Technological Innovations

Technological advancements are playing a crucial role in shaping the High Density Fiberboard Market. Innovations in manufacturing processes, such as improved fiber bonding techniques and enhanced surface treatments, are leading to higher quality products with better performance characteristics. For instance, the introduction of advanced machinery has enabled manufacturers to produce high-density fiberboard with greater precision and efficiency. This not only reduces production costs but also enhances product durability and aesthetic appeal. As technology continues to evolve, it is expected that the High Density Fiberboard Market will witness further improvements, potentially increasing market penetration and expanding applications across various sectors, including furniture and construction.

Sustainability Initiatives

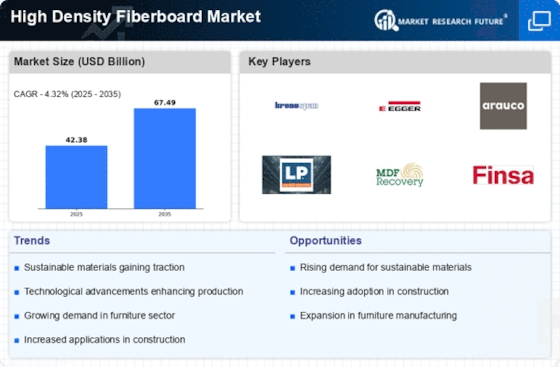

The increasing emphasis on sustainability within the High Density Fiberboard Market is driving demand for eco-friendly materials. Manufacturers are increasingly adopting sustainable practices, such as using recycled wood fibers and non-toxic adhesives, to produce high-density fiberboard. This shift aligns with consumer preferences for environmentally responsible products, which has been evidenced by a rise in market share for sustainable options. In 2025, the market for sustainable high-density fiberboard is projected to account for a significant portion of overall sales, reflecting a broader trend towards green building materials. As regulations tighten around environmental impact, companies that prioritize sustainability are likely to gain a competitive edge, further propelling growth in the High Density Fiberboard Market.

Rising Construction Activities

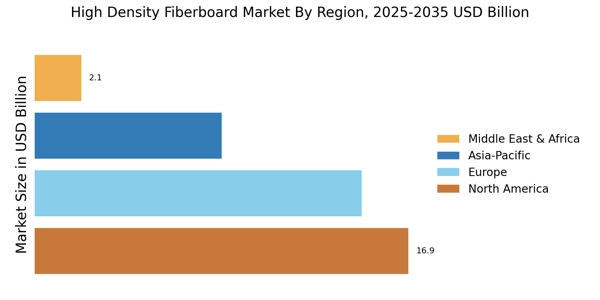

The resurgence of construction activities is significantly influencing the High Density Fiberboard Market. As urbanization accelerates, there is a growing demand for building materials that offer both functionality and aesthetic appeal. High-density fiberboard is increasingly favored for its versatility, being used in applications ranging from wall panels to cabinetry. In 2025, the construction sector is anticipated to contribute substantially to the overall growth of the high-density fiberboard market, with projections indicating a compound annual growth rate that reflects the sector's expansion. This trend suggests that as more residential and commercial projects emerge, the demand for high-density fiberboard will likely increase, reinforcing its position in the market.

Consumer Preferences for Aesthetics

Consumer preferences are shifting towards aesthetically pleasing materials, which is positively impacting the High Density Fiberboard Market. High-density fiberboard offers a wide range of finishes and designs, making it an attractive choice for interior applications. As consumers become more design-conscious, the demand for high-density fiberboard that mimics natural wood finishes is on the rise. This trend is particularly evident in the furniture and cabinetry sectors, where high-density fiberboard is increasingly used to create stylish and modern designs. The ability to customize high-density fiberboard products to meet specific design needs is likely to enhance its appeal, suggesting a robust growth trajectory for the High Density Fiberboard Market.

Regulatory Support for Sustainable Materials

Regulatory frameworks promoting the use of sustainable materials are emerging as a key driver in the High Density Fiberboard Market. Governments are implementing policies that encourage the adoption of eco-friendly building materials, which includes high-density fiberboard produced from sustainable sources. These regulations not only aim to reduce environmental impact but also support the growth of industries that prioritize sustainability. As a result, manufacturers are increasingly aligning their production processes with these regulations, which could lead to a more favorable market environment for high-density fiberboard. The anticipated increase in regulatory support is likely to bolster the market, making sustainable high-density fiberboard a preferred choice among consumers and builders alike.