Market Share

Healthcare Biometrics Market Share Analysis

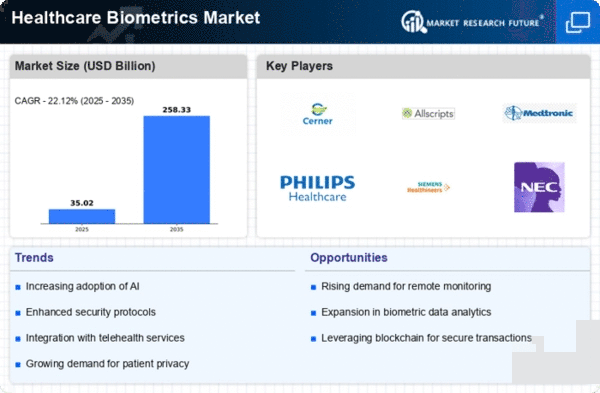

In the Healthcare Biometrics marketplace, corporations prioritize records protection and privateness as a foundational method. Ensuring the protection of sensitive, affected personal information via superior encryption and authentication measures is vital for building belief and gaining marketplace proportion. A key positioning approach entails emphasizing the accuracy of patient identity. Biometric answers, including fingerprint or iris scans, provide an excessive level of precision, reducing mistakes in patient data and remedy plans, thereby contributing to advanced healthcare outcomes. Strict adherence to healthcare guidelines, including HIPAA (Health Insurance Portability and Accountability Act) in the United States, is critical. Companies put money into making sure their biometric answers follow these policies, addressing felony concerns and facilitating market popularity. Acknowledging the rise of telehealth and remote healthcare services, agencies within the Healthcare Biometrics marketplace offer answers for far-off affected person authentication. This allows steady and correct identification of sufferers for the duration of virtual consultations, contributing to the enlargement of telehealth talents. Staying ahead within the market entails continuous studies and development. Companies invest in innovating biometric technologies, exploring new modalities, and refining current solutions to maintain tempo with evolving healthcare wishes and technological improvements. Forming strategic partnerships with healthcare establishments is a common market proportion positioning method. Collaborating with hospitals, clinics, and different healthcare carriers allows biometric organizations to apprehend unique desires and tailor answers for top-of-the-line integration. Recognizing the importance of consumer proficiency, agencies offer complete schooling and schooling applications. These initiatives assist the healthcare body of workers in understanding and correctly using biometric systems, reducing the gaining knowledge of curves and enhancing common machine adoption. Addressing value worries, organizations may additionally undertake a strategy of supplying fee-effective biometric solutions. This entails offering scalable pricing fashions, lowering the total price of possession, or offering subscription-based services to make biometrics more on hand to a broader range of healthcare carriers. Market leaders look to expand their presence globally by identifying and getting into new markets. Understanding local healthcare wishes compliance requirements and adapting biometric solutions to satisfy diverse international requirements are critical for successful marketplace growth. Building a robust brand popularity is paramount. Companies put money into creating considerations through superb client reviews, testimonials, and a music document of hit biometric implementations. A stable popularity enhances marketplace credibility and impacts shopping decisions. Providing gear for monitoring and compliance reporting is important for Healthcare Biometrics. Companies offer capabilities that permit healthcare companies to song gadget usage, audit trails, and generate compliance reports, ensuring adherence to regulatory requirements.

Leave a Comment