Increased Focus on Energy Efficiency

Energy efficiency is becoming a critical focus within the HVAC Refrigerant Recovery System Market. As energy costs rise and environmental concerns grow, both consumers and businesses are seeking solutions that reduce energy consumption. Recovery systems that enhance the efficiency of refrigerant use not only comply with regulations but also contribute to lower operational costs. The market is responding to this demand by developing systems that optimize refrigerant recovery processes, thereby improving overall system performance. This emphasis on energy efficiency is likely to drive innovation and investment in the HVAC Refrigerant Recovery System Market, as stakeholders recognize the long-term benefits of adopting energy-efficient technologies.

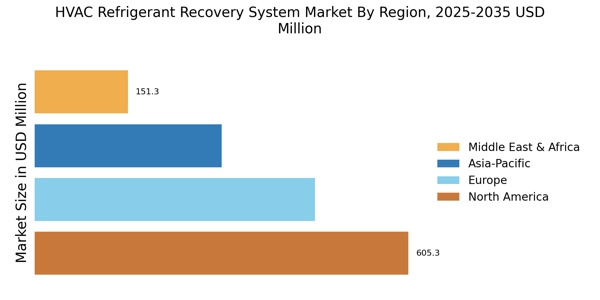

Rising Demand Across Diverse Applications

The HVAC Refrigerant Recovery System Market is witnessing a notable increase in demand across various applications, including residential, commercial, and industrial sectors. As air conditioning and refrigeration systems become more prevalent, the need for effective refrigerant recovery solutions grows. The residential sector, in particular, is seeing a rise in the installation of HVAC systems, which necessitates the use of recovery systems to ensure compliance with environmental regulations. Additionally, the commercial sector is increasingly adopting energy-efficient systems, further driving the demand for recovery solutions. Market data indicates that the commercial segment alone could account for a significant share of the HVAC Refrigerant Recovery System Market, highlighting the diverse applications fueling growth.

Technological Advancements in Recovery Systems

Innovations in technology are reshaping the HVAC Refrigerant Recovery System Market. The introduction of advanced recovery systems equipped with enhanced efficiency and user-friendly interfaces is attracting attention from smart HVAC controls professionals. These systems often feature automated processes that minimize human error and improve recovery rates. For instance, the integration of smart technology allows for real-time monitoring and diagnostics, which can lead to better maintenance practices and reduced operational costs. As technology continues to evolve, the market is likely to witness a shift towards more sophisticated recovery solutions, potentially increasing market penetration and expanding the customer base. This trend indicates a promising future for the HVAC Refrigerant Recovery System Market.

Growing Awareness of Health and Safety Standards

The HVAC Refrigerant Recovery System Market is increasingly influenced by the growing awareness of health and safety standards. As refrigerants can pose health risks if not handled properly, there is a heightened emphasis on safe recovery practices. Regulatory bodies are establishing guidelines that require HVAC technicians to utilize recovery systems that ensure safe handling and disposal of refrigerants. This trend is prompting HVAC companies to invest in advanced recovery technologies that not only comply with safety standards but also enhance operational efficiency. The focus on health and safety is likely to propel the HVAC Refrigerant Recovery System Market forward, as companies strive to meet both regulatory requirements and consumer expectations.

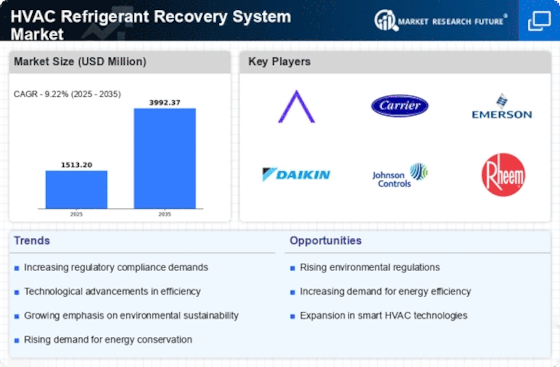

Regulatory Compliance and Environmental Awareness

The HVAC Refrigerant Recovery System Market is experiencing a surge in demand due to stringent regulations aimed at reducing greenhouse gas emissions. Governments worldwide are implementing policies that mandate the recovery and recycling of refrigerants, which are known to contribute to ozone depletion and global warming. This regulatory landscape compels HVAC professionals to adopt recovery systems that comply with environmental standards. As a result, the market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 5% in the coming years. The increasing awareness among consumers regarding environmental issues further drives the need for efficient refrigerant recovery solutions, making compliance a key driver in the HVAC Refrigerant Recovery System Market.