Rising Demand for Electric Vehicles

The increasing demand for electric vehicles (EVs) is a primary driver of the Hub Motor Market. As consumers become more environmentally conscious, the shift towards sustainable transportation solutions accelerates. In 2025, the EV market is projected to grow significantly, with estimates suggesting that electric vehicles could account for over 30% of total vehicle sales. This surge in demand for EVs directly influences the Hub Motor Market, as hub motors are integral components in electric drivetrains. The efficiency and compact design of hub motors make them particularly appealing for electric vehicles, thereby enhancing their adoption. Consequently, manufacturers are likely to invest in hub motor technology to meet the evolving needs of the automotive sector, further propelling the Hub Motor Market.

Government Initiatives and Incentives

Government initiatives and incentives aimed at promoting electric mobility are significantly influencing the Hub Motor Market. Various countries are implementing policies to encourage the adoption of electric vehicles, including tax rebates, subsidies, and infrastructure development for charging stations. In 2025, it is anticipated that these initiatives will lead to a substantial increase in electric vehicle sales, thereby driving demand for hub motors. For example, some regions are setting ambitious targets for reducing carbon emissions, which necessitates a transition to electric transportation. This regulatory environment creates a favorable landscape for the Hub Motor Market, as manufacturers align their strategies with government goals to capitalize on the growing market for electric mobility.

Growth of E-Bike and E-Scooter Segments

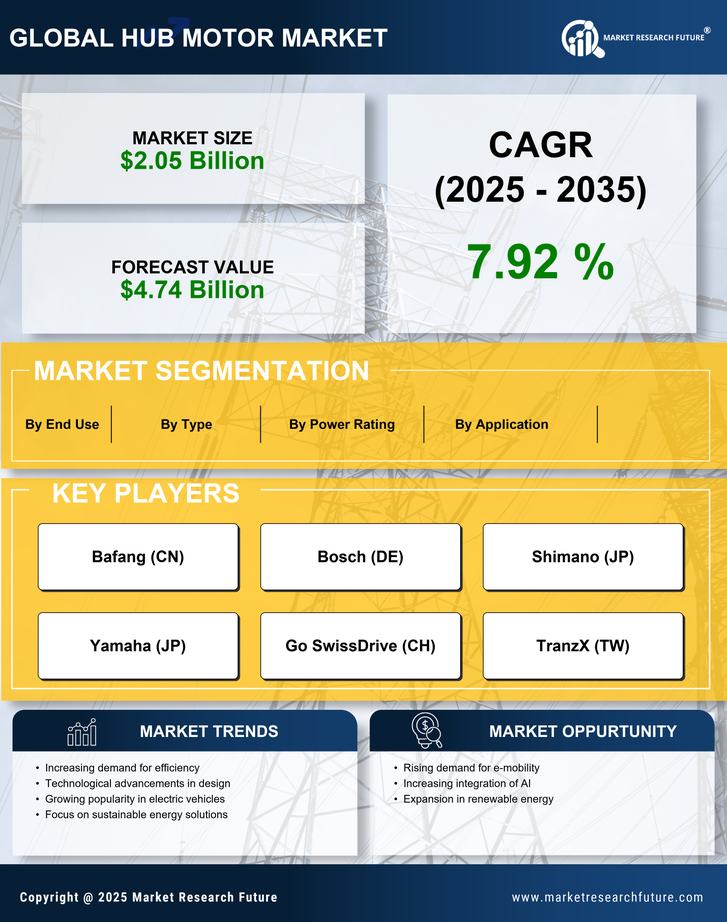

The growth of e-bike and e-scooter segments is emerging as a significant driver for the Hub Motor Market. As urbanization continues to rise, there is an increasing preference for alternative modes of transportation that are both efficient and environmentally friendly. In 2025, the e-bike market is projected to expand rapidly, with estimates indicating a compound annual growth rate (CAGR) of over 10%. Hub motors are particularly well-suited for e-bikes and e-scooters due to their compact design and ease of integration. This trend is likely to encourage manufacturers to focus on developing specialized hub motors tailored for these applications, thereby enhancing the overall growth of the Hub Motor Market.

Technological Advancements in Motor Design

Technological advancements in motor design are reshaping the Hub Motor Market. Innovations such as improved magnetic materials and advanced control systems enhance the performance and efficiency of hub motors. For instance, the introduction of high-efficiency permanent magnet motors has led to a reduction in energy losses, which is crucial for electric vehicles. In 2025, the market is witnessing a trend towards integrating smart technologies, such as IoT and AI, into motor systems. These technologies enable real-time monitoring and optimization of motor performance, which could lead to increased reliability and longevity. As manufacturers continue to innovate, the Hub Motor Market is expected to benefit from enhanced product offerings that cater to the growing demand for efficient and reliable electric drivetrains.

Consumer Preference for Compact and Efficient Solutions

Consumer preference for compact and efficient solutions is driving the Hub Motor Market. As individuals seek more convenient and space-saving transportation options, hub motors offer a compelling solution due to their integrated design. In 2025, the demand for lightweight and compact electric vehicles is expected to rise, particularly in urban areas where space is limited. Hub motors, which are mounted directly in the wheel, eliminate the need for complex drivetrain systems, thereby simplifying vehicle design. This trend aligns with the growing consumer desire for efficiency and ease of use, suggesting that manufacturers in the Hub Motor Market will need to prioritize the development of compact motor solutions to meet these evolving consumer expectations.