Stringent Regulatory Frameworks

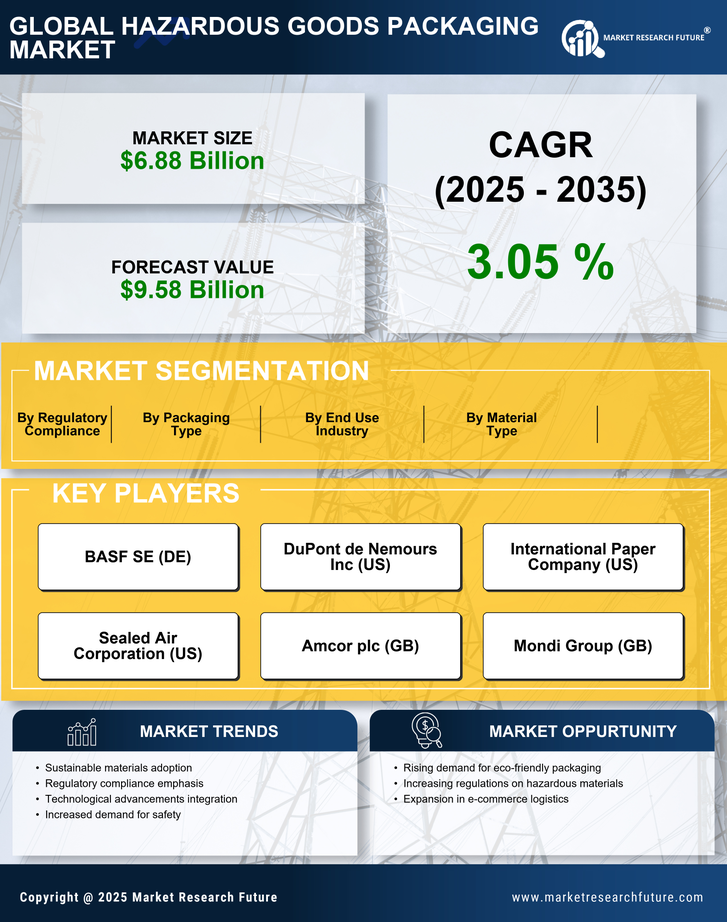

The implementation of stringent regulatory frameworks governing the handling and transportation of hazardous materials is a crucial driver for the Hazardous Goods Packaging Market. Regulatory bodies worldwide are continuously updating safety standards to protect public health and the environment. In 2025, compliance with these regulations is not merely a legal obligation but a competitive necessity for businesses. Companies are increasingly investing in advanced packaging solutions that meet or exceed regulatory requirements, thereby enhancing their market position. The Hazardous Goods Packaging Market is expected to benefit from this trend, as organizations seek to avoid penalties and reputational damage associated with non-compliance. This regulatory landscape compels manufacturers to innovate and develop packaging that not only complies with existing laws but also anticipates future regulations, ensuring long-term sustainability and market relevance.

Rising Demand from Emerging Markets

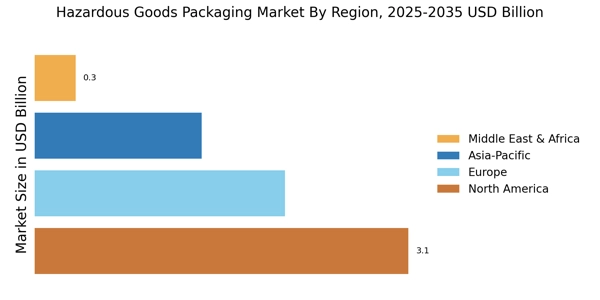

The rising demand for hazardous goods packaging from emerging markets is a significant driver for the Hazardous Goods Packaging Market. As economies in regions such as Asia-Pacific and Latin America continue to develop, the consumption of hazardous materials is increasing across various sectors, including manufacturing and construction. In 2025, these emerging markets are projected to contribute substantially to the overall demand for hazardous goods packaging solutions. This trend presents both challenges and opportunities for manufacturers, as they must adapt their products to meet the specific needs and regulatory requirements of these regions. The Hazardous Goods Packaging Market is likely to experience robust growth as companies expand their operations into these markets, necessitating innovative and compliant packaging solutions that cater to diverse applications.

Growing Awareness of Environmental Impact

The growing awareness of the environmental impact of hazardous materials is driving change within the Hazardous Goods Packaging Market. As consumers and businesses alike become more environmentally conscious, there is a rising demand for sustainable packaging solutions. In 2025, companies are increasingly seeking packaging that minimizes environmental harm while ensuring safety and compliance. This shift is prompting manufacturers to explore eco-friendly materials and designs that reduce waste and enhance recyclability. The Hazardous Goods Packaging Market is likely to see a surge in innovation as companies strive to align their packaging strategies with sustainability goals. This trend not only addresses environmental concerns but also enhances brand reputation, making it a pivotal factor in the market's evolution.

Increasing Transportation of Hazardous Materials

The rising transportation of hazardous materials across various industries is a primary driver for the Hazardous Goods Packaging Market. As industries such as chemicals, pharmaceuticals, and energy expand, the need for effective packaging solutions becomes paramount. In 2025, the transportation of hazardous goods is projected to reach unprecedented levels, necessitating robust packaging that adheres to safety regulations. This trend indicates a growing demand for innovative packaging solutions that ensure the safe transit of dangerous goods, thereby propelling the market forward. Furthermore, the increasing complexity of supply chains adds to the urgency for reliable packaging, as companies seek to mitigate risks associated with hazardous materials. Consequently, the Hazardous Goods Packaging Market is likely to experience significant growth as businesses prioritize safety and compliance in their operations.

Technological Innovations in Packaging Solutions

Technological innovations are reshaping the Hazardous Goods Packaging Market, offering new opportunities for efficiency and safety. Advances in materials science and engineering are leading to the development of packaging solutions that are lighter, stronger, and more resistant to leaks and spills. In 2025, the integration of smart technologies, such as RFID tracking and temperature monitoring, is becoming increasingly prevalent in hazardous goods packaging. These innovations enhance supply chain visibility and ensure that hazardous materials are handled with the utmost care. As companies seek to optimize their operations and reduce risks, the demand for technologically advanced packaging solutions is expected to rise. This trend not only improves safety but also streamlines logistics, making it a key driver of growth in the Hazardous Goods Packaging Market.