Market Share

Healthcare Information Systems Market Share Analysis

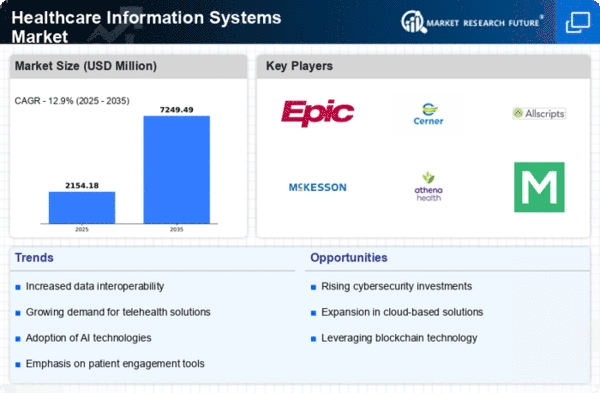

Online safety is crucial as health records become more digitally based. HIS providers fundamentally invest in robust network security measures to safeguard sensitive patient data. By keeping their word about information security, companies gain the trust of healthcare providers and establish themselves as trustworthy partners during a time when network security threats are growing, increasing their market share. The patient's experience is fundamental to health information systems. Organizations prioritize the development of user-friendly interfaces and strategies to enhance ease for medical professionals. Easy navigation and efficient workflows improve customer satisfaction, which contributes to favorable word-of-mouth and market share growth. Utilizing information examination and business insight instruments is an essential move. HIS suppliers offer high level examination abilities to assist healthcare associations with getting significant experiences from their information. Organizations that enable healthcare suppliers with noteworthy information position themselves as supporters of worked on persistent results and functional proficiency, supporting market share development. The reception of cloud-based arrangements is a critical pattern in the HIS market. Organizations offering cloud-based stages give versatility, adaptability, and availability. Embracing cloud innovation positions suppliers as ground breaking and light-footed, taking care of the developing necessities of healthcare associations and adding to a serious market share. The combination of telehealth capacities is a reaction to the developing interest for distant healthcare administrations. HIS suppliers that consolidate telehealth functionalities into their systems add to the extension of virtual consideration. This flexibility positions organizations as empowering agents of healthcare availability, driving market share development in the period of computerized wellbeing. Global healthcare demands a critical approach to managing international markets. Businesses that firmly expand globally access a variety of healthcare systems and consumer demands. By identifying key areas of strength across many districts, a may enhance their market share position and reduce their dependence on clear markets. The global marketplace for HIS is dynamic and constantly evolving mechanically. Businesses that invest in ongoing, creative effort remain ahead of emerging trends. Advances in HIS solutions attract early adopters and establish providers as trailblazers in shaping the future of healthcare information systems, hence facilitating the growth of market share.

Leave a Comment