Regulatory Compliance

Regulatory compliance is becoming increasingly stringent, influencing the Glass Fibers And Specialty Synthetic Fiber Market. Governments worldwide are implementing regulations aimed at reducing environmental impact and ensuring product safety. Compliance with these regulations often necessitates the adoption of advanced materials and manufacturing processes, which can drive innovation within the industry. Companies that proactively adapt to these regulations may find themselves at a competitive advantage, as they can market their products as compliant and environmentally friendly. The potential for penalties and market exclusion for non-compliance further emphasizes the importance of adhering to these regulations. As a result, the market is likely to see a shift towards more sustainable practices, which could enhance the overall growth of the Glass Fibers And Specialty Synthetic Fiber Market.

Sustainability Initiatives

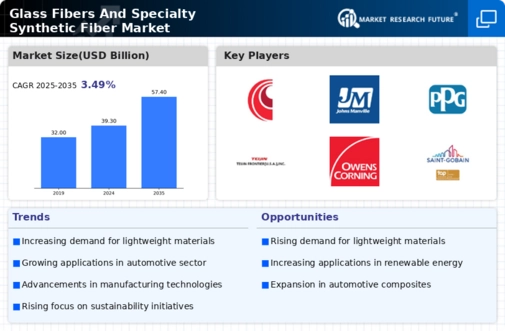

The increasing emphasis on sustainability is a pivotal driver for the Glass Fibers And Specialty Synthetic Fiber Market. Manufacturers are increasingly adopting eco-friendly practices, which include the use of recycled materials and the development of biodegradable fibers. This shift not only meets regulatory requirements but also aligns with consumer preferences for sustainable products. As a result, companies that prioritize sustainability are likely to gain a competitive edge. The market for sustainable glass fibers is projected to grow, with estimates suggesting a compound annual growth rate of over 5% in the coming years. This trend indicates a significant opportunity for innovation and investment in sustainable practices within the Glass Fibers And Specialty Synthetic Fiber Market.

Technological Advancements

Technological advancements play a crucial role in shaping the Glass Fibers And Specialty Synthetic Fiber Market. Innovations in manufacturing processes, such as the development of advanced weaving techniques and improved resin systems, enhance the performance characteristics of glass fibers. These advancements lead to products that are lighter, stronger, and more durable, thereby expanding their applications across various sectors, including automotive, aerospace, and construction. The integration of smart technologies, such as sensors embedded in fibers, is also emerging, which could revolutionize the functionality of these materials. As a result, the market is expected to witness a surge in demand for high-performance glass fibers, with projections indicating a potential increase in market size by approximately 7% over the next five years.

Increased Investment in R&D

Increased investment in research and development (R&D) is a vital driver for the Glass Fibers And Specialty Synthetic Fiber Market. Companies are allocating more resources to R&D to innovate and improve the performance of glass fibers and specialty synthetic fibers. This focus on R&D is essential for developing new applications and enhancing existing products, which can lead to increased market share. The trend of investing in R&D is particularly pronounced in sectors such as aerospace and automotive, where performance and safety are paramount. Reports indicate that R&D spending in the materials sector is expected to rise by approximately 10% over the next few years, suggesting a robust commitment to innovation. This investment is likely to yield new products that meet evolving consumer demands, thereby propelling the growth of the Glass Fibers And Specialty Synthetic Fiber Market.

Growing Demand in Emerging Markets

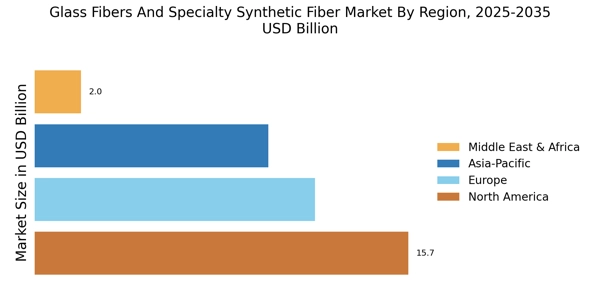

The rising demand for glass fibers and specialty synthetic fibers in emerging markets is a significant driver for the Glass Fibers And Specialty Synthetic Fiber Market. Countries in Asia-Pacific and Latin America are experiencing rapid industrialization and urbanization, leading to increased consumption of these materials in construction, automotive, and consumer goods. For instance, the construction sector in Asia is projected to grow at a rate of 8% annually, which directly correlates with the demand for glass fibers used in reinforced concrete and insulation. This trend suggests that manufacturers should focus on these regions to capitalize on the expanding market opportunities. The growth in emerging markets is likely to contribute to a substantial increase in the overall market size of the Glass Fibers And Specialty Synthetic Fiber Market.

.png)