Market Analysis

In-depth Analysis of Healthcare Biometrics Market Industry Landscape

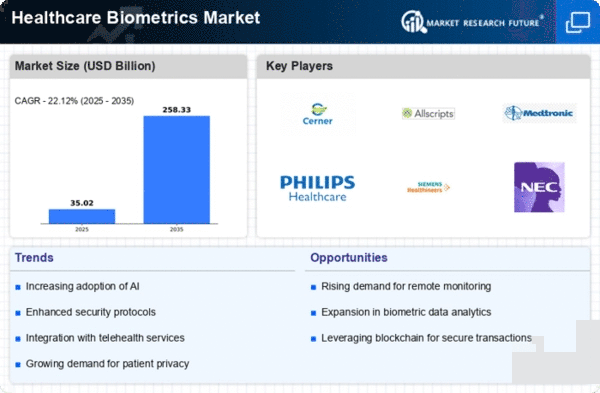

The Healthcare Biometrics marketplace is at the forefront of the digital transformation in the healthcare enterprise, leveraging biometric technology for identity verification, admission to manage, and affected person authentication. This dynamic marketplace is fashioned by way of factors, which include technological advancements, increasing concerns about records security, and the growing demand for streamlined healthcare tactics. The healthcare zone is witnessing a paradigm shift in the direction of stepped-forward affected person identity control. Biometric answers offer a robust and reliable approach to verifying patient identities, reducing the threat of scientific errors, ensuring correct record-keeping, and enhancing patient protection. The increasing frequency of safety breaches and healthcare fraud has heightened the importance of robust authentication measures. Healthcare Biometrics offers a secure manner to defend touchy affected persons' records, save you unauthorized right of entry to medical records, and mitigate the dangers associated with identification robbery. The seamless integration of biometric technology with electronic health records (EHRs) is a key driving force within the healthcare biometrics market. This integration streamlines workflows, complements factual accuracy, and guarantees that only legal employees have the right to access patient records, contributing to progressed healthcare transport. Stringent information protection policies, together with the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) in Europe, affect the Healthcare Biometrics marketplace. Compliance with those regulations is vital for market gamers to ensure the felony and ethical use of biometric facts. The global shift in the direction of telehealth and far-flung affected person monitoring has amplified the significance of stable and reliable affected person authentication. Biometric solutions enable healthcare companies to verify affected persons' identities remotely, ensuring the confidentiality of virtual scientific consultations and faraway tracking classes. Despite the benefits, the implementation of Healthcare Biometrics faces challenges, which include initial setup prices, issues with statistics breaches, and the need for standardized protocols. Overcoming those demanding situations is crucial for the great adoption of biometric answers in healthcare settings. Intense competition among market players is fostering innovation in Healthcare Biometrics. Companies are specializing in developing advanced biometric solutions, improving accuracy charges, and exploring new packages to take advantage of an aggressive part of the dynamic Healthcare Biometrics market. The destiny of the healthcare biometrics market holds promise with emerging trends, including voice popularity, behavioral biometrics, and the use of biometrics in wearable devices. As the era continues to evolve, biometrics is anticipated to play a more and more imperative role in shaping the future of healthcare.

Leave a Comment