Research Methodology on Hospital Bed Market

Introduction

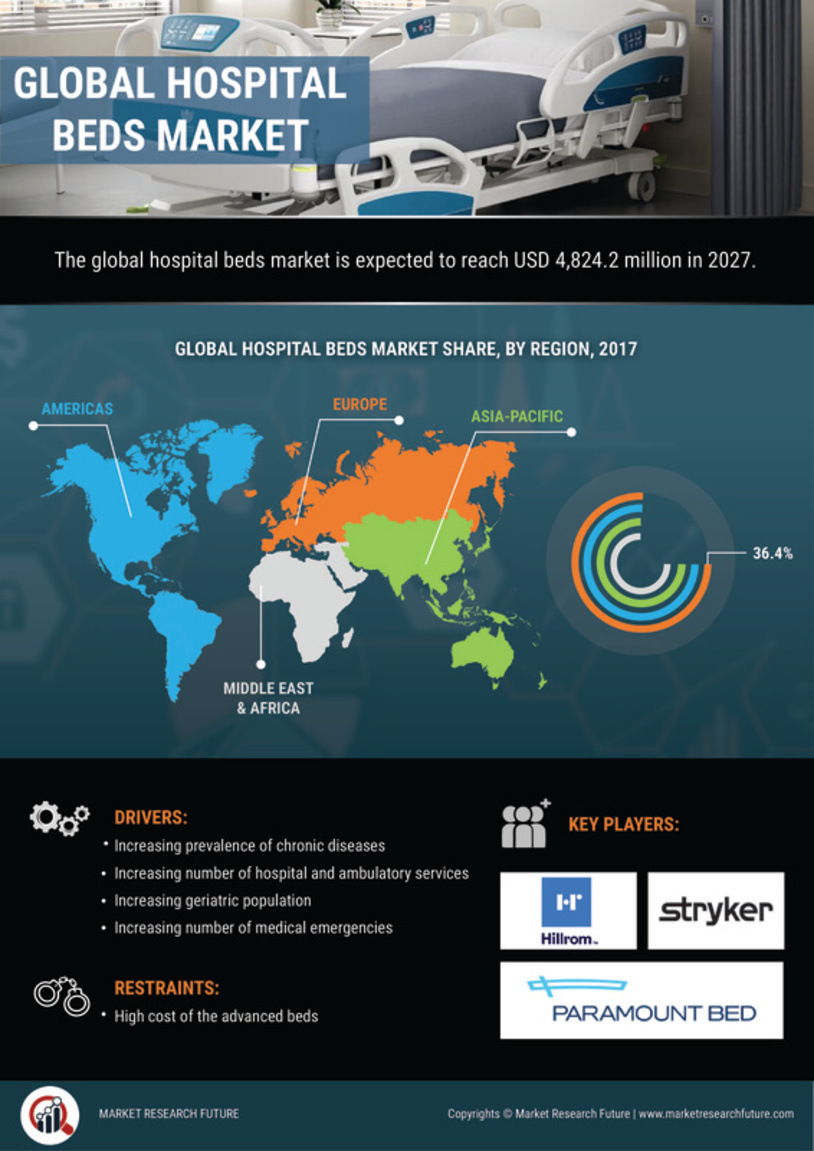

In this research report the market potential of hospital beds is evaluated. The research report consists of an analysis of the market size of hospital beds, the drivers of the market, and the market restraints. This report explores the factors that are hampering the growth of the hospital beds market and the challenges faced by the market.

The global hospital beds market are witnessing growth during the past few years. The growing demand for medical beds along with technological advancements in healthcare are the major drivers of this market. Furthermore, the increasing population, rising geriatric population and the advancements in medical technology are other imperative driving factors for this market.

Research Methodology

For the purpose of this research study, Market Research Future (MRFR) has adopted an inclusive and extensive research methodology. The market research approach is developed to gain an extensive understanding of the drivers and restraints of the market and the varying trends from macroeconomic perspectives. This approach is also adopted so that the research study could include a detailed overview of the global hospital beds market.

This research study involves both primary and secondary research. As part of the primary research, several industry professionals and market experts are interviewed to gain an in-depth understanding of the market. The results of the survey are then combined with the data collected through secondary sources to gain insight into the market. The primary sources that are used include industry experts, healthcare providers, and market research experts.

The secondary research involved is used to collect the database of information related to the market. The secondary resources used were government databases, industry databases, professional journals, white papers and market reports. The findings of the survey conducted by MRFR were used to validate the data collected from secondary sources.

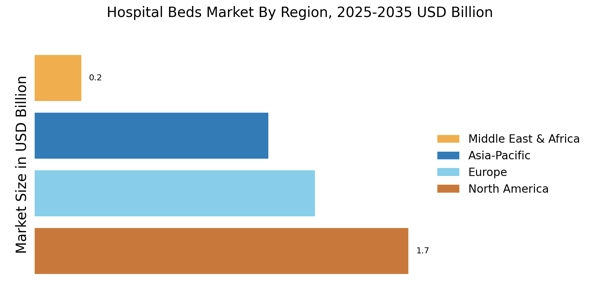

The market-sizing exercise included the analysis of the historic data related to the market to arrive at the estimated market forecast for the period of 2023 to 2030. The various parameters used for the market-sizing exercise included unit sales, pricing, volume, and market share. Furthermore, the estimated market estimates were validated by industry experts and opinion leaders.

The market trends identified in this research study are a combination of both qualitative and quantitative insights. The qualitative data is collected through interviews conducted with market experts and opinion leaders. On the other hand, the quantitative data is collected with the help of the customer and pricing analysis.

The research study has also taken into account the macroeconomic and industry factors that can affect the growth of the hospital beds market. The market dynamics discussed are framed to gain a comprehensive understanding of the market. The market dynamics included the market drivers, restraints, opportunities and threats.

Conclusion

This research report analyzes the market potential of hospital beds and the respective factors that are propelling the growth of the market. The report further provides a detailed overview of the factors that are hampering the growth of the market and the challenges faced by the market. Furthermore, a comprehensive research methodology is used to gain an extensive understanding of the market. The findings of this study are used as a guide for companies to better assess and plan their strategies for entering or expanding their presence in the market.