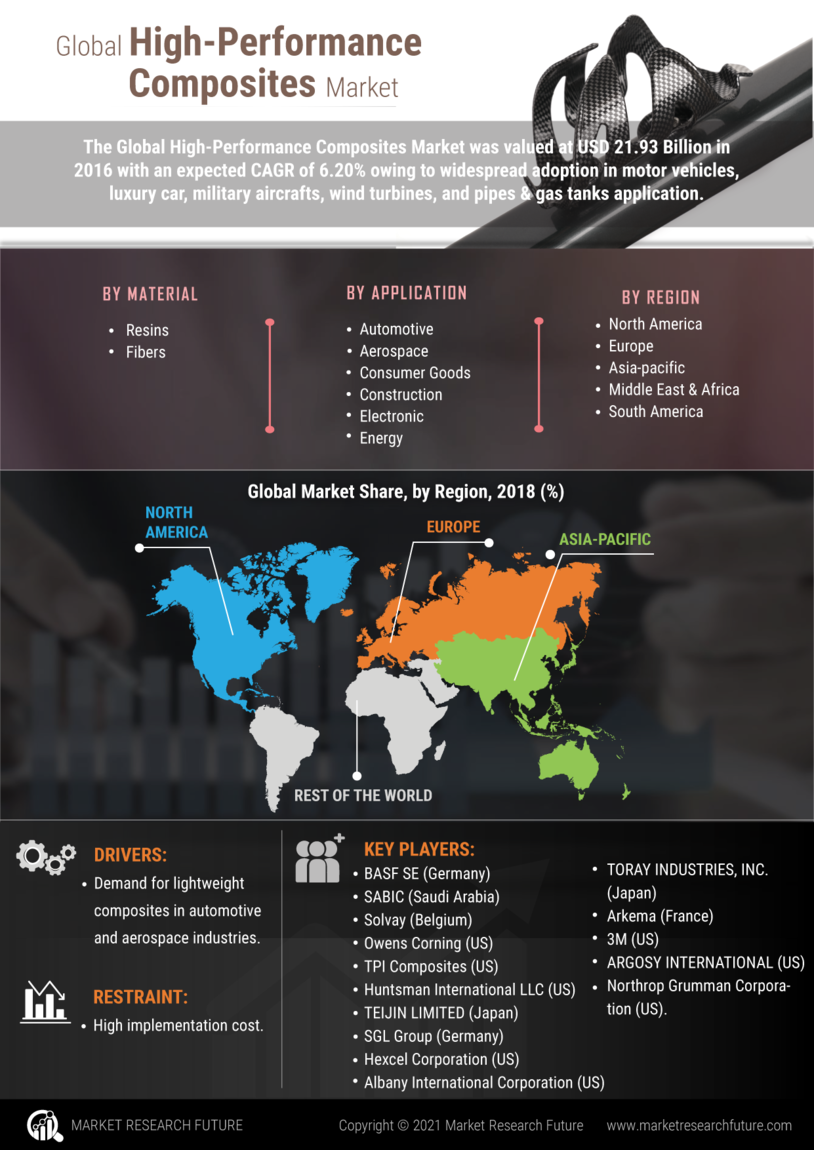

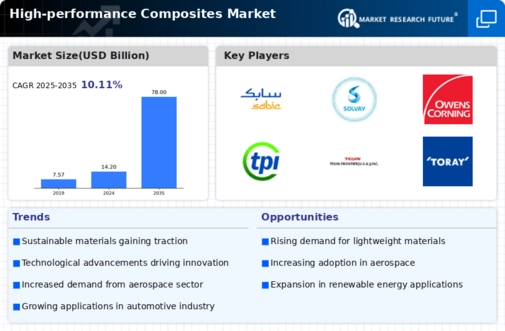

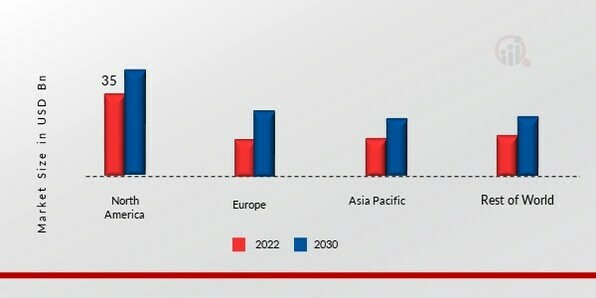

Market Growth Projections

The Global High-performance Composites Market Industry is projected to experience substantial growth over the next decade. With an anticipated market value of 14.2 USD Billion in 2024, the industry is expected to reach 78.0 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate of 16.75% from 2025 to 2035, reflecting the increasing adoption of high-performance composites across various sectors, including aerospace, automotive, and renewable energy. The market's expansion is likely to be driven by technological advancements, rising demand for lightweight materials, and growing investments in infrastructure.

Growth in Renewable Energy Sector

The Global High-performance Composites Market Industry is poised for growth due to the increasing demand for renewable energy solutions, particularly in wind energy applications. Wind turbine manufacturers are increasingly utilizing high-performance composites to enhance the durability and efficiency of turbine blades. These materials provide the necessary strength and lightweight properties that are crucial for optimizing energy production. As the global push for clean energy intensifies, the market for high-performance composites in this sector is likely to expand significantly, contributing to the overall market growth and aligning with global sustainability initiatives.

Rising Demand in Aerospace Sector

The Global High-performance Composites Market Industry experiences a robust demand surge from the aerospace sector, driven by the need for lightweight materials that enhance fuel efficiency and performance. As airlines increasingly focus on reducing operational costs and emissions, the adoption of high-performance composites is likely to rise. For instance, the aerospace industry is projected to utilize these materials extensively in aircraft structures and components, contributing to an estimated market value of 14.2 USD Billion in 2024. This trend may continue as manufacturers seek to innovate and improve aircraft designs, potentially leading to a market valuation of 78.0 USD Billion by 2035.

Technological Innovations and Research

Technological advancements play a pivotal role in shaping the Global High-performance Composites Market Industry. Continuous research and development efforts are leading to the creation of new composite materials with enhanced properties, such as improved thermal resistance and impact strength. These innovations are likely to open new applications across various industries, including construction, marine, and sports equipment. As manufacturers adopt these advanced materials, the market is expected to witness substantial growth, driven by the increasing need for high-performance solutions that meet stringent regulatory standards and consumer demands.

Advancements in Automotive Applications

The automotive industry significantly influences the Global High-performance Composites Market Industry, as manufacturers increasingly integrate these materials to enhance vehicle performance and safety. High-performance composites offer superior strength-to-weight ratios, which can improve fuel efficiency and reduce emissions. Major automotive players are investing in research and development to incorporate these composites into electric and hybrid vehicles, aligning with global sustainability goals. This shift is expected to contribute to a compound annual growth rate of 16.75% from 2025 to 2035, reflecting the industry's commitment to innovation and environmental responsibility.

Increasing Investment in Infrastructure

The Global High-performance Composites Market Industry benefits from rising investments in infrastructure development worldwide. Governments and private sectors are increasingly focusing on building sustainable and resilient infrastructure, which often incorporates high-performance composites due to their durability and lightweight characteristics. These materials are particularly advantageous in construction applications, where they can enhance structural integrity while reducing overall weight. As global infrastructure projects expand, the demand for high-performance composites is likely to grow, contributing to the industry's overall market expansion.

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Leave a Comment