Aging Population

The demographic shift towards an aging population is a significant factor influencing the Global Glaucoma Surgery Market Industry. Older adults are at a higher risk of developing glaucoma, which correlates with the increasing prevalence of the disease. As the global population aged 60 and above continues to expand, the demand for glaucoma surgeries is expected to rise correspondingly. This trend is particularly evident in developed nations, where healthcare systems are adapting to cater to the needs of older patients. Consequently, the Global Glaucoma Surgery Market Industry is likely to experience robust growth, supported by the rising number of surgical procedures performed on this demographic.

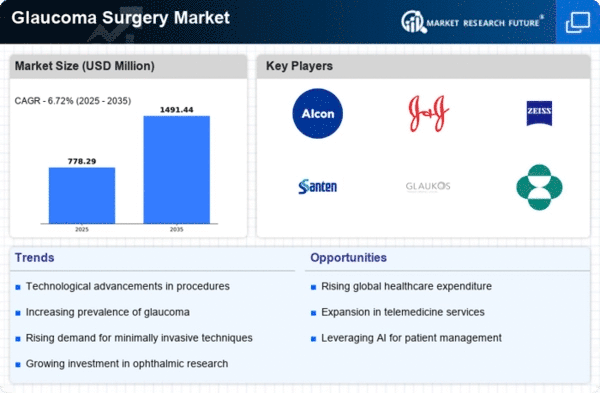

Market Growth Projections

The Global Glaucoma Surgery Market Industry is projected to experience substantial growth over the next decade. With an anticipated market size of 0.73 USD Billion in 2024, the industry is expected to expand at a compound annual growth rate (CAGR) of 6.73% from 2025 to 2035, potentially reaching 1.49 USD Billion by 2035. This growth trajectory suggests a robust demand for glaucoma surgical procedures, driven by factors such as technological advancements, increasing prevalence of the disease, and rising healthcare expenditure. The market dynamics indicate a promising future for stakeholders involved in the Global Glaucoma Surgery Market Industry.

Rising Prevalence of Glaucoma

The increasing incidence of glaucoma globally serves as a primary driver for the Global Glaucoma Surgery Market Industry. According to the World Health Organization, glaucoma affects approximately 76 million individuals worldwide, a figure projected to rise significantly in the coming years. This growing patient population necessitates advanced surgical interventions, thereby propelling market growth. The Global Glaucoma Surgery Market Industry is expected to reach 0.73 USD Billion in 2024, reflecting the urgent need for effective treatment options. As awareness about the disease escalates, more patients are likely to seek surgical solutions, further stimulating market demand.

Increased Healthcare Expenditure

Rising healthcare expenditure across various regions is contributing to the growth of the Global Glaucoma Surgery Market Industry. Governments and private sectors are investing more in healthcare infrastructure, which includes the provision of advanced surgical options for glaucoma patients. This increase in funding facilitates better access to surgical treatments, thereby enhancing patient outcomes. Countries with higher healthcare budgets are likely to see a surge in glaucoma surgeries, as more patients can afford these interventions. The Global Glaucoma Surgery Market Industry is expected to benefit from this trend, as the financial commitment to healthcare continues to grow.

Growing Awareness and Screening Programs

The rise in awareness campaigns and screening programs for glaucoma is significantly impacting the Global Glaucoma Surgery Market Industry. Educational initiatives aimed at informing the public about the risks and symptoms of glaucoma are leading to earlier diagnoses and increased demand for surgical interventions. Health organizations are actively promoting regular eye examinations, which are crucial for early detection. As more individuals become aware of their eye health, the likelihood of seeking surgical treatment increases. This trend is expected to drive the Global Glaucoma Surgery Market Industry forward, as proactive measures lead to higher surgery rates.

Technological Advancements in Surgical Techniques

Innovations in surgical techniques and technologies are transforming the landscape of the Global Glaucoma Surgery Market Industry. Procedures such as minimally invasive glaucoma surgery (MIGS) have gained traction due to their reduced recovery times and lower complication rates. The introduction of advanced devices and tools enhances the precision of surgeries, leading to improved patient outcomes. As these technologies become more accessible, they are likely to attract a broader patient base. The Global Glaucoma Surgery Market Industry is poised for substantial growth, with projections indicating a market size of 1.49 USD Billion by 2035, driven by these advancements.