Market Trends

Key Emerging Trends in the Hydraulic Equipment Market

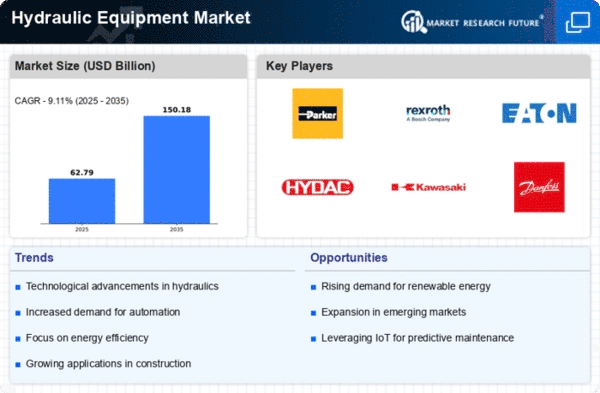

The Hydraulic Equipment Market is undergoing significant transformations, marked by notable trends that are reshaping the landscape of industries relying on hydraulic systems. One key trend is the growing adoption of Advanced Hydraulic Systems in various applications. Industries such as construction, agriculture, and manufacturing are increasingly embracing hydraulic systems with advanced features, including electronic control, sensor technologies, and predictive maintenance capabilities. This trend aims to enhance the overall efficiency, precision, and reliability of hydraulic equipment, meeting the evolving demands of modern industrial processes.

A noteworthy aspect in the Hydraulics Equipment market is focusing on making more energy-efficient hydraulic systems. With more attention being paid to saving the environment and stopping waste of energy, companies are looking for ways they can save power using hydraulics. These solutions help lower harm on nature too. Makers are making hydraulic tools with better use of energy. They're using technologies like speed changing drives, systems that return energy and improved ways to control fluid. This pattern matches worldwide efforts to encourage green habits in business practices.

The market is also seeing the use of IoT (Internet of Things) and Industry 4.0 technologies in Hydraulic Systems, too. Using smart sensors and connections allows us to watch, use data analysis, or control hydraulic equipment from far away in real-time. This connection lets us do things before they break, keep an eye on the state and make better diagnoses. This helps lower time lost to problems and boost production overall. The use of IoT in water systems shows how the industry is moving more towards digital and smart production.

Moreover, there is an increasing movement towards making hydraulic parts smaller and more compact. More and more industries want hydraulic gear that takes up little space, is not too heavy but still works well. Small hydraulic parts are used in portable things, robots and places with no space. They offer freedom to be used many ways in different job situations. This way of doing things answers the need for small and good working systems using liquid power in today's production processes. This is because space can be a big issue there.

People want green solutions so the market for machinery parts is changing to use Breakable Hydraulic Fluids. Old-fashioned hydraulic liquids may harm the environment. More and more people want eco-friendly fluids that can break down in nature instead of hurting our planet. Makers are making machines that work well with these liquids. This meets the earth-friendly needs of businesses while also guaranteeing good and quick hydraulic performance. This habit goes along with the worldwide effort to use eco-friendly ways in factories around the world.

Also, the Hydraulic Equipment market is getting more requests for special and purpose-built solutions. Businesses want hydraulic machines that can be changed to match what they need and the problems they face. Makers are answering by giving special hydraulic choices. These answers help the different needs of many things like building machines, farming tools and factory automation parts. This habit highlights how important it is for water systems to be able to change and adjust in different areas. Additionally, the market is witnessing geographic expansion, with emerging economies playing a significant role in driving market growth. Rapid industrialization, infrastructure development, and increased investment in construction and manufacturing activities in regions such as Asia-Pacific contribute to the rising demand for hydraulic equipment. The geographic expansion underscores the global nature of the hydraulic equipment market and the need for diverse solutions to address the varied requirements of different industries.

Leave a Comment