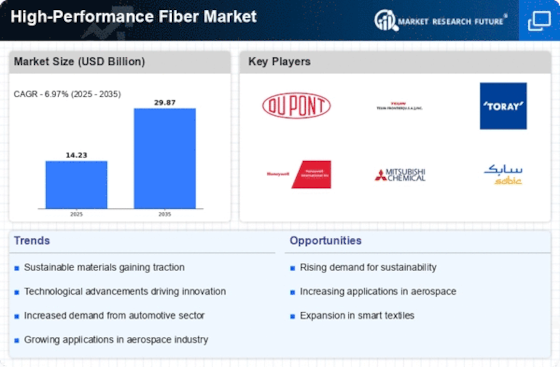

Growth in Automotive Applications

The automotive industry is experiencing a paradigm shift towards lightweight materials to enhance fuel efficiency and reduce emissions. High-performance fibers are increasingly utilized in vehicle manufacturing, particularly in electric and hybrid models. The High-Performance Fiber Market is expected to expand as automakers seek to comply with stringent environmental regulations. Reports suggest that the use of these fibers can reduce vehicle weight by up to 30%, thereby improving performance and energy consumption. As the automotive sector continues to innovate, the integration of high-performance fibers is likely to become a standard practice, further propelling market growth.

Increased Focus on Sustainability

Sustainability has become a pivotal concern across various industries, influencing the High-Performance Fiber Market. Manufacturers are increasingly adopting eco-friendly practices, including the use of recycled materials in fiber production. This shift is driven by consumer preferences for sustainable products and regulatory pressures to reduce environmental impact. The market for sustainable high-performance fibers is projected to grow significantly, as companies strive to meet these demands. Innovations in bio-based fibers and recycling technologies are likely to play a crucial role in this transformation, suggesting that sustainability will not only enhance brand reputation but also drive market growth.

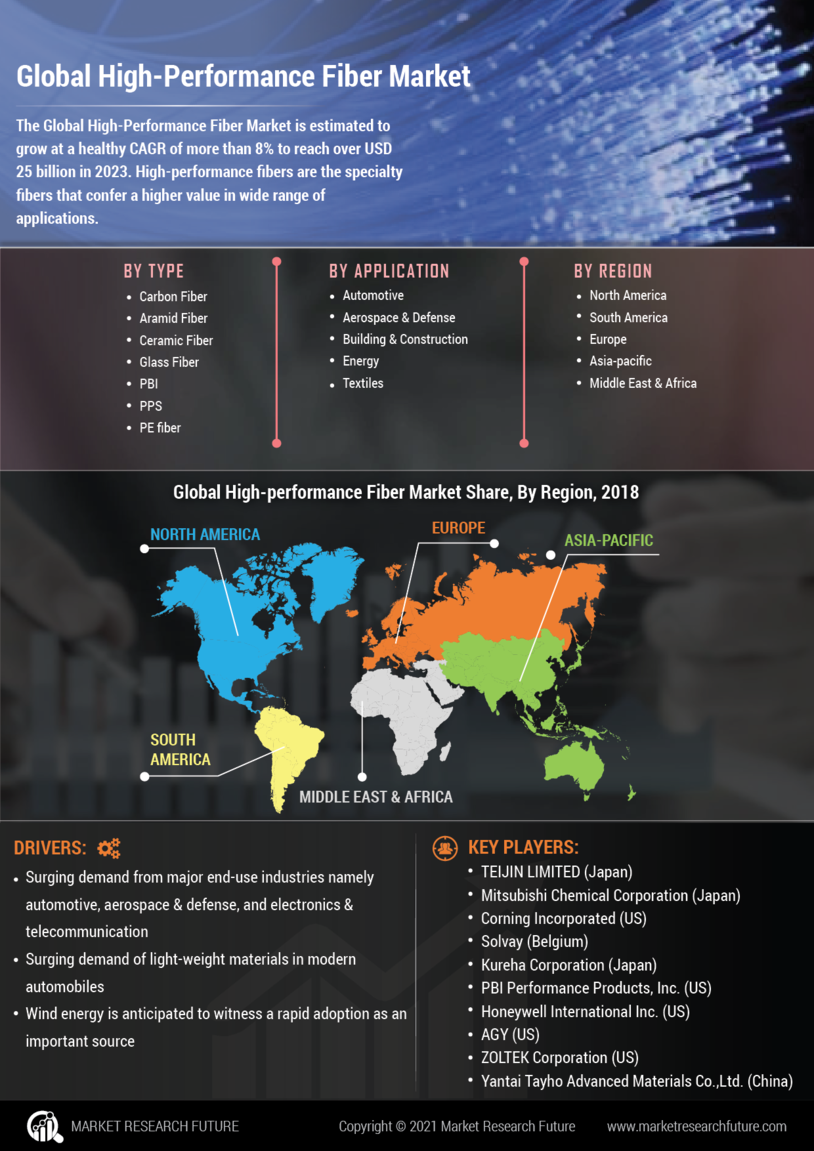

Rising Demand in Aerospace and Defense

The aerospace and defense sectors are increasingly adopting high-performance fibers due to their lightweight and high-strength properties. These materials are essential for manufacturing components that require durability and resistance to extreme conditions. The High-Performance Fiber Market is projected to witness a compound annual growth rate of approximately 10% in these sectors. This growth is driven by the need for fuel-efficient aircraft and advanced military equipment, where every ounce of weight reduction can lead to significant operational advantages. As nations invest in modernizing their fleets, the demand for high-performance fibers is likely to surge, indicating a robust market trajectory.

Emerging Applications in Medical Devices

The medical sector is increasingly recognizing the advantages of high-performance fibers in the development of advanced medical devices. These materials are utilized in applications such as sutures, implants, and prosthetics, where biocompatibility and strength are paramount. The High-Performance Fiber Market is poised for growth as healthcare providers seek innovative solutions to improve patient outcomes. The integration of these fibers can enhance the durability and functionality of medical devices, potentially leading to a market expansion of over 8% in the coming years. As research continues to unveil new applications, the demand for high-performance fibers in the medical field is likely to escalate.

Advancements in Sports and Recreational Equipment

The sports and recreational equipment market is witnessing a transformation with the incorporation of high-performance fibers. These materials offer enhanced strength-to-weight ratios, which are crucial for developing high-quality gear. The High-Performance Fiber Market is benefiting from this trend, as manufacturers aim to produce equipment that enhances performance while ensuring safety. For instance, high-performance fibers are used in the production of lightweight bicycles, high-tech sportswear, and protective gear. The increasing consumer demand for premium sports products is likely to drive further innovation and investment in high-performance fibers, suggesting a promising outlook for the industry.

Leave a Comment