Market Share

Hydraulic Equipment Market Share Analysis

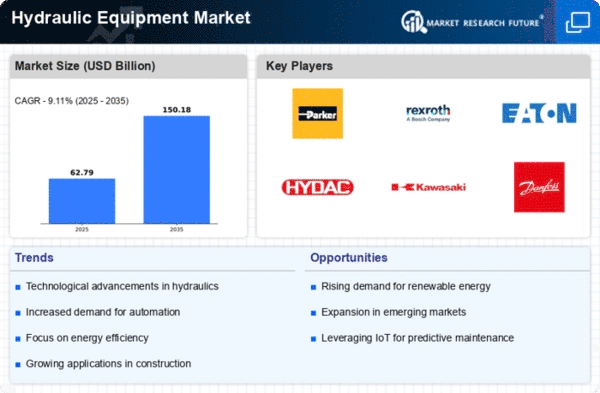

The Hydraulic Equipment Market, a critical component of various industries, employs diverse market share positioning strategies to navigate its competitive landscape. Differentiation is a key strategy, with companies focusing on offering hydraulic equipment with unique features such as advanced control systems, improved energy efficiency, and enhanced durability. By providing cutting-edge solutions that address the evolving needs of industries like construction, manufacturing, and agriculture, companies can attract customers seeking reliable and innovative hydraulic equipment.

Cost leadership is another important plan used in the Hydraulic Equipment Market. Businesses try to be the best at low cost by improving how they make things, finding materials well and getting big discounts. This helps them give low prices for hydraulic setups, attracting people and businesses who want cheap ways to make machines work. In a market where doing things better and cheaper is very important, cost leadership helps to get more of the market.

Companies use market specialization as a plan to concentrate on particular areas within the Hydraulic Equipment Market. Rather than giving a wide variety of hydraulic services, some firms focus only on specific industries or uses. For example, a business might focus on machines for water work at sea, tools used in forests or systems made for air travel. This speciality lets businesses become experts in certain areas. They can give special solutions to customers and earn their trust.

Working together and teaming up are very important in the Hydraulic Equipment Market. Often, firms partner with makers, sellers and final customers to boost their position in the market. These relationships can result in shared stuff, joint work on new projects and greater ways to get things out there. Working together with important people in business helps companies make themselves better, reach new places to sell and grow more.

For businesses wanting to profit from different needs and industry trends, expanding across regions is very important. As businesses grow across the world, they often expand their operations so that they match market changes and local tastes. This growth might mean setting up nearby factories, making deals with local sellers and changing the products to match special needs in different areas. By placing themselves in important areas, businesses can be close to customers and change things according to local sales environment. This helps them grow their share of the market.

In the Hydraulic Equipment Market, plans that focus on customers are very important. Understanding and meeting the special needs of customers, like trustworthiness, quality performance after they buy something is key to doing well. Businesses put money into helping customers, teaching courses and quick repair services to make sure users have a good time with their products. By making sure customers are happy, businesses can create long-lasting ties with them. This will keep people coming back and help grow their market share.

Leave a Comment