times, which are critical factors in maintaining competitive advantage in the fast-paced market.

In August KGHM Polska Miedz S.A. (Poland) launched a new line of eco-friendly copper powders, targeting the growing market for sustainable materials. This initiative not only aligns with global sustainability trends but also positions KGHM as a leader in environmentally responsible production practices. The strategic importance of this move is underscored by the increasing regulatory pressures and consumer preferences for sustainable products, which could enhance KGHM's market share and brand reputation.

As of November current competitive trends in the copper powder market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming pivotal in shaping the landscape, enabling companies to pool resources and expertise for innovation. The competitive differentiation is likely to evolve from traditional price-based competition towards a focus on technological advancements, sustainable practices, and supply chain reliability. This shift suggests that companies that prioritize innovation and sustainability will be better positioned to thrive in the future market.