Rising Healthcare Expenditure

The increase in healthcare expenditure across various regions is a significant factor influencing the Glucose-6-Phosphate Dehydrogenase Deficiency Market. As governments and private sectors allocate more resources to healthcare, there is a corresponding rise in funding for research and development of treatments for G6PD deficiency. This financial commitment is likely to enhance the availability of diagnostic tools and therapeutic options, thereby improving patient access to necessary care. Furthermore, higher healthcare spending often correlates with increased awareness and education about genetic disorders, which could lead to more individuals seeking diagnosis and treatment. Consequently, this trend may foster a more robust market environment for G6PD deficiency-related products.

Growing Focus on Genetic Testing

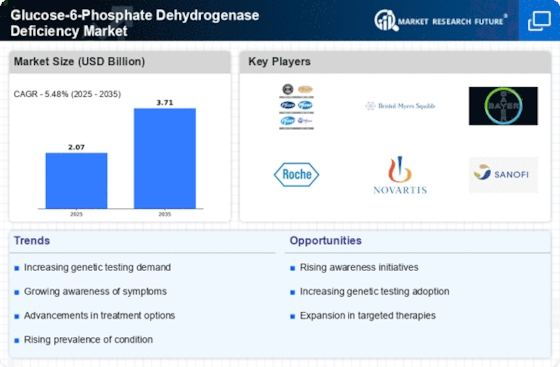

The emphasis on genetic testing for Glucose-6-Phosphate Dehydrogenase Deficiency is becoming increasingly pronounced, serving as a critical driver in the Glucose-6-Phosphate Dehydrogenase Deficiency Market. Genetic testing allows for early diagnosis and personalized treatment plans, which are essential for managing the condition effectively. The market for genetic testing is projected to grow substantially, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This trend is likely to encourage healthcare providers to adopt genetic screening as a standard practice, thereby increasing the demand for related diagnostic tools and services. As more individuals are screened, the market for G6PD deficiency-related products and services is expected to expand.

Advancements in Treatment Options

Innovations in treatment modalities for Glucose-6-Phosphate Dehydrogenase Deficiency are transforming the landscape of the Glucose-6-Phosphate Dehydrogenase Deficiency Market. Recent developments in enzyme replacement therapies and gene therapy hold promise for more effective management of the condition. These advancements not only enhance patient outcomes but also stimulate market growth by attracting investment and research funding. The introduction of novel pharmacological agents designed to mitigate symptoms associated with G6PD deficiency is likely to expand treatment options available to patients. As these therapies gain regulatory approval and enter the market, they could significantly alter the treatment paradigm, thereby increasing the overall market size.

Regulatory Support and Initiatives

Regulatory support and initiatives aimed at addressing Glucose-6-Phosphate Dehydrogenase Deficiency are emerging as a pivotal driver in the Glucose-6-Phosphate Dehydrogenase Deficiency Market. Governments and health organizations are increasingly recognizing the need for policies that promote research, awareness, and treatment accessibility for G6PD deficiency. Initiatives such as funding for public health campaigns and incentives for pharmaceutical companies to develop new therapies are likely to enhance market dynamics. Additionally, regulatory bodies are streamlining the approval processes for diagnostic and therapeutic products, which could facilitate quicker access to innovative solutions for patients. This supportive regulatory environment may ultimately lead to a more vibrant and responsive market.

Increasing Prevalence of G6PD Deficiency

The rising incidence of Glucose-6-Phosphate Dehydrogenase Deficiency is a notable driver in the Glucose-6-Phosphate Dehydrogenase Deficiency Market. It is estimated that approximately 400 million individuals worldwide are affected by this condition, particularly in regions with high malaria prevalence. This growing patient population necessitates enhanced healthcare services and treatment options, thereby propelling market growth. Furthermore, the increasing recognition of G6PD deficiency as a significant public health issue has led to more comprehensive screening programs. As awareness spreads, healthcare providers are more likely to diagnose and manage the condition effectively, which could lead to a surge in demand for therapeutic interventions and diagnostic tools within the industry.