Green Tires Size

Market Size Snapshot

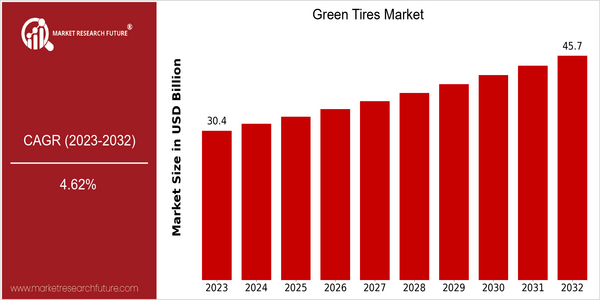

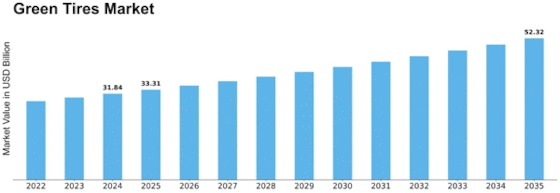

| Year | Value |

|---|---|

| 2023 | USD 30.43 Billion |

| 2032 | USD 45.7 Billion |

| CAGR (2024-2032) | 4.62 % |

Note – Market size depicts the revenue generated over the financial year

The Green Tires Market is expected to reach $30.4 billion by 2023 and grow at a CAGR of 4.6% from 2024 to 2032. The demand for environmentally friendly tires is expected to increase as a result of growing consumer awareness of sustainable development and the need to reduce the carbon footprint of the automobile industry. The use of green tires, which are designed to minimize the impact on the environment through the use of sustainable materials and improved fuel efficiency, is expected to increase significantly. There are several factors that are driving the growth of this market, including the advancement of tire manufacturing technology, the growing popularity of electric vehicles, and strict government regulations to promote the use of eco-friendly products. The major players in the green tire market, such as Michelin, Bridgestone, and Goodyear, are investing heavily in R & D to develop new sustainable tire solutions. These companies are also establishing strategic alliances with car manufacturers and investing in the development of sustainable materials to strengthen their position in the market. Michelin's commitment to producing tires made with 80% sustainable materials by 2048 is an example of the industry's shift towards sustainable development, which enables these companies to take advantage of the growing demand for green tires.

Regional Market Size

Regional Deep Dive

Green Tires Market is expected to grow at a CAGR of over 6% during the forecast period, owing to the increasing awareness of the environment, the stringent regulations on emissions, and the technological developments in tires. In North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America, the demand for eco-friendly tires is driven by government initiatives to reduce carbon emissions. Each region has its own regulatory, economic, and cultural influences on the green tire market.

Europe

- The European Union's Green Deal aims to make Europe climate-neutral by 2050, leading to increased investments in sustainable tire technologies, with companies like Continental and Pirelli at the forefront of developing eco-friendly tire solutions.

- Regulatory changes, such as the introduction of the EU Tire Labeling Regulation, are pushing manufacturers to improve the environmental performance of their products, thereby enhancing consumer awareness and demand for green tires.

Asia Pacific

- The Chinese government has issued a number of policies to encourage the use of green tires, as part of its overall plan to reduce air pollution. The local rubber industry, such as the Zhongce Rubber Group, has also made a large investment in the production of green tires.

- The growing automotive market in India is witnessing a shift towards eco-friendly tires, with companies like Apollo Tyres launching initiatives to educate consumers about the benefits of green tires.

Latin America

- Brazil's National Policy on Climate Change is fostering a market for green tires, with local companies like Pirelli Brazil investing in sustainable tire technologies to meet regulatory requirements.

- The growing popularity of electric vehicles in Latin America is creating a niche market for specialized green tires, as manufacturers adapt to the changing automotive landscape.

North America

- The U.S. Environmental Protection Agency (EPA) has introduced stricter fuel efficiency standards, prompting tire manufacturers like Michelin and Goodyear to innovate in producing low rolling resistance tires that enhance fuel economy.

- The rise of electric vehicles (EVs) in North America is driving demand for specialized green tires designed to optimize performance and range, with companies like Bridgestone launching dedicated lines for EVs.

Middle East And Africa

- In the UAE, the government is promoting sustainable practices through initiatives like the Dubai Clean Energy Strategy 2050, which encourages the adoption of green technologies, including eco-friendly tires.

- The increasing awareness of environmental issues among consumers in South Africa is leading to a gradual shift towards green tires, with local manufacturers exploring sustainable materials and production methods.

Did You Know?

“Approximately 30% of a vehicle's fuel consumption can be attributed to tire rolling resistance, making the development of green tires crucial for improving overall vehicle efficiency.” — International Energy Agency (IEA)

Segmental Market Size

Green tires are currently experiencing a steady growth. This is mainly due to the increased public awareness of the environment and the efforts of the government to reduce carbon emissions. Demand for low-rolling-resistance tires that reduce fuel consumption has also been increasing. Michelin and Bridgestone have responded to these requirements with a number of innovations. The development of green tires is at the advanced stage, and the progress has been particularly noticeable in Europe and North America, where there are strict regulations on the environment. The main applications are for cars, trucks, and buses. Green tires are also being used for electric cars, such as the ones made by the company Tesla, which uses them to enhance the car’s green image. The trend towards low-emissions cars and green tires is accelerating. The developments in the materials and production processes, such as the use of bio-based rubber and recycled materials, will have a major impact on the future of the market.

Future Outlook

The Green Tires Market is projected to grow at a CAGR of 4.62% from 2023 to 2032, rising from USD 30,439.3 million to USD 45,713.1 million over the forecast period. Rising awareness of the environment, stricter regulations, and advancements in tire technology are driving the market. Moreover, the increasing focus on the environment among consumers and manufacturers is expected to boost the demand for green tires, thus accelerating the market growth. Green tires are expected to constitute approximately 25% of the total tire market by 2032, increasing from approximately 15% in 2023, as more automobile manufacturers adopt sustainable practices in their production processes. The development of bio-based materials and new methods of tire recycling will further drive the market. Also, government initiatives to reduce CO2 emissions and promote sustainable transportation will drive the market growth. Electric vehicles (EVs) and shared mobility solutions are projected to create new opportunities for green tire manufacturers. In the future, as the automobile industry changes, the green tires market will become an important component of the sustainable mobility trend and will play a key role in the future of transportation.

Leave a Comment