Top Industry Leaders in the Hard Disk Market

Competitive Landscape of the Hard Disk Market:

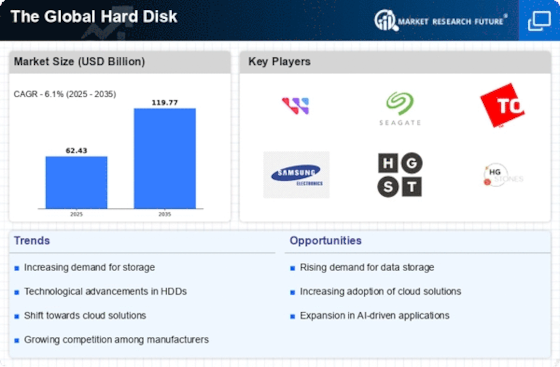

The hard disk drive (HDD) market, despite facing challenges from solid-state drives (SSDs), remains a significant pillar of the data storage landscape. Understanding the current competitive dynamics is crucial for both established players and potential entrants. This analysis delves into the strategies adopted by key players, factors influencing market share, the rise of new companies, and the overall competitive scenario.

Some of the Hard Disk companies listed below:

- Western Digital Corporation

- Seagate Technology LLC

- Toshiba Corporation

- Sony Corporation

- Transcend Information. Inc.

- Samsung Electronics

- ADATA Technology Co. Ltd.

- Hewlett Packard Enterprise Company (HP)

- Apple Inc.

- Quantum Corp.

- SK Hynix Inc.

- Intel Corporation

- Mushkin Enhanced

- Micron Technology Inc.

Strategies Adopted by Key Players:

The HDD market is characterized by oligopolistic competition, with Seagate Technology and Western Digital Corporation holding the lion's share. These giants have adopted multi-pronged strategies to maintain their dominance:

- Technological Advancements: Both companies invest heavily in R&D, focusing on increasing storage capacity, read/write speeds, and energy efficiency. Seagate's HAMR (Heat-Assisted Magnetic Recording) technology and Western Digital's OptiNAND flash cache are examples of such innovations.

- Diversification: Recognizing the shifting market, both players are moving beyond traditional HDDs. Seagate focuses on providing data center solutions and Western Digital caters to enterprise and embedded systems markets.

- Vertical Integration: Both companies control key aspects of the supply chain, ensuring greater cost control and product quality.

Factors Influencing Market Share Analysis:

Analyzing market share in the HDD landscape requires consideration of diverse factors:

- Product Portfolio: Offering a comprehensive range of capacities, speeds, and functionalities across different segments (consumer, enterprise, data center) is crucial.

- Pricing Strategy: Balancing competitive pricing with profitability is a constant challenge. Seagate tends towards aggressive pricing, while Western Digital adopts a more premium approach.

- Geographic Reach: Strong presence in key markets, particularly Asia-Pacific, is essential for growth. Seagate has a slight edge in China, while Western Digital excels in Southeast Asia.

- Brand Reputation: Established brand names have an advantage in attracting customers. Western Digital leverages its legacy in consumer electronics, while Seagate focuses on partnerships and industry endorsements.

Emerging Players and Disruptive Technologies:

While the giants reign supreme, new entrants are stirring the pot:

- HGST (Hitachi Global Storage Technologies): Formerly Hitachi's HDD arm, HGST focuses on high-performance enterprise drives and has gained traction in server and cloud infrastructure markets.

- Toshiba Storage Products Company: Renowned for its quality and reliability, Toshiba maintains a niche presence in specific enterprise segments.

- Emerging Startups: Companies like GREAND and Flash Storage Corporation are exploring alternative magnetic recording technologies like Microwave-Assisted Magnetic Recording (MAMR) and E-beam Recording, potentially disrupting the established players.

Latest Company Updates:

On Oct. 20, 2023- Seagate introduced a new line of magnetic storage units, refreshing its Exos line with the Exos X24 HDD models. Seagate's new Exos X24 hard disk line reaches up to 24TB and 28TB. The new hard drives are designed to work in hyperscale and enterprise environments with scale-out data centers, providing the highest density in the industry.

On Oct. 31, 2023- Western Digital announced its decision to split its hard disk and NAND memory drive businesses, creating two separate public companies. The change is aimed at refining the focus and operational efficiency of each business segment. Slated for completion in the second half of 2024, this separation will allow each business unit to refine its strategic directions, focusing on unique market opportunities and technological innovations.

On Oct. 31, 2023- Toshiba announced discounts of up to 55% on several of its X300 hard drives. The Toshiba X300 hard disk drive lineup consists of high-capacity 3.5-inch Conventional Magnetic Recording HDDs (CMR) spinning at 7200 RPM with up to 512MB of cache. Capacities range from 4TB to 18TB, giving each user a perfect configuration. The X300 3.5 inch internal hard drive is designed for professional or gaming PCs, delivering reliable, large-capacity, incredibly high-performance storage.