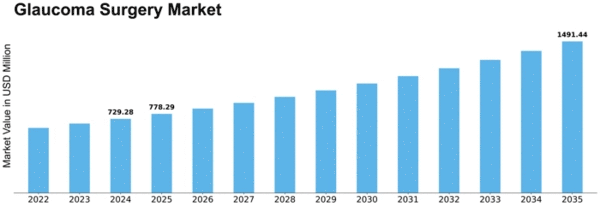

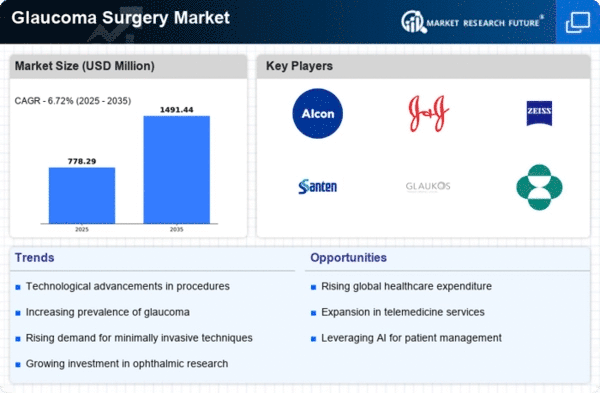

Glaucoma Surgery Size

Glaucoma Surgery Market Growth Projections and Opportunities

The Glaucoma Surgery Market is influenced by various market factors that play a crucial role in shaping its dynamics and growth trajectory. One of the key factors driving the market is the increasing prevalence of glaucoma worldwide. Glaucoma, a progressive eye condition that can lead to irreversible blindness, has witnessed a rise in incidence due to factors such as aging populations and lifestyle-related issues. As the global population continues to age, the demand for glaucoma surgeries is expected to surge, propelling the market forward.

Technological advancements in the field of ophthalmology also contribute significantly to the growth of the Glaucoma Surgery Market. The continuous development of innovative surgical techniques and equipment enhances the efficacy and safety of glaucoma surgeries, making them more accessible to patients. Advanced surgical options, such as minimally invasive glaucoma surgery (MIGS), have gained popularity due to their reduced postoperative complications and faster recovery times. As these technologies become more widespread, they are likely to drive market expansion further.

Moreover, the increasing awareness about eye health and the importance of early detection and treatment of glaucoma is another pivotal market factor. Governments, healthcare organizations, and non-profit entities are actively involved in promoting eye health awareness campaigns, educating the public about the risks associated with glaucoma and the available treatment options. This heightened awareness is expected to result in more individuals seeking medical intervention, consequently boosting the demand for glaucoma surgeries.

Reimbursement policies and healthcare infrastructure also play a significant role in shaping the Glaucoma Surgery Market. Adequate reimbursement for glaucoma surgeries encourages patients to opt for these procedures and facilitates easier access to advanced treatment options. Additionally, the presence of well-established healthcare infrastructure in developed regions ensures that patients have access to cutting-edge surgical interventions, contributing to market growth.

However, challenges such as the high cost of glaucoma surgeries and the limited accessibility of advanced healthcare facilities in certain regions may hinder market growth. Affordability remains a critical factor, especially in developing countries where healthcare resources may be limited. Efforts to address these challenges, such as the development of cost-effective surgical solutions and initiatives to improve healthcare infrastructure, are essential to overcoming barriers and expanding the reach of glaucoma surgeries.

Furthermore, the competitive landscape of the Glaucoma Surgery Market is shaped by factors like mergers and acquisitions, partnerships, and collaborations among key players in the industry. Companies are strategically aligning themselves to gain a competitive edge by leveraging each other's strengths, whether in terms of research and development capabilities, distribution networks, or market presence. Such collaborations contribute to the overall growth and development of the market by fostering innovation and improving the availability of glaucoma surgical solutions.

Leave a Comment