Integration of Industry 4.0 Principles

The integration of Industry 4.0 principles is significantly influencing the Germany electrical electronic computer aided design market. As manufacturers increasingly adopt smart technologies and automation, the demand for CAD tools that can seamlessly integrate with these systems is rising. This trend is particularly evident in sectors such as manufacturing and construction, where real-time data exchange and collaboration are essential. The implementation of IoT devices and smart sensors is driving the need for CAD solutions that can accommodate these advancements. Consequently, the Germany electrical electronic computer aided design market is poised for growth as companies seek to leverage these technologies to enhance productivity and efficiency in their design processes.

Growing Demand for Advanced Design Tools

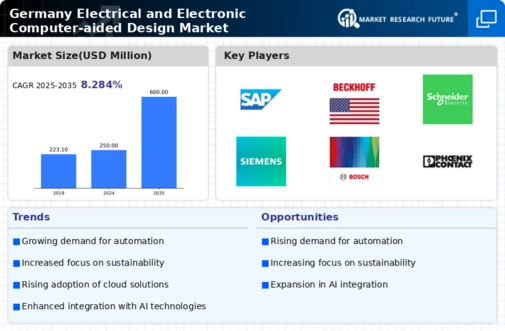

The Germany electrical electronic computer aided design market is experiencing a notable increase in demand for advanced design tools. This surge is primarily driven by the need for more efficient and precise design processes across various sectors, including automotive, aerospace, and consumer electronics. As companies strive to enhance their product development cycles, the adoption of sophisticated CAD software is becoming essential. According to recent data, the market for CAD software in Germany is projected to grow at a compound annual growth rate of approximately 6% over the next five years. This growth reflects the industry's commitment to innovation and the necessity for tools that can handle complex design challenges, thereby positioning the Germany electrical electronic computer aided design market for sustained expansion.

Government Initiatives Supporting Innovation

The German government has implemented several initiatives aimed at fostering innovation within the electrical electronic computer aided design market. Programs such as the High-Tech Strategy 2025 focus on promoting research and development in advanced technologies, including CAD systems. These initiatives not only provide funding opportunities for startups and established companies but also encourage collaboration between academia and industry. The government's commitment to enhancing the technological landscape is evident in its investment in digital infrastructure, which is crucial for the growth of the CAD market. As a result, the Germany electrical electronic computer aided design market is likely to benefit from increased funding and resources, facilitating the development of cutting-edge design solutions.

Increased Investment in Research and Development

Investment in research and development is a critical driver for the Germany electrical electronic computer aided design market. Companies are recognizing the importance of innovation in maintaining a competitive edge, leading to increased funding for R&D activities. This trend is particularly pronounced in sectors such as automotive and aerospace, where advanced design capabilities are essential for developing next-generation products. According to industry reports, R&D spending in the German engineering sector is expected to rise significantly, reflecting a broader commitment to technological advancement. As a result, the Germany electrical electronic computer aided design market is likely to see enhanced capabilities and new product offerings, further stimulating market growth.

Rising Focus on Customization and Personalization

In the Germany electrical electronic computer aided design market, there is a growing emphasis on customization and personalization of products. As consumer preferences evolve, companies are increasingly required to offer tailored solutions that meet specific customer needs. This shift is prompting the adoption of CAD tools that enable designers to create highly customized products efficiently. Industries such as fashion, automotive, and consumer electronics are particularly affected by this trend, as they strive to differentiate their offerings in a competitive market. The ability to quickly adapt designs to meet individual customer requirements is becoming a key competitive advantage, thereby driving the growth of the Germany electrical electronic computer aided design market.