- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

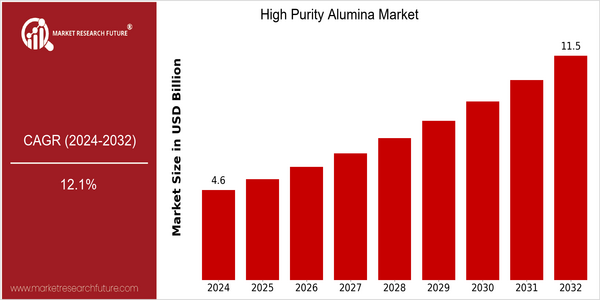

High Purity Alumina Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 4.6 Billion |

| 2032 | USD 11.5 Billion |

| CAGR (2024-2032) | 12.1 % |

Note – Market size depicts the revenue generated over the financial year

High-purity alumina is expected to grow at a CAGR of 12.1% from 2024 to 2032. This growth will be driven by the growing demand for high-purity alumina in various applications, mainly in the manufacture of LED lights, semi-conductors, and lithium-ion batteries, which are critical to the ongoing development of the electronics and the renewable energy sectors. This growth will be further driven by the growing popularity of electric vehicles and the increasing demand for energy-efficient lighting solutions. High-purity alumina is essential to the performance and lifespan of batteries. The key players in this market, including Alcoa, Nippon Light Metal, and Sasol, are actively engaging in strategic initiatives, such as strategic alliances and the development of advanced production technology, in order to maintain their market share and meet the increasing demand for high-purity alumina.

Regional Deep Dive

HPA is experiencing considerable growth in various regions of the world, as the demand for HPA is rising, especially in the areas of the electronics, automobile, and the renewable energy industries. In North America, the market is characterized by a strong focus on technology and sustainable development, and the leading companies are investing in new production methods. In Europe, HPA is experiencing a growing demand due to stricter regulations in the field of the environment and the growing importance of the production of electric cars. The Asia-Pacific region remains the largest HPA market, which is mainly influenced by rapid industrialization and a booming electronics industry. The Middle East and Africa (MEA) are emerging markets with great potential, which are characterized by the availability of raw materials and the expansion of production capacity. HPA is gradually developing in Latin America, which is influenced by local mining and international cooperation.

North America

- The United States government has taken measures to promote the use of aluminum in energy storage devices, especially for electric vehicles, which will stimulate demand for this product.

- Alcoa and Norsk Hydro are investing in advanced refining technology to produce HPA more sustainably. This fits in with the region's focus on reducing carbon footprints.

- High-tech manufacturers are requesting higher purity materials and are collaborating with HPA manufacturers more and more.

Europe

- The Green Deal is influencing the HV market by promoting sustainable development and encouraging investment in high-purity materials for the manufacture of batteries.

- Orbite Technologies and Altech are expanding their activities in Europe, concentrating on new extraction methods which reduce the harmful effects on the environment.

- In the transport and energy sectors, in Germany and France, HPA is mainly used in the production of biofuels and bio-gas, and is used in the production of bio-gas.

Asia-Pacific

- China is the main supplier of HPA, and the main companies are China Minmetals and China Nonferrous Metal Mining.

- A number of joint ventures and cooperative ventures have been established in the region, such as the collaboration between Sumitomo Chemcial and local companies to increase the production capacity of the HPA.

- In some countries, such as India, the development of HPA for the batteries of electric vehicles is supported by government initiatives, which are expected to significantly boost local production.

MEA

- The United Arab Emirates are investing heavily in the development of the HPA market. The Dubai Industrial Strategy aims to make the emirate a centre for the advanced materials industry.

- In addition, companies like the Emirates Global Aluminium, which diversify its production, are working on producing high-purity alumina, which is in great demand in the world.

- In some of the countries of the Middle East and Africa, legislation is being drafted to encourage the extraction and processing of alumina, which would increase local production.

Latin America

- Brazil is establishing itself as a major player in the HPA market. The country’s bauxite reserves are being explored for the production of HPA.

- Brazilian mining companies are establishing alliances with foreign companies to share technology and increase the efficiency of their production.

- The growing interest in sustainable mining practices is influencing the development of HPA, as companies seek to align their operations with international standards.

Did You Know?

“High-purity alumina is not only used in the manufacture of LEDs, but lithium-ion batteries are increasingly used in the manufacture of electric cars.” — International Energy Agency (IEA)

Segmental Market Size

High-purity alumina (HPA) has a major share in the overall market, mainly due to its application in lithium-ion batteries, LED lights and semiconductors. This market is currently experiencing strong growth, driven by the growing demand for high-performance materials in advanced technology. HPA is in high demand, mainly for the production of lithium-ion batteries for electric vehicles. HPA is also in high demand for energy-saving lamps, which are based on high-performance materials.

High-pressure aluminum aqueous solutions are now in commercial production. The companies Alcoa and Sumitomo Chemical are the forerunners. High-pressure aluminum aqueous solutions are currently used for the production of sapphire wafers for LEDs and as a component in the production of the separation layer of lithium-ion batteries. This trend is being driven by the global trend towards sustainable development and the development of green technology. In addition, advances in the Bayer process and hydrometallurgy are making it easier to use HPA in a variety of industrial applications.

Future Outlook

HPA market is expected to grow from $ 4,600,000 to $ 11,500,000, a CAGR of 11.1 percent. The main reason for this is the increasing demand for HPA in various high-tech industries, especially in the production of LED lights, semi-conductors and lithium ion batteries. HPA is expected to increase its penetration into the semi-conductor industry to 25 percent and 30 percent in the lithium ion battery industry by 2032. According to the forecasts of authoritative sources such as Markets and Markets and Grand View Research, the penetration of HPA into the high-tech industry will continue to increase.

Market expansion is expected to be accelerated by key technological developments and government support. HPA extraction and refining methods are being improved to increase the purity of the product and reduce its cost, thus making it more accessible to a wider range of applications. Meanwhile, government initiatives to promote clean energy and reduce carbon emissions will encourage the use of HPA in the manufacture of batteries, especially for electric vehicles. HPA’s growing integration into advanced ceramics and the aerospace industry will also drive growth, as HPA establishes itself as a key material in the transition towards a more sustainable and technologically advanced future.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 19.40% (2024-2030) |

High Purity Alumina Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.