Growing Energy Storage Applications

The expansion of energy storage applications is emerging as a significant driver for the Graphite Anode for Lib Market. As the demand for renewable energy sources increases, the need for efficient energy storage solutions becomes paramount. Graphite anodes are integral to the performance of lithium-ion batteries used in energy storage systems, which are essential for balancing supply and demand in renewable energy generation. In 2025, the energy storage market is projected to reach USD 50 billion, with a considerable share attributed to lithium-ion technology. This growth indicates a rising need for graphite anodes, as manufacturers seek to enhance the efficiency and lifespan of energy storage systems. The Graphite Anode for Lib Market is thus positioned to benefit from this trend, as energy storage solutions become increasingly vital in the transition to sustainable energy.

Rising Demand for Electric Vehicles

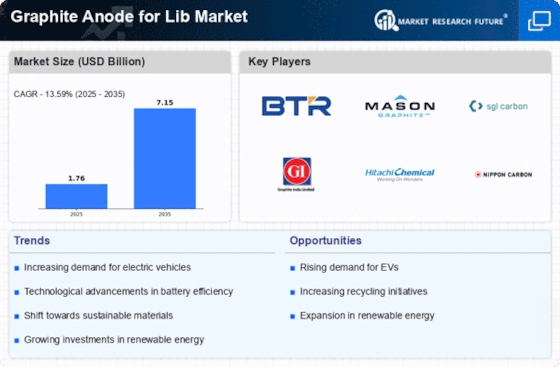

The increasing adoption of electric vehicles (EVs) is a primary driver for the Graphite Anode for Lib Market. As consumers and manufacturers prioritize sustainable transportation, the demand for high-performance batteries has surged. In 2025, the EV market is projected to grow at a compound annual growth rate (CAGR) of approximately 20%, necessitating advanced battery technologies. Graphite anodes are essential for enhancing battery efficiency and longevity, making them a critical component in EV production. This trend indicates a robust market for graphite anodes, as automakers seek to improve energy density and reduce charging times. Consequently, the Graphite Anode for Lib Market is likely to experience significant growth, driven by the need for innovative battery solutions that meet the evolving demands of the automotive sector.

Government Policies Supporting Renewable Energy

Government initiatives aimed at promoting renewable energy sources are playing a pivotal role in shaping the Graphite Anode for Lib Market. Policies that incentivize the use of electric vehicles and renewable energy storage solutions are driving demand for efficient battery technologies. For example, various countries have implemented tax credits and subsidies for EV purchases, which directly impacts the demand for lithium-ion batteries and, consequently, graphite anodes. In 2025, it is estimated that government support will contribute to a 15% increase in the adoption of electric vehicles, further propelling the need for high-quality graphite anodes. This supportive regulatory environment is likely to foster growth within the Graphite Anode for Lib Market, as manufacturers align their strategies with governmental objectives to enhance sustainability.

Increased Focus on Recycling and Sustainability

The heightened emphasis on recycling and sustainability is influencing the Graphite Anode for Lib Market. As environmental concerns grow, manufacturers are exploring ways to recycle graphite anodes from used batteries, thereby reducing waste and promoting circular economy practices. This focus on sustainability is likely to drive innovation in the development of recyclable anode materials, which can enhance the overall lifecycle of lithium-ion batteries. In 2025, the market for battery recycling is expected to reach USD 10 billion, reflecting a growing recognition of the importance of sustainable practices in the battery supply chain. Consequently, the Graphite Anode for Lib Market may experience increased demand for anodes that are designed with recyclability in mind, aligning with broader sustainability goals.

Technological Innovations in Battery Manufacturing

Technological advancements in battery manufacturing processes are significantly influencing the Graphite Anode for Lib Market. Innovations such as improved anode design and production techniques are enhancing the performance and cost-effectiveness of graphite anodes. For instance, the introduction of silicon-graphite composite anodes has shown potential in increasing energy capacity, which is crucial for next-generation lithium-ion batteries. As manufacturers strive to optimize battery performance, the market for graphite anodes is expected to expand. In 2025, the market for lithium-ion batteries is anticipated to reach USD 100 billion, with a substantial portion attributed to advancements in anode technology. This growth underscores the importance of continuous innovation within the Graphite Anode for Lib Market, as companies seek to maintain competitive advantages through enhanced product offerings.

Leave a Comment