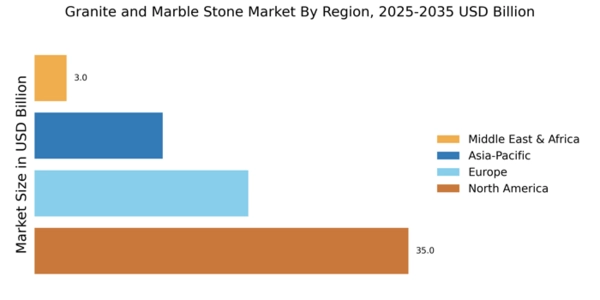

North America : Market Leader in Granite Marble

North America holds a commanding 35.0% share of the granite marble stone market, driven by robust construction activities and a growing preference for natural stone in residential and commercial projects. Regulatory support for sustainable sourcing and environmental standards further catalyzes market growth. The region's demand is also bolstered by increasing investments in infrastructure and renovation projects, reflecting a strong economic recovery post-pandemic.

The competitive landscape in North America is characterized by key players such as Polycor Inc, Daltile, and Marble Systems, which dominate the market with innovative product offerings and extensive distribution networks. The U.S. is the leading country, with significant contributions from Canada. The presence of established brands and a focus on high-quality materials ensure that North America remains at the forefront of the granite marble stone market.

Europe : Emerging Trends in Europe

Europe's granite marble stone market, valued at 20.0%, is experiencing growth driven by sustainability trends and increasing consumer awareness regarding eco-friendly materials. Regulatory frameworks across the EU promote the use of natural stones, enhancing market demand. The region's focus on green building practices and energy-efficient construction is also a significant catalyst for growth, aligning with the EU's environmental goals and initiatives.

Leading countries in Europe include Spain and Italy, home to major players like Levantina and Antolini. The competitive landscape is marked by a mix of local artisans and large-scale manufacturers, fostering innovation and quality. The presence of established brands and a strong emphasis on design aesthetics further enhance the region's market position, making Europe a key player in the global granite marble stone industry.

Asia-Pacific : Rapid Growth in Asia-Pacific

The Asia-Pacific granite marble stone market, accounting for 12.0%, is witnessing rapid growth fueled by urbanization and rising disposable incomes. Countries like China and India are experiencing a surge in demand for granite and marble in residential and commercial sectors. Government initiatives aimed at boosting infrastructure development and housing projects are significant drivers of this growth, creating a favorable environment for market expansion.

China leads the region, with a strong presence of local manufacturers and increasing imports of high-quality stones. The competitive landscape is evolving, with both established players and new entrants vying for market share. The region's diverse consumer preferences and growing interest in luxury home decor are further propelling the demand for granite marble stones, positioning Asia-Pacific as a promising market for future investments.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa granite marble stone market, valued at 3.0%, presents untapped opportunities driven by increasing construction activities and a growing preference for luxury materials. The region's economic diversification efforts and investments in infrastructure projects are key growth drivers. Additionally, the rising demand for high-quality finishes in residential and commercial spaces is fostering market expansion, supported by favorable government policies.

Leading countries in this region include the UAE and South Africa, where local and international players are establishing a strong foothold. The competitive landscape is characterized by a mix of established companies and emerging brands, focusing on quality and design. As the region continues to develop, the granite marble stone market is expected to grow, attracting investments and enhancing its global presence.