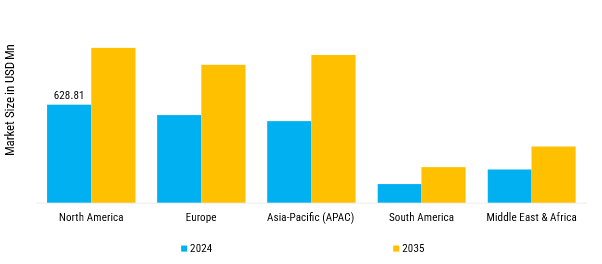

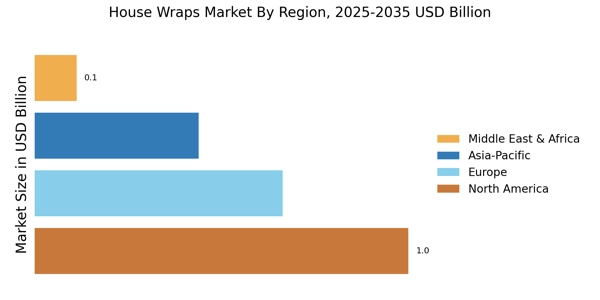

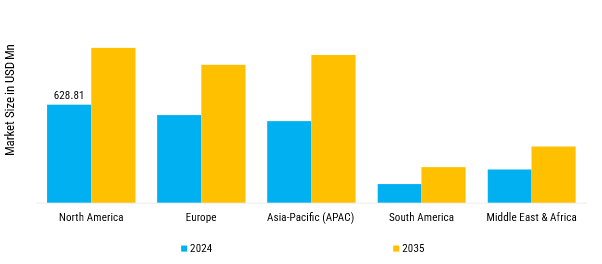

House Wraps Regional Insights

Based on region, the House Wraps Market is segmented into North America, Europe, Asia-Pacific, South America and Middle East and Africa. North America accounted for the largest market share in 2024 and is anticipated to reach USD 992.9 Million by 2035. Asia-Pacific is projected to grow at the highest CAGR of 5.5% during the forecast period.

Europe: Emerging Operation Market

The future outlook for the European house wraps market is highly positive, driven by a convergence of regulatory support, technological innovation, financial incentives, and sustainability awareness. Continued investment in product research and development, coupled with government policies aimed at achieving zero-carbon buildings, will sustain market growth. Renovation and retrofitting of Europe’s aging building stock, combined with increasing consumer awareness of energy efficiency and environmental impact, ensure a stable and expanding demand base. The integration of circular economy principles, alongside advancements in smart building technologies, will further reinforce the market’s trajectory, providing manufacturers with opportunities to innovate, differentiate, and deliver value across multiple segments of the construction industry.

North America: Expanding operation Evolution

Technological advancements in material science are transforming the house wraps market. Modern house wraps now offer improved vapor permeability, UV resistance, and self-adhering membranes, enabling quicker installation and longer service life. Manufacturers are actively investing in research and development to design products that meet evolving building codes and environmental targets. NIST has evaluated the performance of different air barrier materials, confirming that innovative house wraps significantly enhance building energy efficiency and resilience. These developments not only meet regulatory demands but also cater to the construction industry’s growing emphasis on sustainable, durable, and high-performance materials.

South America: Emerging and Growing

The South American house wraps market is experiencing a notable transformation, driven by a convergence of factors including evolving building codes, increasing demand for energy-efficient solutions, and a growing emphasis on sustainability. As the region navigates its unique challenges and opportunities, house wraps have emerged as a critical component in enhancing building performance, reducing energy consumption, and promoting environmental responsibility. In South America, the regulatory landscape for energy efficiency in buildings is gradually evolving. While the region may not yet have the stringent mandates seen in other parts of the world, there is a noticeable shift towards adopting more sustainable construction practices. Countries like Brazil, Argentina, and Chile are beginning to implement building codes that encourage energy efficiency, including the use of materials that improve thermal insulation and reduce energy consumption.

Asia-pacific: Experiencing Dynamic Growth

The global push toward zero-carbon buildings is influencing construction practices in the APAC region. International organizations and environmental bodies are advocating for the adoption of building codes that promote energy efficiency and sustainability. This global trend is prompting APAC countries to strengthen their building regulations and standards, further driving the demand for high-performance materials like house wraps. Looking ahead, the APAC house wraps market is poised for continued growth. Factors such as urban expansion, increasing disposable incomes, and heightened environmental awareness are expected to fuel demand. Additionally, the ongoing development of smart cities and infrastructure projects presents significant opportunities for the integration of energy-efficient materials, including house wraps, into building designs.

Middle-East & Africa: Driven by Increasing Urbanization

In the MEA region, building codes and energy efficiency standards are gradually being implemented to address the challenges posed by extreme climates and resource constraints. For example, Egypt's Energy Code for Residential Buildings (EECRB), first issued in 2006, provides guidelines for passive design strategies, including building orientation and window placement, to enhance energy performance. Additionally, countries like the United Arab Emirates (UAE) and Qatar have developed their own green building rating systems, such as the Estidama Pearl Rating System and the Global Sustainability Assessment System (GSAS), respectively. These systems encourage the use of sustainable materials and energy-efficient designs in buildings, indirectly promoting the adoption of house wraps as part of the building envelope.