Increasing Demand for Renewable Energy

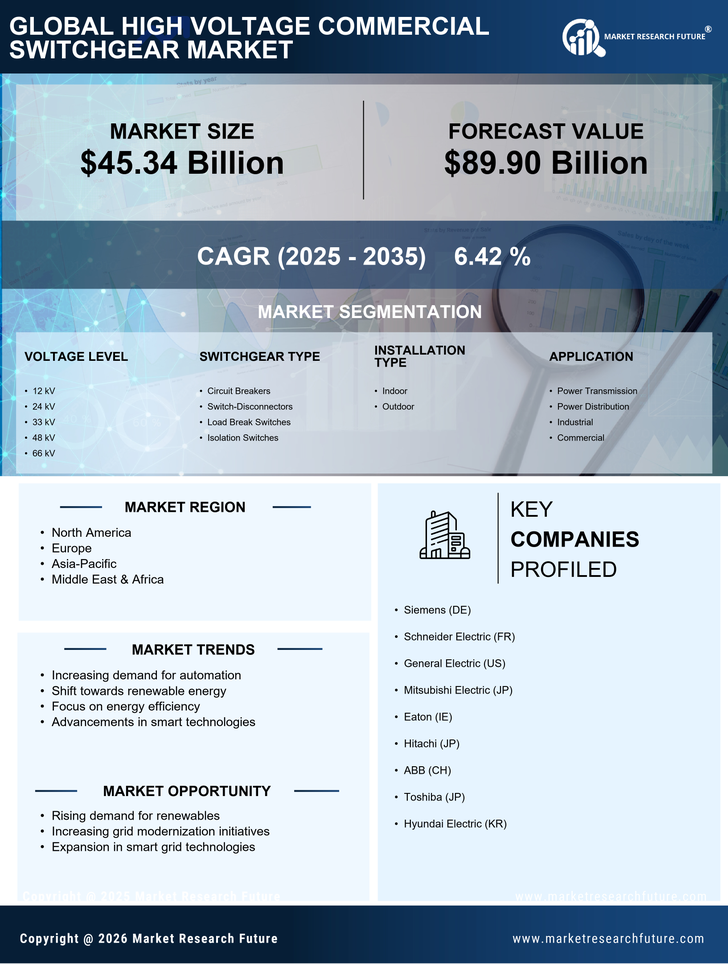

The transition towards renewable energy sources is driving the High Voltage Commercial Switchgear Market. As countries strive to meet their energy needs sustainably, the integration of renewable energy systems, such as wind and solar, necessitates advanced switchgear solutions. This market segment is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years. The need for reliable and efficient energy distribution systems is paramount, as these renewable sources often require high voltage switchgear for effective grid integration. Consequently, the demand for high voltage switchgear is expected to rise, reflecting the industry's adaptation to evolving energy landscapes.

Infrastructure Development Initiatives

Infrastructure development initiatives across various regions are significantly influencing the High Voltage Commercial Switchgear Market. Governments are investing heavily in upgrading and expanding electrical infrastructure to support urbanization and industrial growth. For instance, the construction of new power plants and substations necessitates the deployment of high voltage switchgear to ensure safe and efficient power distribution. This trend is particularly evident in emerging economies, where rapid urbanization is creating a pressing need for robust electrical systems. The market is anticipated to witness a surge in demand as these infrastructure projects progress, potentially leading to a market growth rate of around 7% annually.

Technological Innovations in Switchgear

Technological innovations are reshaping the High Voltage Commercial Switchgear Market, with advancements in materials and design enhancing performance and reliability. The introduction of smart switchgear, which incorporates digital technologies for monitoring and control, is gaining traction. These innovations not only improve operational efficiency but also facilitate predictive maintenance, reducing downtime and operational costs. The market for smart switchgear is expected to expand significantly, driven by the increasing need for automation in electrical systems. As industries seek to optimize their energy management, the adoption of these advanced switchgear solutions is likely to accelerate, contributing to a more dynamic market landscape.

Rising Industrialization and Urbanization

Rising industrialization and urbanization are pivotal factors influencing the High Voltage Commercial Switchgear Market. As economies develop, the demand for electricity surges, necessitating the expansion of electrical infrastructure. Urban areas, in particular, are experiencing increased energy consumption due to population growth and industrial activities. This trend drives the need for high voltage switchgear to manage and distribute electricity efficiently. The market is projected to grow as industries and municipalities invest in modernizing their electrical systems to accommodate this rising demand. The interplay between urbanization and industrial growth is expected to create a robust market environment for high voltage switchgear solutions.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are critical drivers of the High Voltage Commercial Switchgear Market. Governments and regulatory bodies are implementing stringent safety regulations to ensure the reliability and safety of electrical systems. Compliance with these standards necessitates the use of high-quality switchgear that meets specific performance criteria. As industries face increasing scrutiny regarding safety and environmental impact, the demand for compliant switchgear solutions is expected to rise. This trend is likely to propel market growth, as manufacturers innovate to meet evolving regulatory requirements, ensuring that their products align with safety and performance standards.