Rising Healthcare Expenditure

Rising healthcare expenditure is a significant driver influencing the Hospital Infection Therapeutic Market. As healthcare systems allocate more resources to combat hospital-acquired infections, there is an increasing investment in therapeutic solutions. Data suggests that healthcare spending on infection control measures has risen substantially, with hospitals recognizing the financial burden associated with treating infections. The economic impact of hospital-acquired infections, estimated to cost the U.S. healthcare system billions annually, underscores the need for effective therapeutic interventions. Consequently, pharmaceutical companies are responding to this demand by developing innovative therapies that can reduce infection rates and improve patient outcomes. This trend indicates a robust growth trajectory for the Hospital Infection Therapeutic Market as healthcare providers seek to enhance their infection management strategies.

Regulatory Support for New Therapeutics

Regulatory support for the development of new therapeutics is a crucial driver in the Hospital Infection Therapeutic Market. Regulatory agencies are increasingly recognizing the urgent need for innovative treatments to combat hospital-acquired infections. Initiatives such as expedited review processes and incentives for antibiotic development are encouraging pharmaceutical companies to invest in research and development. For instance, the FDA's Qualified Infectious Disease Product designation provides benefits such as priority review and market exclusivity for new antibiotics. This supportive regulatory environment fosters innovation and accelerates the introduction of new therapies into the market. As a result, the Hospital Infection Therapeutic Market is likely to witness a surge in novel therapeutic options that address the pressing challenges posed by resistant infections.

Growing Awareness of Infection Prevention

The growing awareness of infection prevention among healthcare professionals and patients is a significant driver in the Hospital Infection Therapeutic Market. Educational initiatives and campaigns aimed at promoting hygiene practices and infection control measures have led to a heightened understanding of the importance of preventing hospital-acquired infections. This awareness translates into increased demand for therapeutic interventions that can effectively manage and treat infections. Data indicates that hospitals implementing comprehensive infection prevention programs have seen a reduction in infection rates by up to 30%. As healthcare systems prioritize patient safety and quality of care, the Hospital Infection Therapeutic Market is poised for growth, with a focus on developing therapies that align with these preventive measures.

Increasing Prevalence of Antibiotic Resistance

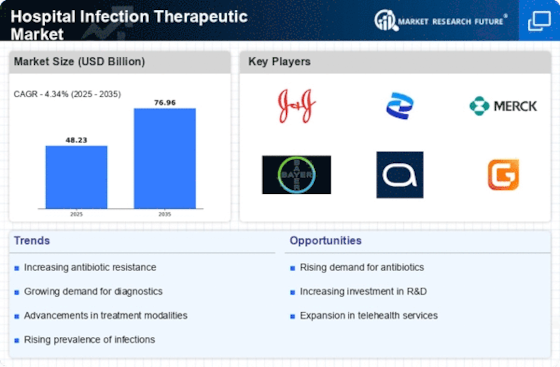

The rising prevalence of antibiotic resistance is a critical driver in the Hospital Infection Therapeutic Market. As pathogens evolve and develop resistance to commonly used antibiotics, healthcare providers face significant challenges in treating infections. This situation has led to an increased demand for novel therapeutic options and alternative treatment strategies. According to recent data, antibiotic-resistant infections contribute to approximately 2 million illnesses and 23,000 deaths annually in the United States alone. Consequently, pharmaceutical companies are investing heavily in research and development to create new antibiotics and therapies that can effectively combat resistant strains. This trend not only highlights the urgency of addressing antibiotic resistance but also underscores the potential for growth within the Hospital Infection Therapeutic Market as new solutions are sought.

Technological Innovations in Infection Control

Technological innovations play a pivotal role in shaping the Hospital Infection Therapeutic Market. The integration of advanced technologies, such as artificial intelligence and machine learning, into infection control practices has the potential to enhance patient outcomes significantly. For instance, predictive analytics can identify infection outbreaks before they escalate, allowing for timely interventions. Furthermore, the development of smart medical devices equipped with infection prevention features is gaining traction. These innovations not only improve the efficacy of existing therapies but also create new avenues for treatment. The market for infection control technologies is projected to grow substantially, driven by the increasing need for effective infection management solutions. As hospitals adopt these technologies, the Hospital Infection Therapeutic Market is likely to experience a corresponding rise in demand for therapeutic products that align with these advancements.

Leave a Comment