Growing Awareness of Patient Safety

The increasing awareness of patient safety among healthcare providers and patients is driving the Hospital-acquired Disease Testing Market. Educational initiatives and campaigns aimed at highlighting the risks associated with HAIs have led to a heightened focus on infection prevention strategies. Hospitals are now prioritizing the implementation of rigorous testing protocols to ensure patient safety and improve overall care quality. This shift in mindset is reflected in the growing adoption of testing solutions that can quickly identify pathogens responsible for infections. As a result, the Hospital-acquired Disease Testing Market is likely to experience sustained growth as stakeholders recognize the importance of proactive disease management.

Regulatory Compliance and Quality Standards

Regulatory compliance and adherence to quality standards are critical factors influencing the Hospital-acquired Disease Testing Market. Healthcare facilities are increasingly required to meet stringent regulations set forth by health authorities to ensure patient safety and quality of care. Compliance with these regulations often necessitates the adoption of advanced testing methodologies to accurately diagnose and monitor HAIs. The pressure to maintain high standards of care is prompting hospitals to invest in reliable testing solutions that align with regulatory requirements. Consequently, this trend is expected to drive the growth of the Hospital-acquired Disease Testing Market as healthcare providers seek to enhance their compliance efforts.

Technological Innovations in Diagnostic Tools

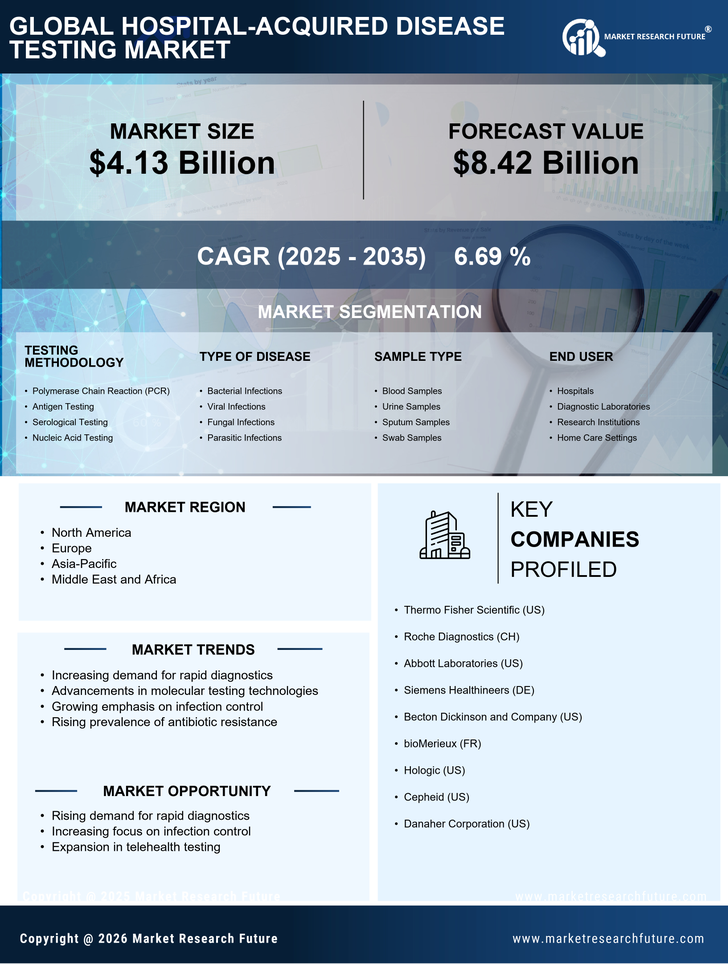

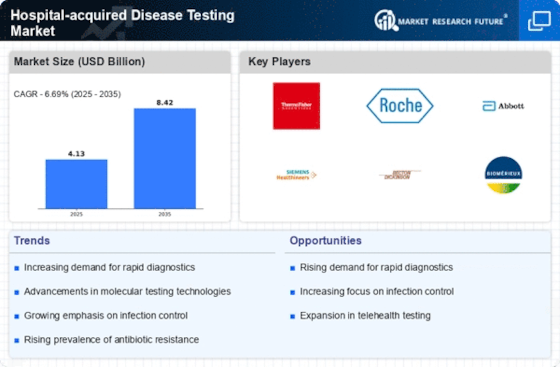

Technological advancements in diagnostic tools are significantly influencing the Hospital-acquired Disease Testing Market. Innovations such as rapid molecular testing, point-of-care testing, and automated laboratory systems are enhancing the speed and accuracy of disease detection. For instance, the introduction of next-generation sequencing technologies allows for comprehensive pathogen identification, which is crucial in managing HAIs effectively. The market for diagnostic testing is projected to grow, with estimates suggesting a compound annual growth rate of over 10% in the coming years. These advancements not only improve patient outcomes but also streamline hospital operations, making them a vital component of the Hospital-acquired Disease Testing Market.

Rising Incidence of Hospital-acquired Infections

The increasing prevalence of hospital-acquired infections (HAIs) is a primary driver for the Hospital-acquired Disease Testing Market. Reports indicate that HAIs affect millions of patients annually, leading to extended hospital stays and increased healthcare costs. The Centers for Disease Control and Prevention estimates that one in 31 hospital patients has at least one HAI on any given day. This alarming statistic underscores the urgent need for effective testing solutions to identify and manage these infections promptly. As healthcare facilities strive to enhance patient safety and reduce infection rates, the demand for advanced testing methodologies is likely to surge, thereby propelling the Hospital-acquired Disease Testing Market forward.

Increased Investment in Healthcare Infrastructure

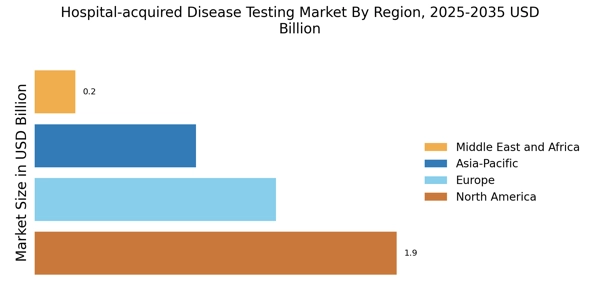

The surge in investment in healthcare infrastructure is a notable driver of the Hospital-acquired Disease Testing Market. Governments and private entities are allocating substantial resources to enhance hospital facilities, which includes upgrading diagnostic capabilities. This investment is particularly evident in developing regions, where the establishment of new healthcare facilities is accompanied by the implementation of advanced testing technologies. As hospitals expand their services and improve their infection control measures, the demand for effective disease testing solutions is expected to rise. This trend indicates a robust growth trajectory for the Hospital-acquired Disease Testing Market, as healthcare providers seek to mitigate the risks associated with HAIs.