Emergence of IoT Devices

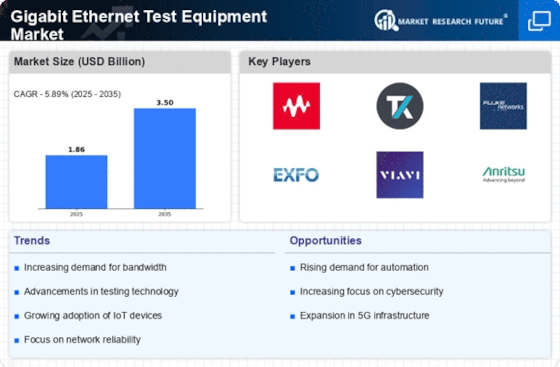

The Internet of Things (IoT) is transforming the landscape of connectivity, with billions of devices expected to be connected in the coming years. This proliferation of IoT devices necessitates robust network infrastructure, which in turn drives the demand for Gigabit Ethernet Test Equipment Market solutions. Testing equipment is essential to ensure that these devices can communicate effectively and reliably over high-speed networks. As IoT adoption accelerates, the market for testing solutions is likely to expand, with projections suggesting a compound annual growth rate of 25% in the sector. This trend highlights the importance of Gigabit Ethernet testing in supporting the seamless integration of IoT technologies.

Expansion of Data Centers

The rapid expansion of data centers is a pivotal driver for the Gigabit Ethernet Test Equipment Market. As businesses increasingly migrate to cloud-based services, the need for efficient and reliable data center operations becomes paramount. Data centers require extensive testing to ensure optimal performance and uptime, leading to a heightened demand for Gigabit Ethernet testing solutions. Recent statistics indicate that the number of data centers is expected to grow by 20% over the next few years, further amplifying the need for advanced testing equipment. This growth presents a significant opportunity for manufacturers and service providers within the Gigabit Ethernet Test Equipment Market.

Increasing Bandwidth Requirements

The demand for higher bandwidth continues to escalate, driven by the proliferation of data-intensive applications such as cloud computing, video streaming, and online gaming. As organizations seek to enhance their network capabilities, the Gigabit Ethernet Test Equipment Market is witnessing a surge in demand for testing solutions that can validate and ensure the performance of high-speed networks. According to recent data, the bandwidth requirements are projected to increase by over 30% annually, necessitating robust testing equipment to maintain service quality and reliability. This trend underscores the critical role of Gigabit Ethernet Test Equipment Market in supporting the infrastructure needed for modern digital communication.

Regulatory Compliance and Standards

As the telecommunications landscape evolves, regulatory compliance and adherence to industry standards become increasingly critical. The Gigabit Ethernet Test Equipment Market is influenced by the need for testing solutions that meet stringent regulatory requirements. Organizations must ensure that their networks comply with various standards to avoid penalties and maintain operational integrity. The demand for testing equipment that can validate compliance with these standards is expected to rise, particularly as new regulations are introduced. This focus on compliance not only drives the market for Gigabit Ethernet testing solutions but also enhances the overall quality and reliability of network services.

Advancements in Testing Technologies

Technological advancements in testing methodologies and equipment are reshaping the Gigabit Ethernet Test Equipment Market. Innovations such as automated testing solutions, real-time monitoring, and enhanced analytics capabilities are becoming increasingly prevalent. These advancements enable network operators to conduct more efficient and comprehensive testing, thereby improving network performance and reducing downtime. The market is witnessing a shift towards more sophisticated testing solutions that can accommodate the complexities of modern networks. As these technologies continue to evolve, they are likely to drive further growth in the Gigabit Ethernet Test Equipment Market, providing organizations with the tools necessary to meet their connectivity demands.