Aging Population

The US glaucoma surgery market is significantly influenced by the aging population, as the prevalence of glaucoma increases with age. According to the National Eye Institute, the number of Americans aged 40 and older with glaucoma is projected to reach 3.6 million by 2030. This demographic shift necessitates a greater demand for surgical interventions, as older adults are more likely to experience vision loss due to glaucoma. Consequently, healthcare providers are increasingly focusing on developing and implementing surgical techniques tailored to this age group. The growing awareness of glaucoma and its potential consequences among older adults further drives the need for effective surgical solutions, thereby propelling the US glaucoma surgery market forward.

Technological Advancements

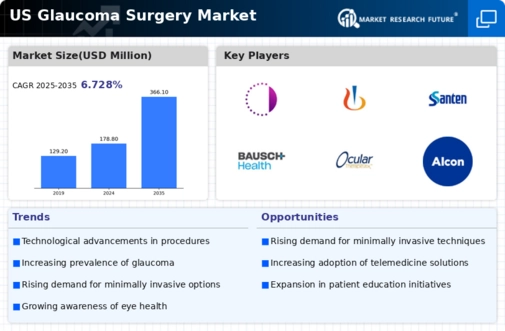

Technological advancements play a pivotal role in shaping the US glaucoma surgery market. Innovations such as minimally invasive surgical techniques and advanced imaging technologies have revolutionized the treatment landscape. For instance, the introduction of devices like the iStent and the CyPass Micro-Stent has enabled surgeons to perform procedures with reduced recovery times and improved patient outcomes. The market for glaucoma surgical devices is projected to grow at a compound annual growth rate (CAGR) of approximately 5.5% from 2021 to 2028, indicating a robust demand for these advanced solutions. As technology continues to evolve, the US glaucoma surgery market is likely to witness further enhancements in surgical efficacy and safety.

Rising Healthcare Expenditure

Rising healthcare expenditure in the United States is another critical driver of the US glaucoma surgery market. With healthcare spending projected to reach nearly $6 trillion by 2027, there is a growing investment in advanced medical technologies and surgical procedures. This increase in funding allows for the development and adoption of innovative glaucoma surgical techniques, enhancing patient access to necessary treatments. Furthermore, insurance coverage for glaucoma surgeries is expanding, making these procedures more financially accessible to patients. As healthcare expenditure continues to rise, the US glaucoma surgery market is likely to benefit from increased investment in surgical advancements and patient care.

Increased Awareness and Screening

Increased awareness and screening initiatives are driving growth in the US glaucoma surgery market. Public health campaigns aimed at educating individuals about the importance of regular eye examinations have led to earlier detection of glaucoma. The American Academy of Ophthalmology recommends that individuals over 40 undergo comprehensive eye exams every two years, which has resulted in a higher number of diagnosed cases. This proactive approach not only facilitates timely surgical interventions but also encourages patients to seek treatment options sooner. As awareness continues to rise, the demand for glaucoma surgeries is expected to increase, further propelling the US glaucoma surgery market.

Regulatory Support and Reimbursement Policies

Regulatory support and favorable reimbursement policies are essential drivers of the US glaucoma surgery market. The Food and Drug Administration (FDA) has streamlined the approval process for new glaucoma devices, facilitating quicker access to innovative surgical options. Additionally, Medicare and private insurers are increasingly covering glaucoma surgeries, which enhances patient access to these critical treatments. This supportive regulatory environment encourages manufacturers to invest in research and development, leading to the introduction of new surgical techniques and devices. As reimbursement policies continue to evolve favorably, the US glaucoma surgery market is expected to experience sustained growth.