Market Trends

Key Emerging Trends in the Germany lithium ion battery market

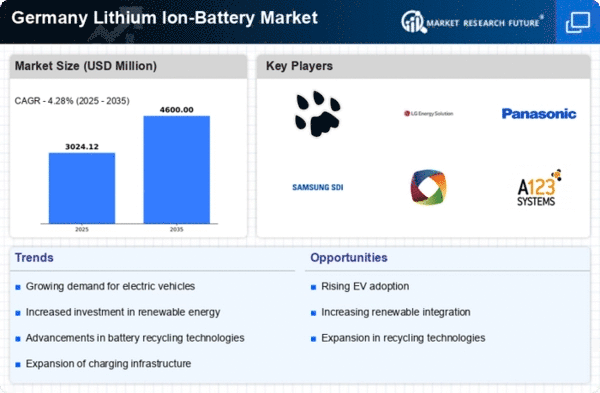

The lithium-ion battery market in Germany is experiencing significant growth, driven by several key market trends. One prominent trend is the increasing demand for electric vehicles (EVs) in the country. As Germany aims to reduce greenhouse gas emissions and combat climate change, there has been a surge in consumer interest in EVs, which rely heavily on lithium-ion batteries for power storage. This heightened demand for EVs has subsequently led to a rise in the demand for lithium-ion batteries.

Additionally, the push towards renewable energy sources has bolstered the lithium-ion battery market in Germany. With the government's ambitious goals to transition to renewable energy, there has been a growing need for energy storage solutions to address the intermittency of renewable sources like solar and wind power. Lithium-ion batteries offer a reliable and efficient means of storing excess energy generated from renewables, thus supporting the expansion of renewable energy capacity in the country.

Moreover, advancements in technology and manufacturing processes have contributed to the growth of the lithium-ion battery market in Germany. Innovations in battery chemistry, such as the development of higher energy density materials, have led to improvements in battery performance, driving further adoption across various sectors. Additionally, economies of scale and increased production efficiencies have helped lower the cost of lithium-ion batteries, making them more accessible to consumers and businesses alike.

Furthermore, the expansion of the electronics and consumer goods industries has fueled demand for lithium-ion batteries in Germany. From smartphones and laptops to power tools and home appliances, lithium-ion batteries have become ubiquitous in modern electronic devices. As these industries continue to grow and innovate, the demand for high-performance batteries is expected to remain strong, further propelling the lithium-ion battery market forward.

Another significant trend shaping the lithium-ion battery market in Germany is the focus on sustainability and environmental responsibility. With increasing awareness of the environmental impact of traditional energy sources and battery technologies, there is a growing emphasis on developing eco-friendly and recyclable battery solutions. Manufacturers in Germany are investing in research and development efforts to improve the sustainability of lithium-ion batteries, exploring alternatives to critical materials and implementing recycling programs to reduce waste.

Moreover, government support and incentives have played a crucial role in driving the growth of the lithium-ion battery market in Germany. Subsidies for EV purchases, tax incentives for renewable energy installations, and research grants for battery technology development are among the measures implemented to promote the adoption of lithium-ion batteries and accelerate the transition to a low-carbon economy.

The lithium-ion battery market in Germany is witnessing robust growth driven by various market trends, including the rise of electric vehicles, the expansion of renewable energy, technological advancements, increasing demand from electronics and consumer goods industries, sustainability initiatives, and government support. With ongoing innovation and investment, the market is poised for continued expansion as lithium-ion batteries play an increasingly integral role in powering the transition towards a more sustainable and electrified future.

Leave a Comment