Market Analysis

In-depth Analysis of High Performance Polyamide Market Industry Landscape

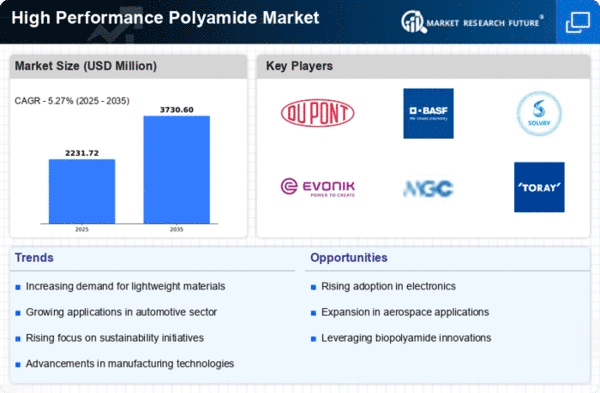

The market dynamics of high-performance polyamide depict a dynamic landscape influenced by various factors that impact its production, demand, and overall market trajectory. High-performance polyamides, known for their exceptional strength, heat resistance, and chemical stability, find extensive applications in industries such as automotive, aerospace, electronics, and consumer goods. One of the primary drivers of the high-performance polyamide market is the growing demand from the automotive sector. As automotive manufacturers seek lightweight and durable materials to enhance fuel efficiency and performance, high-performance polyamides are increasingly used in components such as engine parts, fuel systems, and structural components.

Technological advancements and innovations in polymer science significantly impact the dynamics of the high-performance polyamide market. Ongoing research and development efforts focus on enhancing the properties of polyamides, such as impact resistance, flame retardancy, and dimensional stability. The development of advanced polyamide formulations, including PA11, PA12, and PA46, caters to specific industry requirements and expands the potential applications of high-performance polyamides in challenging environments. These innovations contribute to market competitiveness and drive the adoption of high-performance polyamides across diverse industries.

Global economic trends play a pivotal role in shaping the demand for high-performance polyamides. Economic growth, industrialization, and infrastructure development drive the demand for materials in construction, electronics, and automotive sectors, directly impacting the high-performance polyamide market. Conversely, economic downturns can lead to fluctuations in demand, particularly in industries that heavily rely on high-performance polyamides. The cyclicality of these industries makes the high-performance polyamide market sensitive to economic fluctuations.

Environmental sustainability considerations are increasingly influencing the dynamics of the high-performance polyamide market. As industries worldwide focus on reducing their carbon footprint and adopting sustainable practices, there is a growing demand for materials that combine high performance with environmental responsibility. The development of bio-based polyamides and recycling initiatives contributes to shaping the market dynamics, aligning with global environmental goals and the preferences of eco-conscious consumers within various industries.

Globalization has a profound impact on the dynamics of the high-performance polyamide market. The interconnectedness of markets requires polyamide manufacturers to adapt to diverse regulatory frameworks, trade dynamics, and regional variations in demand. Strategic partnerships, collaborations, and acquisitions are common strategies employed by high-performance polyamide manufacturers to strengthen their global presence and address the unique needs of different markets.

Supply chain dynamics, including the availability of raw materials and geopolitical factors, significantly impact the high-performance polyamide market. Key elements such as adipic acid, hexamethylene diamine, and sebacic acid are essential components in polyamide production, and any disruptions in the supply chain of these raw materials can influence production costs and overall market dynamics. Geopolitical tensions, trade restrictions, and fluctuations in commodity prices add layers of complexity to the global supply chain for high-performance polyamides.

Price competitiveness remains a significant factor in the high-performance polyamide market dynamics. End-users, particularly in cost-sensitive industries like automotive and consumer goods, closely monitor the cost-effectiveness of high-performance polyamides compared to alternative materials. Manufacturers focus on optimizing production processes, achieving economies of scale, and ensuring a reliable supply chain to offer competitive pricing and maintain their position in the market.

Leave a Comment