Research Methodology on High-Performance Polyamides Market

Research methodology involves the methods and processes used to investigate a research issue. Various steps of research methodology are collecting the data, analyzing it, and then making a conclusion or recommendation based on the analysis. This research report “High-Performance Polyamides Market” was developed using a comprehensive research methodology which includes both primary and secondary research.

The primary research was conducted to understand the nature and scope of the market, the secondary research was conducted to validate the results of the primary research and the qualitative data collected from the industry experts. The research methodology adopted in this report was used to identify the various levels of analysis such as industry analysis, market segmentation analysis, competitive landscape assessment, and value chain analysis to provide a view of the market.

Information Procurement Process

The information procurement process adopted in the research process includes primary and secondary research. Primary and secondary research involves the collection and analysis of data to understand the market environment and dynamics.

Primary Research

Primary research is a data collection method used to identify the research objectives and is of utmost importance. Primary data was sourced through interviews with industry and market experts, sectoral associations, key employees, industry publications, and annual reports. Primary research plays an important role in the research process, as it produces data which is reliable, valid, and relevant to the research objectives.

Secondary Research

Secondary research was conducted to validate the primary research results. Various sources of information were used to generate insights for the market, such as industry magazines, white papers, research reports, and paid databases. The data collected from various sources was compiled using various data triangulation techniques.

Approaches Used

The research report was built on several approaches such as the bottom-up approach, top-down approach, factor analysis, time-series analysis, and demand-side and supply-side data triangulation.

Bottom-Up Approach

In the bottom-up approach, the data of the individual market segments obtained from the secondary sources were processed to identify the market size and growth rate of the overall market. Subsequently, the resulting market size and growth rate were projected to obtain the overall market size.

Top-Down Approach

The top-down approach was used to validate the bottom-up approach and authenticate the results obtained by estimating the overall market size. The estimated data from the bottom-up approach was used to obtain the size of the overall market.

Factor Analysis

Factor analysis was used to identify the current and future trends of the market, assess the various factors driving or constraining the market, and analyze the interdependencies between the different variables. These activities enabled the researchers to forecast the market size more accurately.

Time-series Analysis

Time-series analysis was used to determine the annual, monthly, and quarterly growth and decline trends in the market. The analysis was based on the historical data collected from various sources.

Demand-Side and Supply-Side Data Triangulation

Data triangulation is a process to validate the accuracy of the data and to eliminate inconsistencies or discrepancies in the data. The primary and secondary data collected were compared in order to gain insights into the market.

Data Analysis

The data collected from the different sources was analyzed using various statistical techniques such as PESTEL analysis, SWOT analysis, Porter's Five Forces model, and others. The market size, share, and forecast of the market were estimated by using various macro- and micro-economic factors. All the data obtained from the primary and secondary research and data triangulation were fed into the analytical models. The models were used to predict the future growth of the market and to provide an overall market estimation for the coming years.

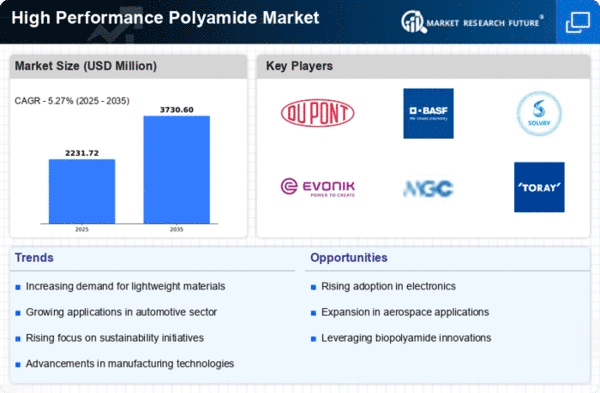

Finally, this report was presented in the form of tables, diagrams, and charts to explain the market dynamics effectively and to provide insights into the market structure. All these steps were taken to obtain an in-depth understanding of the overall market.