Market Analysis

In-depth Analysis of Germany lithium ion battery market Industry Landscape

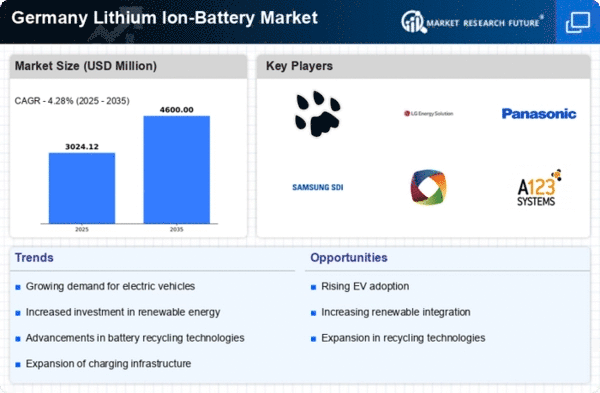

The lithium-ion battery market in Germany is experiencing dynamic shifts driven by several key factors. Firstly, the increasing demand for electric vehicles (EVs) is a major driver of growth in the lithium-ion battery market. With Germany's ambitious goals to reduce greenhouse gas emissions and promote sustainable transportation, the adoption of EVs has been steadily rising. This surge in EV sales directly translates to a higher demand for lithium-ion batteries, as they are the primary energy storage solution in electric vehicles.

Secondly, the push for renewable energy sources and energy storage solutions is contributing to the growth of the lithium-ion battery market in Germany. As the country seeks to transition away from fossil fuels and towards a more sustainable energy infrastructure, the need for efficient energy storage solutions becomes paramount. Lithium-ion batteries play a crucial role in storing excess energy generated from renewable sources such as wind and solar power, providing stability to the grid and enabling greater integration of renewables into the energy mix.

Moreover, technological advancements and innovations in lithium-ion battery technology are driving market dynamics in Germany. Continuous research and development efforts are leading to improvements in battery performance, energy density, and cost reduction. These advancements not only enhance the capabilities of lithium-ion batteries but also make them more affordable and accessible to a wider range of applications beyond electric vehicles, such as consumer electronics, stationary energy storage systems, and industrial applications.

Additionally, government policies and incentives are shaping the market dynamics of the lithium-ion battery industry in Germany. Supportive policies, subsidies, and incentives aimed at promoting the adoption of electric vehicles and renewable energy technologies are driving investment and innovation in the battery sector. For instance, Germany's National Innovation Program for Battery Cells aims to support research and development activities in battery technology and strengthen the country's position in the global battery market.

Furthermore, partnerships and collaborations between industry players, research institutions, and government agencies are fostering growth and innovation in the lithium-ion battery market in Germany. By pooling resources, expertise, and knowledge, stakeholders can accelerate the development and commercialization of advanced battery technologies, driving competitiveness and sustainability in the market.

However, the market dynamics of the lithium-ion battery industry in Germany also face challenges and uncertainties. One major challenge is the availability and sourcing of raw materials such as lithium, cobalt, and nickel, which are essential components of lithium-ion batteries. Ensuring a stable and sustainable supply chain for these materials is crucial to meet the growing demand for batteries while minimizing environmental and social impacts associated with their extraction and production.

Moreover, competition from other battery technologies and emerging markets poses a threat to the dominance of lithium-ion batteries in Germany. Technologies like solid-state batteries and next-generation energy storage solutions could potentially disrupt the market by offering superior performance, safety, and sustainability compared to conventional lithium-ion batteries.

The market dynamics of the lithium-ion battery industry in Germany are characterized by growth opportunities driven by factors such as the rising demand for electric vehicles, renewable energy integration, technological advancements, supportive policies, and collaborative efforts. However, challenges such as raw material sourcing, competition from alternative technologies, and market uncertainties remain significant considerations for industry players and policymakers alike as they navigate the evolving landscape of the battery market.

Leave a Comment