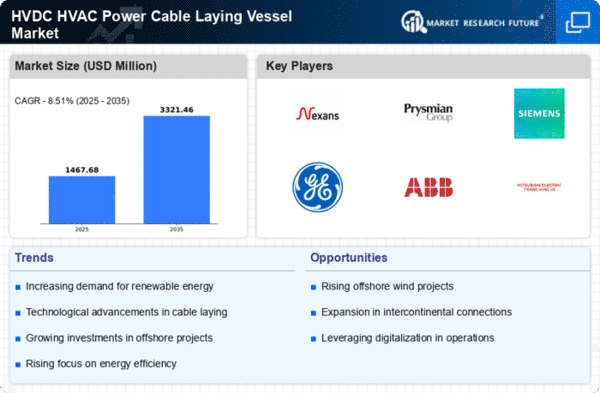

The HVDC HVAC Power Cable Laying Vessel Market is currently characterized by a dynamic competitive landscape, driven by the increasing demand for efficient energy transmission solutions and the global shift towards renewable energy sources. Key players such as Nexans (FR), Prysmian Group (IT), and Siemens (DE) are strategically positioning themselves through innovation and partnerships, which collectively shape the competitive environment. These companies are focusing on enhancing their technological capabilities and expanding their operational footprints to capture emerging market opportunities. In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to enhance operational efficiency. The market appears moderately fragmented, with several key players exerting influence over their respective segments. This competitive structure allows for a diverse range of offerings, catering to various customer needs while fostering innovation and collaboration among industry participants. In November 2025, Nexans (FR) announced a strategic partnership with a leading offshore wind farm developer to supply HVDC cables for a new project in the North Sea. This collaboration is expected to enhance Nexans' market presence and reinforce its commitment to sustainable energy solutions. The strategic importance of this partnership lies in its potential to position Nexans as a key player in the growing offshore wind sector, which is increasingly reliant on advanced cable laying technologies. In October 2025, Prysmian Group (IT) unveiled a new state-of-the-art cable laying vessel designed to improve operational efficiency and reduce environmental impact. This investment reflects Prysmian's focus on innovation and sustainability, aligning with global trends towards greener energy solutions. The introduction of this vessel is likely to enhance Prysmian's competitive edge by enabling faster and more efficient cable installation processes, thereby meeting the rising demand for HVDC solutions. In September 2025, Siemens (DE) secured a major contract for the supply and installation of HVDC systems for a large-scale interconnection project in Europe. This contract underscores Siemens' strategic emphasis on expanding its footprint in the HVDC market and highlights its capabilities in delivering complex energy solutions. The successful execution of this project could further solidify Siemens' reputation as a leader in the HVDC sector, potentially leading to additional opportunities in the future. As of December 2025, current competitive trends indicate a strong focus on digitalization, sustainability, and the integration of AI technologies within the HVDC HVAC Power Cable Laying Vessel Market. Strategic alliances are increasingly shaping the landscape, allowing companies to leverage complementary strengths and enhance their service offerings. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition towards a greater emphasis on innovation, technological advancements, and supply chain reliability, reflecting the industry's shift towards more sustainable and efficient energy solutions.