Urbanization Trends

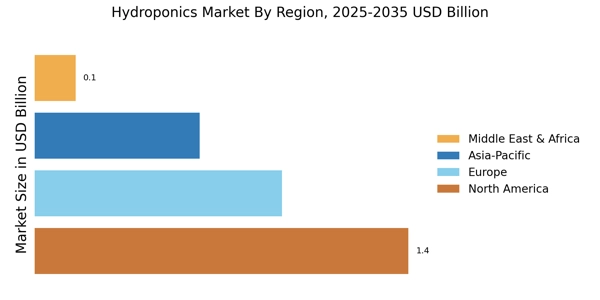

Urbanization trends are significantly impacting the Hydroponics Market, as more people migrate to urban areas. This demographic shift creates a pressing need for innovative agricultural solutions to meet the food demands of densely populated cities. Hydroponics Market offers a viable solution, allowing for food production in limited spaces, such as rooftops and vertical farms. According to recent studies, urban agriculture could potentially supply up to 30% of the food needs in metropolitan areas. As cities seek to enhance food security and reduce transportation costs, the adoption of hydroponic systems is likely to increase. This trend underscores the importance of the Hydroponics Market in addressing urban food challenges.

Health Consciousness

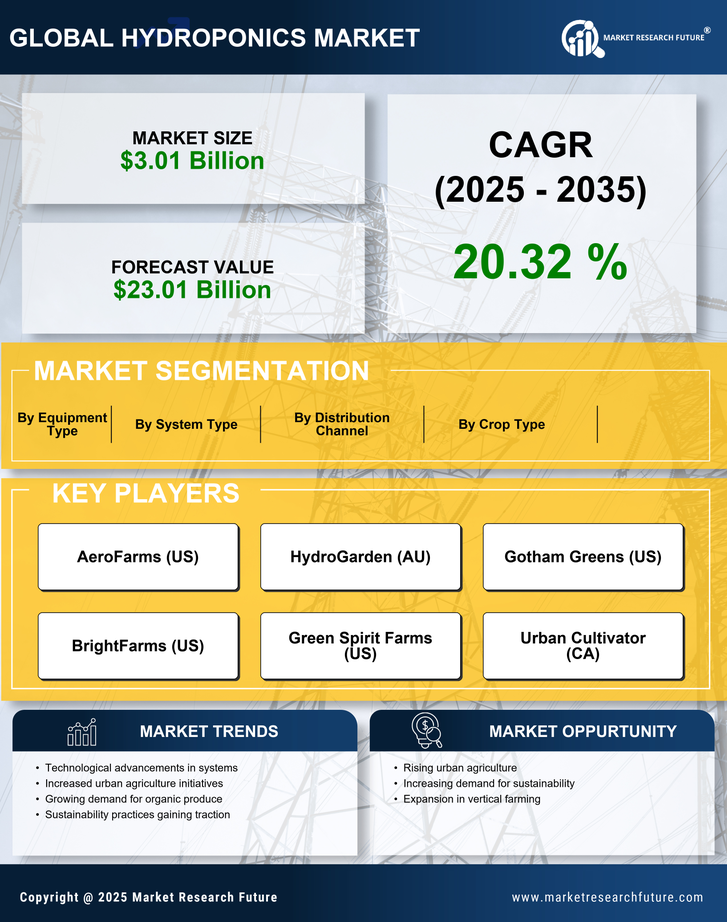

The rising health consciousness among consumers is a driving force in the Hydroponics Market. As individuals become more aware of the nutritional value of fresh produce, the demand for locally grown, pesticide-free fruits and vegetables is surging. Hydroponically grown crops are often perceived as healthier options due to their reduced exposure to chemicals and enhanced nutrient profiles. Market analysis indicates that the organic produce segment, which includes hydroponically grown items, is expected to grow at a compound annual growth rate of over 10% in the coming years. This increasing preference for health-oriented food choices is likely to propel the Hydroponics Market forward, as consumers seek out fresh, nutritious options.

Technological Innovations

Technological innovations play a pivotal role in shaping the Hydroponics Market. Advances in automation, sensors, and artificial intelligence are enhancing the efficiency and productivity of hydroponic systems. For instance, automated nutrient delivery systems and climate control technologies allow for precise management of growing conditions, leading to higher yields. Market data suggests that the integration of smart technologies could increase crop production by up to 30%. As these technologies become more accessible and affordable, they are expected to attract a broader range of growers, from small-scale urban farmers to large commercial operations. This trend indicates a promising future for the Hydroponics Market, as technology continues to evolve and improve agricultural practices.

Sustainability Initiatives

The Hydroponics Market is increasingly influenced by sustainability initiatives aimed at reducing environmental impact. As consumers become more environmentally conscious, the demand for sustainable farming practices rises. Hydroponics Market, which utilizes significantly less water than traditional agriculture, aligns well with these initiatives. Reports indicate that hydroponic systems can use up to 90% less water, making them an attractive option for water-scarce regions. Furthermore, the ability to grow crops without soil minimizes the need for harmful pesticides and fertilizers, appealing to eco-friendly consumers. This shift towards sustainable practices is likely to drive growth in the Hydroponics Market, as both consumers and businesses seek to adopt more responsible agricultural methods.

Government Support and Policies

Government support and policies are crucial drivers of the Hydroponics Market. Many governments are recognizing the potential of hydroponics to enhance food security and promote sustainable agriculture. Initiatives such as grants, subsidies, and research funding are being implemented to encourage the adoption of hydroponic systems. For example, certain regions have introduced tax incentives for businesses investing in hydroponic technology. This supportive regulatory environment is likely to stimulate growth in the Hydroponics Market, as it lowers the barriers to entry for new players and encourages innovation. As governments continue to prioritize food sustainability, the hydroponics sector stands to benefit significantly.