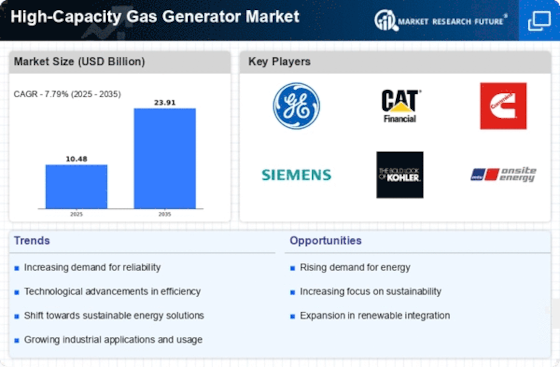

Rising Energy Demand

The increasing demand for energy across various sectors is a primary driver for the High-Capacity Gas Generator Market. As urbanization and industrialization continue to expand, the need for reliable and efficient power sources becomes paramount. According to recent data, energy consumption is projected to rise significantly, with estimates suggesting a growth rate of approximately 2.5% annually. This surge in energy demand necessitates the deployment of high-capacity gas generators, which offer a flexible and responsive solution to meet peak load requirements. Furthermore, the ability of these generators to operate on natural gas, a cleaner alternative to coal, aligns with the global shift towards more sustainable energy practices. Consequently, the High-Capacity Gas Generator Market is likely to experience robust growth as stakeholders seek to enhance energy security and reliability.

Environmental Regulations

The implementation of stringent environmental regulations is significantly influencing the High-Capacity Gas Generator Market. Governments worldwide are increasingly focusing on reducing greenhouse gas emissions and promoting cleaner energy sources. This regulatory landscape encourages the adoption of high-capacity gas generators, which typically produce lower emissions compared to traditional fossil fuel-based power generation methods. Data from environmental agencies indicates that natural gas generators can reduce CO2 emissions by up to 50% compared to coal-fired plants. As regulatory frameworks evolve, the demand for compliant and efficient gas generators is expected to rise, thereby propelling the growth of the High-Capacity Gas Generator Market. Companies that invest in cleaner technologies are likely to gain a competitive edge, aligning their operations with both regulatory requirements and consumer preferences for sustainable energy solutions.

Technological Innovations

Technological advancements play a crucial role in shaping the High-Capacity Gas Generator Market. Innovations in generator design, efficiency, and emissions control technologies are enhancing the performance and appeal of gas generators. For instance, the integration of digital controls and IoT capabilities allows for real-time monitoring and optimization of generator operations, leading to improved efficiency and reduced operational costs. Additionally, advancements in materials and manufacturing processes are enabling the production of more compact and lightweight generators without compromising power output. Market data indicates that the adoption of these technologies is expected to increase, with a projected compound annual growth rate (CAGR) of around 4% over the next five years. As a result, the High-Capacity Gas Generator Market is poised for transformation, driven by the continuous pursuit of innovation and efficiency.

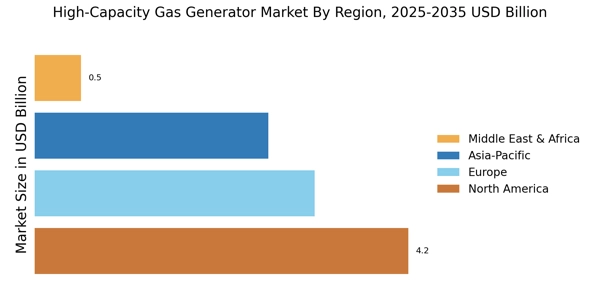

Increased Investment in Infrastructure

The surge in infrastructure development projects is a significant driver for the High-Capacity Gas Generator Market. As nations invest in upgrading and expanding their energy infrastructure, the demand for reliable power generation solutions becomes critical. This trend is particularly evident in emerging economies, where rapid urbanization and industrial growth necessitate the establishment of robust energy systems. Market analysis suggests that infrastructure investments in energy generation are expected to reach trillions of dollars over the next decade. High-capacity gas generators are well-positioned to meet the energy needs of these projects, providing a flexible and efficient power source. Consequently, the High-Capacity Gas Generator Market is likely to benefit from this influx of investment, as stakeholders seek to ensure energy availability and reliability in the face of growing demand.

Shift Towards Decentralized Energy Systems

The transition towards decentralized energy systems is emerging as a pivotal driver for the High-Capacity Gas Generator Market. As energy consumers increasingly seek autonomy and resilience in their power supply, decentralized generation solutions are gaining traction. High-capacity gas generators offer the flexibility to be deployed in various settings, from industrial facilities to remote locations, thereby supporting localized energy production. This shift is further supported by advancements in energy storage technologies, which enhance the reliability of decentralized systems. Market trends indicate that the demand for decentralized energy solutions is expected to grow, with projections suggesting a CAGR of approximately 5% in the coming years. As a result, the High-Capacity Gas Generator Market is likely to experience heightened interest and investment as stakeholders recognize the benefits of localized energy generation.

Leave a Comment