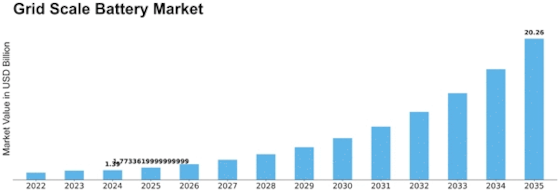

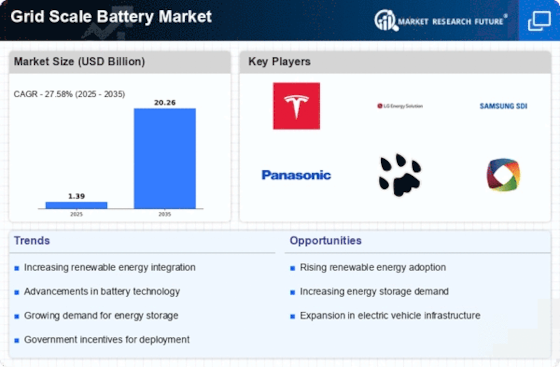

Grid Scale Battery Size

Grid Scale Battery Market Growth Projections and Opportunities

The grid-scale battery is the energy stored strength on a massive scale inside an electrical power grid. Grid-scale battery technology is split into UPS, T&D grid support, and strength control. UPS, as a power garage, performs a big function in terms of frequency and electricity. T&D grid support uses the method referred to as AGC (automatic grid control) to stabilize the era and load. The energy management approach is typically used in bulk strength control. Inventions on this battery have been finished on a wide scale on the business foundation to save strength all through height, length, and launch while the consumption of power is less. The market dynamics of the grid-scale battery market are experiencing a transformative shift driven by a confluence of things that reflect the evolving landscape of the power region. One of the outstanding market developments is the growing integration of renewable energy assets into the electricity grid. As the arena moves toward a more sustainable electricity destiny, the demand for grid-scale batteries has surged. Moreover, advancements in battery technology have substantially strengthened the performance and value-effectiveness of grid-scale batteries. Lithium-ion batteries, mainly, have come to be the dominant era in this market, attributable to their high power density, lengthy cycle existence, and declining fees. Another noteworthy trend shaping the market dynamics is the growing consciousness of strength garages as a way to enhance grid flexibility and manipulate the demanding situations related to variable electricity generation. Grid-scale batteries are increasingly considered a valuable asset for grid operators, presenting them with the capability to stabilize supply and demand in actual time, mitigate voltage fluctuations, and enhance the overall reliability of the strength grid. Furthermore, the market dynamics are inspired by the evolving regulatory panorama and government initiatives aimed at selling strength storage and grid modernization. Governments around the arena are spotting the pivotal position that grid-scale batteries play in attaining power transition desires and are implementing supportive guidelines, incentives, and mandates to encourage the deployment of these structures. In the end, the market dynamics of the grid-scale battery market are characterized by a confluence of traits that together mirror the evolving strength landscape. The integration of renewable energy assets, improvements in battery technology, the point of interest in grid flexibility, supportive regulatory frameworks, and declining charges are key factors influencing the increase and development of the grid-scale battery market.

Leave a Comment