Green Diesel Market Summary

As per MRFR Analysis, the Global Green Diesel Market was valued at USD 27.30 Billion in 2022 and is projected to grow from USD 30.73 Billion in 2023 to USD 70.33 Billion by 2030, exhibiting a CAGR of 12.65% during the forecast period. The market is driven by the increasing demand for environmentally friendly fuels, rapid depletion of fossil fuels, and government initiatives promoting renewable energy. The vegetable oil segment accounted for approximately 40-45% of the market revenue in 2022, while hydro-processing technology dominated the market. North America held the largest market share, valued at USD 4.07 Billion in 2022, with significant growth expected due to favorable government policies and initiatives.

Key Market Trends & Highlights

The Green Diesel Market is witnessing significant trends driven by biofuel adoption and technological advancements.

- Global energy usage is projected to increase by nearly 50% by 2050, boosting demand for renewable energy sources.

- Biofuels are expected to account for 64% of the transport sector's renewable energy consumption by 2050.

- The blended form of green diesel dominated the market in 2022, while the pure form is projected to grow faster during 2023-2030.

- North America is expected to exhibit a 19.20% CAGR during the study period, driven by government policies and renewable fuel demand.

Market Size & Forecast

2022 Market Size: USD 27.30 Billion

2023 Market Size: USD 30.73 Billion

2030 Market Size: USD 70.33 Billion

CAGR (2023-2030): 12.65%

Largest Regional Market Share in 2022: North America

Major Players

Major players include Neste Oyj, Chevron Corporation, Valero Energy Corporation, Gevo, Inc., Phillips 66, and Shell Plc.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Green Diesel Market Trends

-

Growing Prevalence of Biofuels in energy consumption

With increasing urbanization and rapid industrialization there is a significant increase in demand for energy. According to the U. S. Energy Information Association, global energy usage is projected to increase by nearly 50% by the year 2050. While with growing environmental awareness among individuals and the government authorities’ various initiatives and measures are being undertaken to support growth in a sustainable manner.

While at present only approximately 15-20 percent of the world’s energy is produced using various renewable energy sources, including hydropower, solar, ocean energy, biomass, biofuel, wind, and geothermal, this proportion is expected to keep increasing as renewable energy is becoming more affordable with technological advancement. The increasing demand for biofuels in renewable energy consumption over the forecast period is expected to promote market growth in green diesel market.

Green diesel, one of the alternative energy products, is a second generation of biofuel, with the market expansion of biofuels the green diesel market is also expected to trend during the forecast period. According to Net Zero Emissions by 2050 Scenario biofuels are expected to make up to 64% of the transport sectors’ renewable energy consumption.

The biofuel consumption is expected to triple between 2019 to 2030 to 12 EJ in the 2050 scenario. According to Statista, the global biofuel market was valued at about 110 billion USD in 2021, and with growing global demand the market is forecast to reach up to 201 billion USD by 2030. Hence with the growing biofuel market and increasing use of biofuels for renewable energy consumption, the global market for green diesel is expected to boom during the forecast period. As a result, the growing prevalence of biofuels in energy consumption is likely to fuel the expansion of the Green Diesel market revenue.

Green Diesel Market Segment Insights

Green Diesel Feedstock Insights

The Green Diesel Market segmentation, based on feedstock, includes vegetable oil, animal or fish fats, agricultural residue, and other biomass. The vegetable oil segment held the majority share in 2022 contributing to around ~40-45% with respect to the Green Diesel Market revenue. This is because Vegetable oils have high energy density and similar chemical composition to petroleum derivatives, making them the perfect widely available renewable feedstock for biofuel production such as green diesel. However, the market use of animal or fish fast feedstock is expected to grow during the forecast period as animal fat waste are potential low-cost feedstock for commercial green diesel (second generation of biofuel) production.

Green Diesel Technology Insights

Based on technology, the global green diesel segmentation includes hydro-processing, catalytic upgrading, pyrolysis, and biomass-to-liquid (BTL) thermochemical process (gasification). The hydro-processing segment dominated the market in 2022 and is expected to continue to dominate the market during the forecast period.

Currently, commercial production facilities are using the hydrotreating pathway. It is increasingly becoming a common path of production also due to the legislations present in the US and European Union. The products of this technology have improved characteristics, such as high heating value and cetane number, and increased oxidation stability.

Green Diesel Type Insights

The Green Diesel Market data has been bifurcated by type largely into pure form and blended form. The blended form segment dominated the market in 2022 however, with increasing production the pure form is projected to be the faster-growing segment during the forecast period, 2023-2030.

The blended form is created by combining, green diesel (renewable diesel) with biodiesel or even with petro-diesel. Green diesel (renewable diesel) has the same chemical molecular structure as petroleum, therefore being easily blended. For instance, Chevron Renewable Diesel Blend, offered by Chevron Corporation, is made with at least 80% renewable diesel (green diesel) and up to 20% biodiesel, with no more than 1% conventional petroleum diesel.

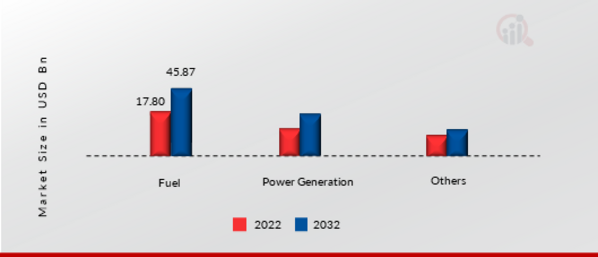

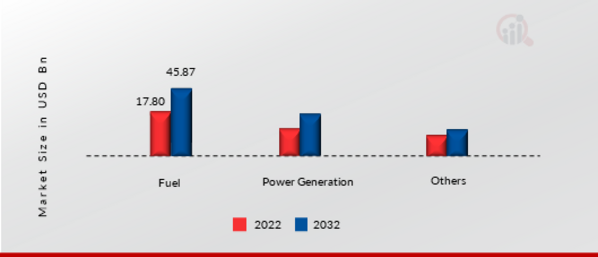

Green Diesel Application Insights

The Green Diesel Market data has been bifurcated by application into fuel, power generation, and others. The fuel segment dominated the market in 2022 and is projected to be the faster-growing segment during the forecast period, 2023-2030. This is because renewable biofuels such as green diesel are growing replacements for conventional diesel, renewable diesel meets the conventional petroleum ASTM D975 specification making it feasible to be used in existing automotive infrastructure and diesel engines. With renewable diesel reduced both carbon dioxide and nitrogen oxide emissions when compared with petroleum diesel in fuel applications.

Figure 2: Green Diesel Market, by Application, 2021 & 2030 (USD Billion) Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

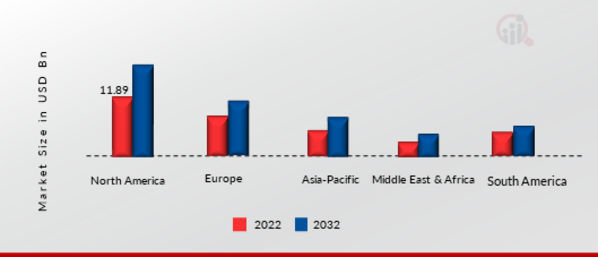

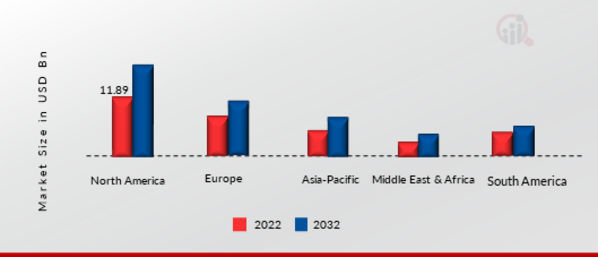

Green Diesel Insights

By Region, the Green Diesel Market industry study segments the market into North America, Europe, Asia-Pacific, Middle East & Africa, and South America. North America Green Diesel Market accounted for USD 4.07 billion in 2022 and is expected to exhibit a 19.20 % CAGR during the study period. This is attributed to government policies and initiatives to promote sustainable and affordable sources of fuel as well as growing renewable fuel demand.

Further, the major countries studied are the U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: Green Diesel Market Share By Region 2021-2030 (%) Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

North America Green Diesel Market accounts for the largest market share due to the presence of tax incentives and many prominent green diesel market players are based out of the United States. The availability of cost-competitive green diesel allows for its increasing adoption, especially as a transport fuel. The presence of market players such as Chevron Corporation, Valero Energy Corporation, Gevo, Inc, Phillips 66, and others increases market expansion potentials in this region.

Furthermore, the US Green Diesel Market retained the greatest market share. In California, the application of the Low Carbon Fuel Standard (LCSF) makes renewable diesel (green diesel) cost-competitive when compared to biodiesel and petro-diesel by offsetting some of the expenses. While in the Canada Green Diesel Market the Clean Fuel Standard, which aims at reducing 30 million tons of greenhouse gas emissions annually by 2030, is expected to boost market expansion in the region.

In January 2023, Imperial Oil Canada also announced an investment of about $720 million (USD $560 million) to commence with the construction of the largest renewable diesel facility in the country, while Mexico Green Diesel Market will exhibit significant expansion, with increasing potential for biofuel production in the North American region.

The Europe Green Diesel Market is expected to grow at a significant CAGR from 2022 to 2030. This is owing to increased government regulations aimed at reducing environmental contamination, the policies present in Europe have boosted market adoption in this region. With the application of the Renewable Energy Directive (RED) II, with renewable energy targets set to be achieved by 2030, the region is expected to experience and drastic boost in market expansion of green diesel.

The Asia-Pacific Green Diesel Market is expected to see rapid market growth during the forecast period, as a significant portion of renewable diesel (green diesel) is imported from Asia. The existence of a large customer base and a fast-increasing transportation industry in developing nations is expected to drive growth in the Asia-Pacific Green Diesel Market in the near future.

The Singapore Green Diesel Market is booming with the presence of Neste Oyj renewable diesel (green diesel) refinery in the country. In the Australia Green Diesel Market, BP Australia is advancing with plans to develop a renewable fuels plant at the Kwinana site, by producing sustainable aviation fuel (SAF) and renewable diesel (green diesel). The Middle East and Africa Green Diesel Market are predicted to expand, owing to increasing demand for alternative energy sources, and the rising prevalence of biofuel usage in the market.

Green Diesel Key Market Players & Competitive Insights

Major market players are spending a lot of money on R&D to increase their product lines, which will help Green Diesel grow even more. Market participants are also taking a range of strategic initiatives to grow their worldwide footprint, including new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Competitors in the Green Diesel Industry are expanding their market presence globally as the market is expected to boom in the future.

One of the primary business strategies adopted by manufacturers in the global Green Diesel Industry to benefit clients and expand the Green Diesel Market sector is to manufacture locally to reduce operating costs.

Neste Oyj (Finland) is an oil refining and marketing company. Neste Oyj is one of the largest producers of green diesel (renewable Diesel) and jet fuel in the world. The company makes use of waste, residues, and innovative raw materials to produce various oil products using its proprietary NEXBTL technology, a platform that allows us to turn a wide variety of renewable fats and oils into premium-quality renewable products, such as fuels and feedstock for polymers and chemicals production. Neste MY Renewable Diesel™ can be used as a drop-in solution to replace fossil diesel, as their chemical compositions are similar. Neste manufactures its high-quality products in Finland, the Netherlands, and Singapore.

Shell is a global group of energy and petrochemical companies. Shell Refiners can process 100% bio-feeds into profitable green diesel (renewable diesel) and sustainable aviation fuel with our hydrotreated vegetable oil (HVO) technology. Shell has introduced renewable diesel in several areas, including Europe and the US.

Vegetable oils and used cooking fats are only two of the many feedstocks the company uses to make renewable diesel (green diesel). The low-carbon renewable diesel (green diesel) offered by Shell emits fewer greenhouse gases than conventional diesel made from petroleum. The development and use of renewable energies are part of Shell’s commitment to investing in green energy and lowering its carbon impact.

Key Companies in the Green Diesel Market include

- NX100 Green Diesel & Lubricants (India)

- Valero Energy Corporation (US)

- Marathon Petroleum Corporation (US)

- Global Clean Energy Holdings, Inc. (US)

- Honeywell International Inc. (US)

Green Diesel Industry Developments

February 2023 Eni Sustainable Mobility and PBF Energy Inc. today entered into definitive agreements to partner in a 50-50 joint venture, St. Bernard Renewables LLC (SBR), for biorefinery currently under construction located near PBF’s Chalmette Refinery in Louisiana (US).

The St. Bernard Renewables biorefinery startup is scheduled in the first half of 2023 and the facility is targeted to have a processing capacity of about 1.1 million tonnes/year of raw materials, to produce mainly HVO Diesel (Hydrotreated Vegetable Oil, commonly known as ‘renewable diesel’ (green diesel) in North America), with a production capacity of 306 million gallons per year.

January 2023 Valero Energy Corporation commissioned and started production from Diamond Green Diesel Holdings LLC (DGD). The facility produced 470 million gal/year of renewable diesel and 20 million gal/year of renewable naphtha plant at the operator’s 395,000-b/d refinery in Port Arthur, Tex. in the fourth quarter of 2022.

September 2021 Royal Dutch Shell plc (Shell) announced the decision to build an 820,000-tonnes-a-year biofuels facility at the Shell Energy and Chemicals Park Rotterdam, the Netherlands, formerly known as the Pernis refinery. The facility is expected to be among the biggest in Europe to produce sustainable aviation fuel (SAF) and renewable diesel (green diesel) made from waste. A facility of such capacity can produce sufficient renewable diesel (green diesel) to avoid 2,800,000 tonnes of carbon dioxide (CO2) emissions a year.

Green Diesel Market Segmentation

Green Diesel Feedstock Outlook

Green Diesel Technology Outlook

- Biomass to Liquid (BTL) Thermochemical Process (Gasification)

Green Diesel Type Outlook

Green Diesel Application Outlook

Green Diesel Regional Outlook

- Middle East & Africa

- Rest of the Middle East & Africa

| Report Attribute/Metric |

Details |

| Market Size 2022 |

USD 27.30 billion |

| Market Size 2023 |

USD 30.73billion |

| Market Size 2030 |

USD 70.33 billion |

| Compound Annual Growth Rate (CAGR) |

12.65% (2022-2030) |

| Base Year |

2022 |

| Forecast Period |

2023-2030 |

| Historical Data |

2019 - 2021 |

| Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Feedstock, Technology, Type, Application and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, Middle East & Africa, and South America |

| Countries Covered |

The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and, Turkey, GCC, Brazil, and Argentina |

| Key Companies Profiled |

Neste, Chevron Corporation, Valero Energy Corporation, Gevo, Inc., Phillips 66, Marathon Petroleum Corporation, Aemetis, Inc., Global Clean Energy Holdings, Inc., Shell Plc, PBF Energy Inc., Honeywell International Inc., Eni |

| Key Market Opportunities |

Potential increase in sustainability in the transport fuel sector |

| Key Market Dynamics |

Growing demand for environment-friendly fuel Rapidly depleting fossil fuel supply |

Frequently Asked Questions (FAQ) :

As of 2022, Green Diesel is worth USD $27.30 Billion.

The green diesel market is growing at a CAGR of 12.56%.

The North America region holds the largest market share in Green Diesel Market.

Neste Oyj, Chevron Corporation, Valero Energy Corporation, Gevo, Inc., and Phillips 66, are some of the prominent players in the market.

The hydro-processing technology in the green diesel market is leading commercial market growth.

The Fuel segment application has the largest market share.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review