Top Industry Leaders in the High Temperature Composite Resin Market

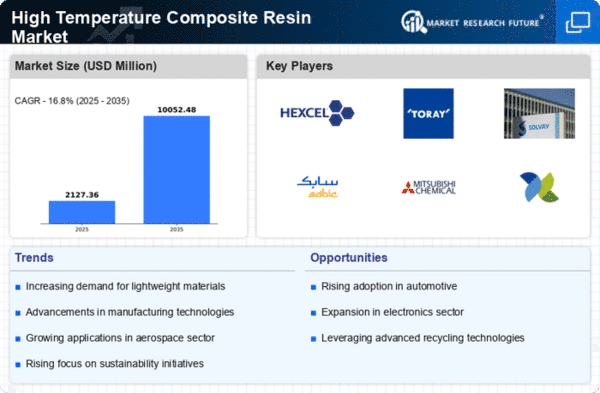

The high-temperature composite resin market is a fiercely competitive space, fueled by the relentless pursuit of high-performance materials for demanding applications. it's no surprise that leading players are pulling out all the stops to secure their share of the pie. Let's delve into the current landscape, analyzing strategies, market share drivers, recent developments, and industry news.

The high-temperature composite resin market is a fiercely competitive space, fueled by the relentless pursuit of high-performance materials for demanding applications. it's no surprise that leading players are pulling out all the stops to secure their share of the pie. Let's delve into the current landscape, analyzing strategies, market share drivers, recent developments, and industry news.

Strategies Shaping the Market:

-

Product Diversification: Players are expanding their portfolios beyond traditional epoxy resins, venturing into bismaleimides, polyimides, and cyanate esters to cater to diverse industry needs. Hexion Inc., for instance, recently acquired APC Composites, gaining access to advanced cyanate ester resins for aerospace applications. -

R&D Focus: Innovation is key to differentiation. Companies like Solvay and Huntsman are heavily investing in R&D, developing next-generation resins with improved thermal stability, fire resistance, and processing characteristics. The recent launch of Solvay's PRISMAPORE 5977, a high-performance bismaleimide resin for turbine blades, exemplifies this commitment. -

Sustainability Push: With growing environmental concerns, eco-friendly resins are gaining traction. Mitsubishi Chemical's DURANEX ECO series of bio-based epoxy resins addresses this demand, offering comparable performance with a reduced environmental footprint. -

Regional Expansion: Asia-Pacific, driven by burgeoning aerospace and automotive sectors, is a prime target for expansion. Leading players like Jilin Jushi Group and Jiangsu Hengshi Holding Group are establishing new production facilities in the region to capitalize on this growth.

Factors Driving Market Share:

-

End-Use Industry Landscape: The performance needs and regulations vary across industries. Aerospace & defense, demanding lightweight and heat-resistant materials, is a major driver. Increasing use of composites in automotive and marine applications also fuels demand. -

Technological Advancements: New processing techniques like automated fiber placement and resin transfer molding are making composites more cost-effective and accessible, expanding market reach. -

Government Initiatives: Support from governments, through research grants and favorable regulations for the aerospace and renewable energy sectors, stimulates market growth.

Key Players

- Huntsman International LLC (US),

- Hexcel Corporation (US),

- Sumitomo Bakelite Co., Ltd (Japan),

- Koninklijke Ten Cate BV (Netherlands),

- Hexlon (US),

- DIC Corporation (Japan),

- Arkema (France),

- Lonza (Switzerland),

- UBE Industries, Ltd (Japan),

- Evonik Industries AG (Germany),

- and Celanese Corporation (US).

Recent Developments :

September 2023: Mitsubishi Chemical showcases its DURANEX ECO resins at the JEC World composites exhibition, further solidifying its commitment to sustainable solutions.

October 2023: The Chinese government announces new regulations promoting the use of composites in the automotive industry, potentially boosting demand for high-temperature resins in the region.

November 2023: A consortium of European research institutions receives funding to develop bio-based cyanate ester resins, marking a significant step towards sustainable alternatives.

December 2023: Honeywell Aerospace expands its production capacity for high-temperature composite prepregs, anticipating increased demand from the commercial aircraft market.