Market Analysis

In-depth Analysis of Hard Surface Flooring Market Industry Landscape

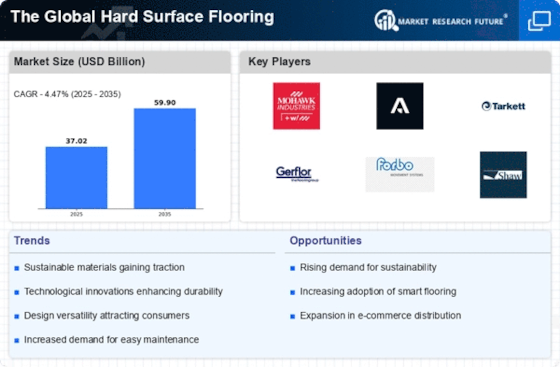

The market for hard surface flooring is a vibrant one that is essential to the building and interior design sectors. The dynamics of the market are influenced by a multitude of elements that impact its growth and tendencies. Material choices: The dynamics of the market are significantly influenced by consumer choices for hard surface flooring materials. Options including tile, vinyl, laminate, and hardwood each have unique qualities that influence demand depending on things like maintenance needs, durability, and aesthetics. technology Innovations: The hard surface flooring industry is impacted by ongoing technology developments in manufacturing and design. Technological advancements like click-and-lock installation techniques, embossing for texture, and digital printing for realistic images impact customer preferences and industry trends. Environmental Sustainability: As environmental sustainability becomes more widely recognized, market dynamics are changing. Customers' choice for environmentally friendly flooring options is driving the industry to develop and implement sustainable materials and manufacturing techniques. Residential and Commercial Construction Trends: The market for hard surface flooring is strongly correlated with these trends. The market is growing because there is a growing need for flooring solutions that are both aesthetically beautiful and long-lasting as construction activities expand. Situation of the World Economy: Regional and worldwide economic factors affect the market for hard surface flooring. The market for flooring materials may be impacted by a slowdown in building and renovation projects during economic downturns. Installation and Maintenance Considerations: Consumer choices are influenced by how simple installation and maintenance are. Products with low maintenance requirements and easy installation techniques, such click-and-lock systems, are more likely to succeed in the marketplace. Color and Design Trends: Shifting interior décor trends in terms of color and style have an impact on market dynamics. In order to satisfy customers and maintain their competitiveness in the market, flooring producers must be aware of how color, pattern, and design preferences are changing. Distribution Channels: Market dynamics are influenced by the distribution channels that hard surface flooring products use to reach consumers. Traditional retail channels have been challenged by the rise of online retail and e-commerce platforms, which has changed how producers and merchants connect with their target market.

Leave a Comment