Decentralization of Energy Systems

The trend towards decentralization of energy systems is significantly impacting the Grid Scale Stationary Battery Storage Market. As more consumers and businesses adopt distributed energy resources, such as rooftop solar and small wind turbines, the need for centralized storage solutions becomes evident. Battery storage systems can effectively balance the energy produced by these decentralized sources with the demand on the grid. This shift towards a more decentralized energy landscape is expected to create new opportunities for battery storage deployment, as utilities and energy providers seek to enhance grid stability and efficiency.

Government Incentives and Regulatory Frameworks

Government incentives and supportive regulatory frameworks play a crucial role in shaping the Grid Scale Stationary Battery Storage Market. Many governments are implementing policies that promote energy storage solutions as part of their broader energy strategies. These include tax credits, grants, and favorable tariffs for energy storage projects. For example, the implementation of the Investment Tax Credit (ITC) in various regions has encouraged investments in battery storage systems. Such regulatory support not only enhances the economic viability of storage projects but also fosters innovation and competition within the market, ultimately driving growth.

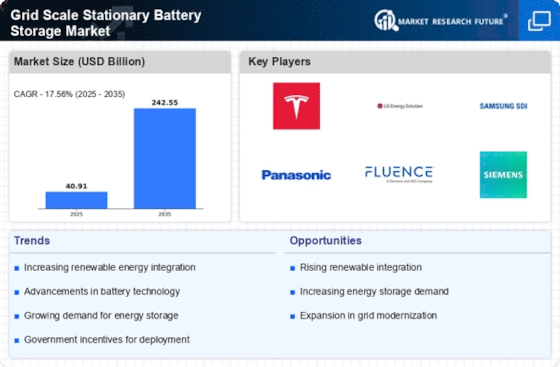

Technological Innovations in Battery Technologies

Technological advancements in battery technologies are significantly influencing the Grid Scale Stationary Battery Storage Market. Innovations such as lithium-ion, flow batteries, and solid-state batteries are enhancing energy density, efficiency, and lifespan. These improvements not only reduce costs but also increase the feasibility of large-scale deployments. For instance, the cost of lithium-ion batteries has decreased by approximately 89% since 2010, making them more accessible for grid applications. As technology continues to evolve, the market is likely to witness the emergence of new battery chemistries that could further optimize performance and reduce environmental impact, thus propelling market expansion.

Increasing Demand for Renewable Energy Integration

The Grid Scale Stationary Battery Storage Market is experiencing a surge in demand due to the increasing integration of renewable energy sources. As countries strive to meet their energy transition goals, the need for efficient energy storage solutions becomes paramount. Battery storage systems facilitate the smooth integration of intermittent renewable sources like solar and wind into the grid. According to recent data, the global installed capacity of renewable energy is projected to reach over 3,000 GW by 2025, necessitating robust storage solutions to manage supply and demand effectively. This trend indicates a growing reliance on grid-scale battery systems to ensure energy reliability and stability, thereby driving market growth.

Rising Energy Demand and Grid Reliability Concerns

The increasing global energy demand, coupled with concerns over grid reliability, is propelling the Grid Scale Stationary Battery Storage Market. As populations grow and economies expand, the pressure on existing energy infrastructure intensifies. Battery storage systems provide a solution to mitigate peak demand and enhance grid resilience. Data indicates that energy consumption is expected to rise by 25% by 2030, necessitating the deployment of advanced storage technologies to ensure a stable energy supply. This growing need for reliable energy solutions is likely to drive investments in grid-scale battery storage, further stimulating market growth.